Related Research Articles

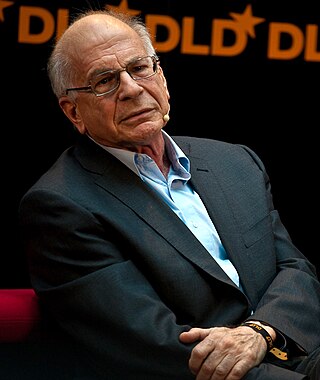

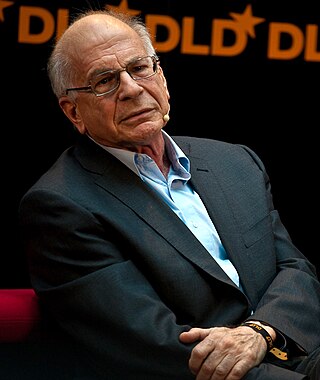

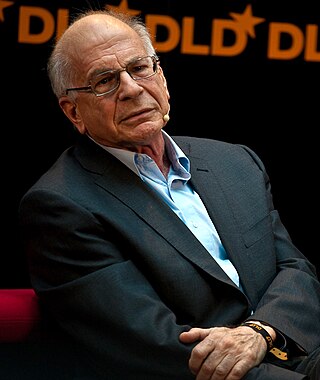

Daniel Kahneman was an Israeli-American author, psychologist, and economist notable for his work on hedonism, the psychology of judgment, and decision-making. He is also known for his work in behavioral economics, for which he was awarded the 2002 Nobel Memorial Prize in Economic Sciences shared with Vernon L. Smith. Kahneman's published empirical findings challenge the assumption of human rationality prevailing in modern economic theory.

Amos Nathan Tversky was an Israeli cognitive and mathematical psychologist and a key figure in the discovery of systematic human cognitive bias and handling of risk.

Behavioral economics is the study of the psychological, cognitive, emotional, cultural and social factors involved in the decisions of individuals or institutions, and how these decisions deviate from those implied by classical economic theory.

Prospect theory is a theory of behavioral economics, judgment and decision making that was developed by Daniel Kahneman and Amos Tversky in 1979. The theory was cited in the decision to award Kahneman the 2002 Nobel Memorial Prize in Economics.

Decision theory is a branch of applied probability theory and analytic philosophy concerned with the theory of making decisions based on assigning probabilities to various factors and assigning numerical consequences to the outcome.

The St. Petersburg paradox or St. Petersburg lottery is a paradox involving the game of flipping a coin where the expected payoff of the theoretical lottery game approaches infinity but nevertheless seems to be worth only a very small amount to the participants. The St. Petersburg paradox is a situation where a naïve decision criterion that takes only the expected value into account predicts a course of action that presumably no actual person would be willing to take. Several resolutions to the paradox have been proposed, including the impossible amount of money a casino would need to continue the game indefinitely.

Loss aversion is a psychological and economic concept, which refers to how outcomes are interpreted as gains and losses where losses are subject to more sensitivity in people's responses compared to equivalent gains acquired. Kahneman and Tversky (1992) suggested that losses can be twice as powerful psychologically as gains.

The expected utility hypothesis is a foundational assumption in mathematical economics concerning decision making under uncertainty. It postulates that rational agents maximize utility, meaning the subjective desirability of their actions. Rational choice theory, a cornerstone of microeconomics, builds this postulate to model aggregate social behaviour.

In decision theory, subjective expected utility is the attractiveness of an economic opportunity as perceived by a decision-maker in the presence of risk. Characterizing the behavior of decision-makers as using subjective expected utility was promoted and axiomatized by L. J. Savage in 1954 following previous work by Ramsey and von Neumann. The theory of subjective expected utility combines two subjective concepts: first, a personal utility function, and second a personal probability distribution.

In prospect theory, the pseudocertainty effect is the tendency for people to perceive an outcome as certain while it is actually uncertain in multi-stage decision making. The evaluation of the certainty of the outcome in a previous stage of decisions is disregarded when selecting an option in subsequent stages. Not to be confused with certainty effect, the pseudocertainty effect was discovered from an attempt at providing a normative use of decision theory for the certainty effect by relaxing the cancellation rule.

In decision theory, the Ellsberg paradox is a paradox in which people's decisions are inconsistent with subjective expected utility theory. John Maynard Keynes published a version of the paradox in 1921. Daniel Ellsberg popularized the paradox in his 1961 paper, "Risk, Ambiguity, and the Savage Axioms". It is generally taken to be evidence of ambiguity aversion, in which a person tends to prefer choices with quantifiable risks over those with unknown, incalculable risks.

The Allais paradox is a choice problem designed by Maurice Allais to show an inconsistency of actual observed choices with the predictions of expected utility theory. Rather than adhering to rationality, the Allais paradox proves that individuals rarely make rational decisions consistently when required to do so immediately. The independence axiom of expected utility theory, which requires that the preferences of an individual should not change when altering two lotteries by equal proportions, was proven to be violated by the paradox.

Cumulative prospect theory (CPT) is a model for descriptive decisions under risk and uncertainty which was introduced by Amos Tversky and Daniel Kahneman in 1992. It is a further development and variant of prospect theory. The difference between this version and the original version of prospect theory is that weighting is applied to the cumulative probability distribution function, as in rank-dependent expected utility theory but not applied to the probabilities of individual outcomes. In 2002, Daniel Kahneman received the Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel for his contributions to behavioral economics, in particular the development of Cumulative Prospect Theory (CPT).

The rank-dependent expected utility model is a generalized expected utility model of choice under uncertainty, designed to explain the behaviour observed in the Allais paradox, as well as for the observation that many people both purchase lottery tickets and insure against losses.

A Choquet integral is a subadditive or superadditive integral created by the French mathematician Gustave Choquet in 1953. It was initially used in statistical mechanics and potential theory, but found its way into decision theory in the 1980s, where it is used as a way of measuring the expected utility of an uncertain event. It is applied specifically to membership functions and capacities. In imprecise probability theory, the Choquet integral is also used to calculate the lower expectation induced by a 2-monotone lower probability, or the upper expectation induced by a 2-alternating upper probability.

In communication studies, science communication, psycholinguistics and choice theory, anecdotal value refers to the primarily social and political value of an anecdote or anecdotal evidence in promoting understanding of a social, cultural, or economic phenomenon. While anecdotal evidence is typically unscientific, in the last several decades the evaluation of anecdotes has received sustained academic scrutiny from economists and scholars such as Felix Salmon, S. G. Checkland, Steven Novella, R. Charleton, Hollis Robbins, Kwamena Kwansah-Aidoo, and others. These academics seek to quantify the value of the use of anecdotes, e.g. in promoting public awareness of a disease. More recently, economists studying choice models have begun assessing anecdotal value in the context of framing; Daniel Kahneman and Amos Tversky suggest that choice models may be contingent on stories or anecdotes that frame or influence choice. As an example, consider the quote, widely misattributed to Joseph Stalin: The death of one man is a tragedy, the death of millions is a statistic.

The certainty effect is the psychological effect resulting from the reduction of probability from certain to probable. It is an idea introduced in prospect theory.

Quantum cognition is an emerging field which applies the mathematical formalism of quantum theory to model cognitive phenomena such as information processing by the human brain, language, decision making, human memory, concepts and conceptual reasoning, human judgment, and perception. The field clearly distinguishes itself from the quantum mind as it is not reliant on the hypothesis that there is something micro-physical quantum-mechanical about the brain. Quantum cognition is based on the quantum-like paradigm or generalized quantum paradigm or quantum structure paradigm that information processing by complex systems such as the brain, taking into account contextual dependence of information and probabilistic reasoning, can be mathematically described in the framework of quantum information and quantum probability theory.

Trade-off talking rational economic person (TOTREP) is one term, among others, used to denote, in the field of choice analysis, the rational, human agent of economic decisions.

The priority heuristic is a simple, lexicographic decision strategy that helps decide for a good option.

References

- ↑ Quiggin, John (1982). "A theory of anticipated utility". Journal of Economic Behavior & Organization. 3 (4): 323–343. doi:10.1016/0167-2681(82)90008-7.

- ↑ Gul, Faruk; Pesendorfer, Wolfgang (2009). "Measurable Ambiguity" (PDF). Levine's Working Paper Archive.

- ↑ Machina, Mark J. (1982). "'Expected Utility' Analysis Without the Independence Axiom" (PDF). Econometrica . 50 (2): 277–323. doi:10.2307/1912631. JSTOR 1912631.