Related Research Articles

Drexel University is a private space-grant research university with its main campus in Philadelphia, Pennsylvania. Drexel's undergraduate school was founded in 1891 by Anthony J. Drexel, a financier and philanthropist. Founded as Drexel Institute of Art, Science and Industry, it was renamed Drexel Institute of Technology in 1936, before assuming its current name in 1970. As of 2020, more than 24,000 students were enrolled in over 70 undergraduate programs and more than 100 master's, doctoral, and professional programs at the university.

Monetary economics is the branch of economics that studies the different theories of money: it provides a framework for analyzing money and considers its functions, and it considers how money can gain acceptance purely because of its convenience as a public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects.

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability. Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since then, though it is still the official strategy in a number of emerging economies.

The Bretton Woods system of monetary management established the rules for commercial relations among the United States, Canada, Western European countries, and Australia and other countries, a total of 44 countries after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold. It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits.

Constantine Papadakis was a Greek-American businessman and the president of Drexel University.

The Federal Reserve Bank of St. Louis is one of 12 regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the United States' central bank. Missouri is the only state to have two main Federal Reserve Banks.

Peter Bain Kenen was an American economist, who was the Walker Professor of Economics and International Finance at Princeton University, and senior fellow in international economics at the Council on Foreign Relations.

The Peterson Institute for International Economics (PIIE), known until 2006 as the Institute for International Economics (IIE), is an American think tank based in Washington, D.C. It was founded by C. Fred Bergsten in 1981 and has been led by Adam S. Posen since 2013. PIIE conducts research, provides policy recommendations, and publishes books and articles on a wide range of topics related to the US economy and international economics.

Axel Alfred Weber is a German economist, professor, and banker. He is currently a board member and chairman of Swiss investment bank and financial services company, UBS Group AG, and has announced his resignation effective 7 April 2022.

The history of Drexel University, a private university in Philadelphia, began with the founding of Drexel Institute of Art, Science and Industry in 1891 by Anthony J. Drexel, with the main building dedicated on December 17 of that year.

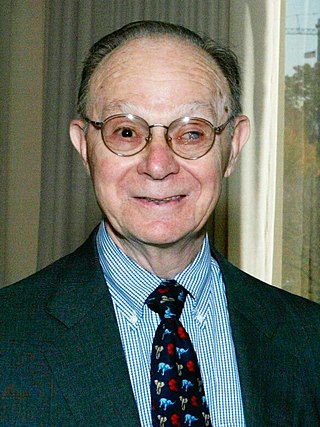

Allan H. Meltzer was an American economist and Allan H. Meltzer Professor of Political Economy at Carnegie Mellon University's Tepper School of Business and Institute for Politics and Strategy in Pittsburgh, Pennsylvania. Meltzer specialized on studying monetary policy and the US Federal Reserve System, and authored several academic papers and books on the development and applications of monetary policy, and about the history of central banking in the US. Together with Karl Brunner, he created the Shadow Open Market Committee: a monetarist council that deeply criticized the Federal Open Market Committee.

William Poole was the eleventh chief executive of the Federal Reserve Bank of St. Louis. He took office on March 23, 1998, and began serving his full term on March 1, 2001. In 2007, he served as a voting member of the Federal Open Market Committee, bringing his District's perspective to policy discussions in Washington. Poole stepped down from the Fed on March 31, 2008.

Michael H. Moskow is currently vice chairman and distinguished fellow on the global economy at the Chicago Council on Global Affairs. From 1994 to 2007, he served as president and chief executive officer of the Federal Reserve Bank of Chicago. In that capacity, he was a member of the Federal Open Market Committee, the Federal Reserve System's most important monetary policy-making body.

Ungku Zeti Akhtar binti Ungku Abdul Aziz was the 7th Governor of Bank Negara Malaysia, Malaysia's central bank. She served as Governor from 2000 to 2016, and was the first woman in the position and at 16 years, the longest to hold the position. Zeti was one of the members of the Council of Eminent Persons (CEP) in Mahathir's second administration, a special advisory council advising the government on economic and financial matters during this transitional period.

The National Association for Business Economics (NABE) is the largest international association of applied economists, strategists, academics, and policy-makers committed to the application of economics. Founded in 1959, it is one of the member organizations of the Allied Social Science Associations. According to the association's website, "NABE's mission is to provide leadership in the use and understanding of economics.".

Markus Konrad Brunnermeier is an economist, who is the Edwards S. Sanford Professor of Economics at Princeton University.

Patrick Timothy Harker is the President of the Federal Reserve Bank of Philadelphia. Harker previously served as the President of University of Delaware. He was the dean of the Wharton School of the University of Pennsylvania from 2001 to 2007. He began his presidency of the University of Delaware in 2007 and resigned in 2015.

Richard Harris Clarida is an American economist who served as the 21st Vice Chair of the Federal Reserve from 2018 to 2022. Clarida resigned his post on January 14, 2022, to return from public service leave to teach at Columbia University for the spring term of 2022. He is the C. Lowell Harriss Professor of Economics and International Affairs at Columbia University and, from 2006 until September 2018 and from October 2022 to the present, a Global Strategic Advisor for PIMCO. He is notable for his contributions to dynamic stochastic general equilibrium theory and international monetary economics. He is a former Assistant Secretary of the Treasury for Economic Policy and is a recipient of the Treasury Medal. He also was a proponent of the theory that inflation was transitory during the COVID-19 pandemic.

Heinz Robert Heller is an economist who served as a governor of the Federal Reserve System and as president of VISA U.S.A. Inc.

References

- 1 2 "About Us". Global Interdependence Center. Retrieved 2009-01-15.

- ↑ "Challenges for Monetary Policy in a Globalized Economy". Federal Reserve Bank of Dallas. January 17, 2008. Retrieved 2009-01-15.

- ↑ "Should Central Banks Help Governments Run Bigger Deficits?". Wall Street Journal. March 26, 2012. Retrieved 2012-06-08.

- ↑ "Is Price Stability Attainable?". Federal Reserve Bank of Cleveland. June 11, 2007. Archived from the original on July 16, 2011. Retrieved 2009-01-15.

- ↑ "Santomero receives Global Citizen Award". Philadelphia Business Journal. July 14, 2005. Retrieved 2009-01-15.

- ↑ "Dr. Constantine Papadakis Biography". Drexel University. November 18, 2008. Archived from the original on October 24, 2007. Retrieved 2009-01-15.

- ↑ "Global Citizen Award - GIC International Financial Leaders". Global Interdependence Center. Retrieved 2020-02-06.

- ↑ "Upcoming Events - GIC International Financial Leaders". Global Interdependence Center. Retrieved 2020-02-06.

- ↑ "Archive of Past Events on Global Issues, International Economics, and The Global Economy". Global Interdependence Center. Retrieved 2020-02-06.