The Federal Reserve System is the central banking system of the United States. It was created on December 23,1913,with the enactment of the Federal Reserve Act,after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years,events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

The monetary policy of the United States is the set of policies which the Federal Reserve follows to achieve its twin objectives of high employment and stable inflation.

A Federal Reserve Bank is a regional bank of the Federal Reserve System,the central banking system of the United States. There are twelve in total,one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve Act of 1913. The banks are jointly responsible for implementing the monetary policy set forth by the Federal Open Market Committee,and are divided as follows:

Kissinger Associates,Inc. is a New York City–based international geopolitical consulting firm,founded and run by Henry Kissinger from 1982 until his death in 2023. The firm assists its clients in identifying strategic partners and investment opportunities and advising them on government relations.

Janet Louise Yellen is an American economist serving as the 78th United States secretary of the treasury. She was appointed to the role on January 26,2021. She previously served as the 15th chair of the Federal Reserve from 2014 to 2018. She is the first woman to hold either post,and has also led the White House Council of Economic Advisers. Yellen is the Eugene E. and Catherine M. Trefethen Professor of Business Administration and Economics at the University of California,Berkeley.

The Federal Reserve Bank of Dallas covers the Eleventh Federal Reserve District of the United States,which includes Texas,northern Louisiana and southern New Mexico,a district sometimes referred to as the Oil Patch. The Federal Reserve Bank of Dallas is one of 12 regional Reserve Banks that,along with the Board of Governors in Washington,D.C.,make up the U.S. central bank. The Dallas Fed is the only one where all external branches reside in the same state . The Dallas Fed has branch offices in El Paso,Houston,and San Antonio. The Dallas bank is located at 2200 Pearl St. in the Uptown neighborhood of Oak Lawn,just north of downtown Dallas and the Dallas Arts District. Prior to 1992,the bank was located at 400 S. Akard Street,in the Government District in Downtown Dallas. The older Dallas Fed building,which opened in 1921,was built in the Beaux-arts style,with large limestone structure with massive carved eagles and additional significant detailing;it is a City of Dallas Designated Landmark structure. The current Dallas Fed building,opened in September 1992,was designed by three architectural firms:Kohn Pedersen Fox Associates,New York;Sikes Jennings Kelly &Brewer,Houston;and John S. Chase,FAIA,Dallas and Houston,Dallas-based Austin Commercial Inc. served as project manager and general contractor.

Robert D. McTeer Jr. is an American economist,and has been a fellow at the US National Center for Policy Analysis since January 2007. McTeer is a former president of the Federal Reserve Bank of Dallas (1981-1991),and a former chancellor of the Texas A&M University System.

Quantitative easing (QE) is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary policy that came into wide application after the 2007–2008 financial crisis. It is used to mitigate an economic recession when inflation is very low or negative,making standard monetary policy ineffective. Quantitative tightening (QT) does the opposite,where for monetary policy reasons,a central bank sells off some portion of its holdings of government bonds or other financial assets.

Membership in the Council on Foreign Relations comes in two types:Individual and Corporate. Individual memberships are further subdivided into two types:Life Membership and Term Membership,the latter of which is for a single period of five years and is available to those between the ages of 30 and 36 at the time of their application. Only U.S. citizens and permanent residents who have applied for U.S. citizenship are eligible. A candidate for life membership must be nominated in writing by one Council member and seconded by a minimum of three others.

This is a list of historical rate actions by the United States Federal Open Market Committee (FOMC). The FOMC controls the supply of credit to banks and the sale of treasury securities.

James Brian Bullard is the former chief executive officer and 12th president of the Federal Reserve Bank of St. Louis,a position he held from 2008 until August 14,2023. In July 2023,he was named dean of the Mitchell E. Daniels Jr. School of Business at Purdue University.

The Emergency Economic Stabilization Act of 2008,also known as the "bank bailout of 2008" or the "Wall Street bailout",was a United States federal law enacted during the Great Recession,which created federal programs to "bail out" failing financial institutions and banks. The bill was proposed by Treasury Secretary Henry Paulson,passed by the 110th United States Congress,and was signed into law by President George W. Bush. It became law as part of Public Law 110-343 on October 3,2008. It created the $700 billion Troubled Asset Relief Program (TARP),which utilized congressionally appropriated taxpayer funds to purchase toxic assets from failing banks. The funds were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases.

Timothy Franz Geithner is an American former central banker who served as the 75th United States Secretary of the Treasury under President Barack Obama from 2009 to 2013. He was the President of the Federal Reserve Bank of New York from 2003 to 2009,following service in the Clinton administration. Since March 2014,he has served as president and chairman of Warburg Pincus,a private equity firm headquartered in New York City.

Sarah Bloom Raskin is an American attorney and financial markets policymaker who served as the 13th United States Deputy Secretary of the Treasury from 2014 to 2017. Raskin previously served as a member of the Federal Reserve Board of Governors from 2010 to 2014. She also was Maryland Commissioner of Financial Regulation. She was a Rubenstein Fellow at Duke University. She is currently the Colin W. Brown Distinguished Professor of the Practice of Law at Duke Law School. She is also a Senior Fellow at the Duke Center on Risk. She also serves as a Partner at Kaya Partners,Ltd.,a climate advisory firm.

In monetary policy of the United States,the term Fedspeak is what Alan Blinder called "a turgid dialect of English" used by Federal Reserve Board chairs in making wordy,vague,and ambiguous statements. The strategy,which was used most prominently by Alan Greenspan,was used to prevent financial markets from overreacting to the chairman's remarks. The coinage is an intentional parallel to Newspeak.

Richard Harris Clarida is an American economist who served as the 21st Vice Chair of the Federal Reserve from 2018 to 2022. Clarida resigned his post on January 14,2022,to return from public service leave to teach at Columbia University for the spring term of 2022. He is the C. Lowell Harriss Professor of Economics and International Affairs at Columbia University and,from 2006 until September 2018 and from October 2022 to the present,a Global Strategic Advisor for PIMCO. He is notable for his contributions to dynamic stochastic general equilibrium theory and international monetary economics. He is a former Assistant Secretary of the Treasury for Economic Policy and is a recipient of the Treasury Medal. He also was a proponent of the theory that inflation was transitory during the COVID-19 pandemic.

Peter R. Fisher has been an attorney,a central banker,a U.S. Treasury official,an asset management executive,and an educator. He is currently a Managing Director in the Strategy Function leading the firm’s global retirement initiative at BlackRock.

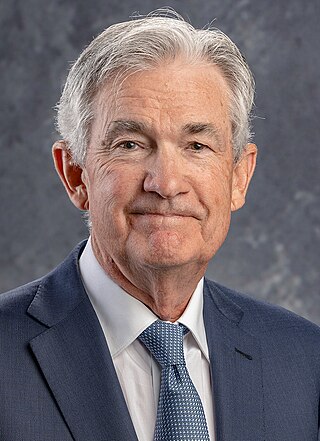

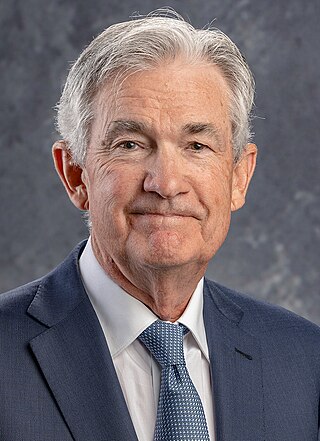

Jerome Hayden "Jay" Powell is an American investment banker and lawyer serving since 2018 as the 16th chair of the Federal Reserve.

Robert Steven Kaplan served as the president and CEO of the Federal Reserve Bank of Dallas from 2015 until 2021 and is a long-time Goldman Sachs executive,where he currently serves as vice chairman.

On 20 February 2020,stock markets across the world suddenly crashed after growing instability due to the COVID-19 pandemic. It ended on 7 April 2020.