Related Research Articles

The balance of trade, commercial balance, or net exports, is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balance of trade for goods versus one for services. The balance of trade measures a flow of exports and imports over a given period of time. The notion of the balance of trade does not mean that exports and imports are "in balance" with each other.

The yen is the official currency of Japan. It is the third most traded currency in the foreign exchange market, after the United States dollar and the Euro. It is also widely used as a third reserve currency after the United States dollar and the Euro.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold foreign central banks, effectively ending the Bretton Woods system. Many states still hold substantial gold reserves.

Purchasing Power Parity (PPP) is the measurement of prices in different countries that uses the prices of specific goods to compare the absolute purchasing power of the countries' currencies. In many cases PPP produces an inflation rate that is equal to the price of the basket of goods at one location divided by the price of the basket of goods at a different location. The PPP inflation and exchange rate may differ from the market exchange rate because of poverty, tariffs, and other transaction costs.

The Canadian dollar is the currency of Canada. It is abbreviated with the dollar sign $, or sometimes CA$, Can$ or C$ to distinguish it from other dollar-denominated currencies. It is divided into 100 cents (¢).

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro.

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing or the money supply, often as an attempt to reduce inflation or the interest rate, to ensure price stability and general trust of the value and stability of the nation's currency.

In macroeconomics, hard currency, safe-haven currency or strong currency is any globally traded currency that serves as a reliable and stable store of value. Factors contributing to a currency's hard status might include the stability and reliability of the respective state's legal and bureaucratic institutions, level of corruption, long-term stability of its purchasing power, the associated country's political and fiscal condition and outlook, and the policy posture of the issuing central bank.

The balance of payments of a country is the difference between all money flowing into the country in a particular period of time and the outflow of money to the rest of the world. These financial transactions are made by individuals, firms and government bodies to compare receipts and payments arising out of trade of goods and services.

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the United States, Canada, Western European countries, Australia, and Japan after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The chief features of the Bretton Woods system were an obligation for each country to adopt a monetary policy that maintained its external exchange rates within 1 percent by tying its currency to gold and the ability of the International Monetary Fund (IMF) to bridge temporary imbalances of payments. Also, there was a need to address the lack of cooperation among other countries and to prevent competitive devaluation of the currencies as well.

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national currency in relation to a foreign reference currency or currency basket. The opposite of devaluation, a change in the exchange rate making the domestic currency more expensive, is called a revaluation. A monetary authority maintains a fixed value of its currency by being ready to buy or sell foreign currency with the domestic currency at a stated rate; a devaluation is an indication that the monetary authority will buy and sell foreign currency at a lower rate.

Non-tariff barriers to trade are trade barriers that restrict imports or exports of goods or services through mechanisms other than the simple imposition of tariffs.

Foreign exchange reserves are cash and other reserve assets such as gold held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and to maintain confidence in financial markets. Reserves are held in one or more reserve currencies, nowadays mostly the United States dollar and to a lesser extent the euro.

Monetary hegemony is an economic and political concept in which a single state has decisive influence over the functions of the international monetary system. A monetary hegemon would need:

The Panic of 1825 was a stock market crash that started in the Bank of England, arising in part out of speculative investments in Latin America, including an imaginary country: Poyais. The crisis was felt most acutely in Britain, where it led to the closure of twelve banks. It was also manifest in the markets of Europe, Latin America and the United States. An infusion of gold reserves from the Banque de France saved the Bank of England from collapse. The panic has been called the first modern economic crisis not attributable to an external event, such as a war, and so the start of modern economic cycles. The Napoleonic Wars had been highly profitable for all sectors of the British financial system, and the expansionist monetary actions taken during transition from war to peace brought a surge of prosperity and speculative ventures. The stock market boom became a bubble and banks caught in the euphoria made risky loans.

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold.

In macroeconomics, sterilization is action taken by a country's central bank to counter the effects on the money supply caused by a balance of payments surplus or deficit. This can involve open market operations undertaken by the central bank whose aim is to neutralize the impact of associated foreign exchange operations. The opposite is unsterilized intervention, where monetary authorities have not insulated their country's domestic money supply and internal balance against foreign exchange intervention.

Inflation rate in India was 5.5% as of May 2019, as per the Indian Ministry of Statistics and Programme Implementation. This represents a modest reduction from the previous annual figure of 9.6% for June 2011. Inflation rates in India are usually quoted as changes in the Wholesale Price Index (WPI), for all commodities.

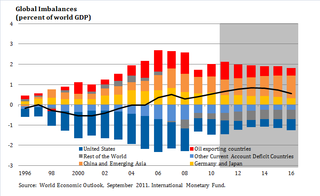

Global imbalances refers to the situation where some countries have more assets than the other countries. In theory, when the current account is in balance, it has a zero value: inflows and outflows of capital will be cancelled by each other. Hence, if the current account is persistently showing deficits for certain period it is said to show an inequilibrium. Since, by definition, all current accounts and net foreign assets of the countries in the world must become zero, then other countries become indebted with the other nations. During recent years, global imbalances have become a concern in the rest of the world. The United States has run long term deficits, as well as many other advanced economies, while in Asia and emerging economies the opposite has occurred.