The economy of Saudi Arabia is the largest in the Middle East and the eighteenth-largest in the world. The Saudi economy is highly reliant on its petroleum sector. Oil accounts on average in recent years for approximately 40% of Saudi GDP and 75% of fiscal revenue, with substantial fluctuations depending on oil prices each year.

Abdulaziz bin Abdul Rahman Al Saud, known in the West as Ibn Saud, was an Arab political and religious leader who founded Saudi Arabia – the third Saudi state – and reigned as its first king from 23 September 1932 until his death in 1953. He had ruled parts of the kingdom since 1902, having previously been Emir, Sultan, and King of Nejd, and King of Hejaz.

Harry St John Bridger Philby, CIE, also known as Jack Philby or Sheikh Abdullah, was a British Arabist, adviser, explorer, writer, and a colonial intelligence officer who served as an advisor to King Abdulaziz ibn Saud, the founder of Saudi Arabia.

Saudi Aramco, officially the Saudi Arabian Oil Group or simply Aramco, is a state-owned petroleum and natural gas company that is the national oil company of Saudi Arabia. As of 2022, it is the second-largest company in the world by revenue and is headquartered in Dhahran. It has repeatedly achieved the largest annual profits in global corporate history. Saudi Aramco has both the world's second-largest proven crude oil reserves, at more than 270 billion barrels, and largest daily oil production of all oil-producing companies.

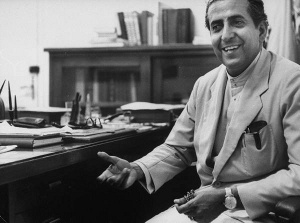

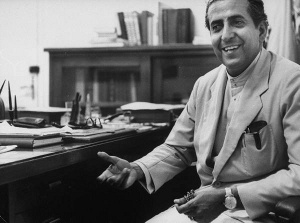

Ahmed Zaki Yamani was a Saudi Arabian politician who served as Minister of Petroleum and Mineral Resources under four Saudi monarchs from 1962 to 1986, and a minister in the Organization of the Petroleum Exporting Countries (OPEC) for 25 years.

Karl Saben Twitchell was an American mining engineer. Twitchell was born in St. Albans, Vermont in 1885. After graduating from St. Albans High School, he attended the Kingston School of Mines at Queens University, Kingston, Ontario, graduating in 1908.

For further details see the "Energy crisis" series by Facts on File.

Dhahran is a city located in the Eastern Province, Saudi Arabia. With a total population of 240,742 as of 2021, it is a major administrative center for the Saudi oil industry. Together with the nearby cities of Dammam and Khobar, Dhahran forms part of the Dammam Metropolitan Area, which is commonly known as greater Dammam and has an estimated population of 4,140,000 as of 2012.

Abdullah Tariki, also known as Red Sheikh, was a Saudi politician and government official. He was the first Saudi oil minister appointed by King Saud and co-founder of the Organization of Petroleum Exporting Countries (OPEC).

Bilateral relations between Saudi Arabia and the United States began in 1933 when full diplomatic relations were established and became formalized in the 1951 Mutual Defense Assistance Agreement. Despite the differences between the two countries—an Islamic absolute monarchy, and a secular constitutional republic—the two countries have been allies ever since. The core logic underpinning the relationship is that the United States of America (U.S.) provides military protection of the Kingdom in exchange for a reliable oil supply from the Saudis, pricing of oil in U.S. dollars, and Saudi support for American foreign policy operations across the world. Ever since the modern relationship began in 1945, the U.S. has been willing to overlook some of the kingdom's domestic and foreign policy aspects such as Wahhabism, its human rights, and alleged state-sponsored terrorism as long as it maintained oil production and supported American national security policies. The high point in relations between the two governments was marked by the Gulf War (1990–1991), when an international coalition led by United States and Saudi Arabia fought a military campaign in response to Iraqi invasion of Kuwait.

Discovery! The Search for Arabian Oil is a non-fiction book written by Pulitzer Prize winning American author Wallace Stegner.

The nationalization of oil supplies refers to the process of confiscation of oil production operations and their property, generally for the purpose of obtaining more revenue from oil for the governments of oil-producing countries. This process, which should not be confused with restrictions on crude oil exports, represents a significant turning point in the development of oil policy. Nationalization eliminates private business operations—in which private international companies control oil resources within oil-producing countries—and transfers them to the ownership of the governments of those countries. Once these countries become the sole owners of these resources, they have to decide how to maximize the net present value of their known stock of oil in the ground. Several key implications can be observed as a result of oil nationalization. "On the home front, national oil companies are often torn between national expectations that they should 'carry the flag' and their own ambitions for commercial success, which might mean a degree of emancipation from the confines of a national agenda."

Russia–Saudi Arabia relations are the bilateral relations between Russian Federation and Kingdom of Saudi Arabia. The two countries are referred to as the two petroleum superpowers and account for about a quarter of the world's crude oil production between them.

The proven oil reserves in Saudi Arabia are reportedly the second largest in the world, estimated in 2017 to be 268 billion barrels, including 2.5 Gbbl in the Saudi–Kuwaiti neutral zone. This would correspond to more than 50 years of production at current rates. In the oil industry, an oil barrel is defined as 42 US gallons, which is about 159 litres, or 35 imperial gallons. The oil reserves are predominantly found in the Eastern Province. These reserves were apparently the largest in the world until Venezuela announced they had increased their proven reserves to 297 Gbbl in January 2011. The Saudi reserves are about one-fifth of the world's total conventional oil reserves. A large fraction of these reserves comes from a small number of very large oil fields, and past production amounts to 40% of the stated reserves. Other sources state that Saudi Arabia has about 297.7 billion barrels.

Saudi Arabian oil was first discovered by the Americans in commercial quantities at Dammam oil well No. 7 in 1938 in what is now modern day Dhahran.

The following is a Gregorian timeline of the history for the city of Riyadh, Saudi Arabia.

The Middle East has been a region of geopolitical and economic significance to the world far before American involvement in the area. This was largely because the “Middle East contained or bordered on the land bridges, passageways, and narrows – the Sinai isthmus, the Caucuses, the Strait of Gibraltar, the Dardanelles, Bab el Mandeb, and the Strait of Hormuz – and the sheltered seas – the Mediterranean, the Black Sea, the Caspian Sea, the Red Sea, and the Persian Gulf – that provided the best routes connecting the different extremities of the vast Eurasian/African continent.” The value of being a prominent player in the region was therefore obvious to the United States as well as to several other Western powers including Great Britain and France. In addition to its pivotal geographic location in the world, the abundance of oil in the Middle East has probably played the biggest role in issues of foreign policy and international relations. The United States needed Middle Eastern oil and Middle Eastern nations needed Western capital and technology. This mutually beneficial but dependent relationship would forge strong alliances but also be the cause of harsh conflicts.

The posted price of oil was the price at which oil companies offered to purchase oil from oil-producing governments. This price was set by the oil companies and used to calculate the share of oil revenues that oil-producing countries would receive. Between 1957 and 1972, the posted price was greater than the market price of crude oil. Between 1961 and 1970 the market price hovered between $1.30 and $1.50 per barrel, while the posted price was a constant $1.80.

The Ministry of Investment (MISA) (Arabic: وزارة الاستثمار), till 2020 as the Saudi Arabian General Investment Authority (SAGIA) (Arabic: الهيئة العامة للإستثمار), is a government ministry in Saudi Arabia that oversees foreign investment in the country besides issuing licenses to foreign investors. It was established as the General Investment Authority in 2000 during the reign of King Fahd and was transformed into a ministry in 2020 through a royal decree issued by King Salman. Khalid al-Falih, the former chairman of Saudi Aramco was appointed as the new minister by replacing governor Ibrahim al-Omar following the ministry's renaming.

Abdullah bin Suleiman Al Hamdan, commonly known as Abdullah Suleiman and also by his nickname Wazīr Kullī Shaīʾ, was the treasurer and long-term as well as first finance minister of Saudi Arabia (1932–1955). He was named "the minister of everything" due to his involvement in nearly all state affairs which included agriculture, transportation and mining resources among the others. During the reign of King Abdulaziz he was the most significant non-royal official.