Related Research Articles

Smuggling is the illegal transportation of objects, substances, information or people, such as out of a house or buildings, into a prison, or across an international border, in violation of applicable laws or other regulations.

The tobacco industry comprises those persons and companies who are engaged in the growth, preparation for sale, shipment, advertisement, and distribution of tobacco and tobacco-related products. It is a global industry; tobacco can grow in any warm, moist environment, which means it can be farmed on all continents except Antarctica.

Brown & Williamson Tobacco Corporation was a U.S. tobacco company and a subsidiary of multinational British American Tobacco that produced several popular cigarette brands. It became infamous as the focus of investigations for chemically enhancing the addictiveness of cigarettes. Its former vice-president of research and development, Jeffrey Wigand, was the whistleblower in an investigation conducted by CBS news program 60 Minutes, an event that was dramatized in the film The Insider (1999). Wigand claimed that B&W had introduced chemicals such as ammonia into cigarettes to increase nicotine delivery and increase addictiveness.

The European Anti-Fraud Office is a body mandated by the European Union (EU) with protecting the Union's financial interests. It was founded on 28 April 1999, under the European Commission Decision 1999/352. Its tasks are threefold:

Japan Tobacco Inc., abbreviated JT, is a cigarette manufacturing company. It is part of the Nikkei 225 and TOPIX Large70 indices. In 2009 the company was listed at number 312 on the Fortune 500 list. The company is headquartered in Toranomon, Minato, Tokyo and Japan Tobacco International's headquarters are in Geneva, Switzerland. As of 2012 the chairman is Hiroshi Kimura and the CEO is Mitsuomi Koizumi. It was founded as an enterprise of the Japanese government in 1945, and became a public company on 1 April 1985.

Excise tax in the United States is an indirect tax on listed items. Excise taxes can be and are made by federal, state and local governments and are not uniform throughout the United States. Certain goods, such as gasoline, diesel fuel, alcohol, and tobacco products, are taxed by multiple governments simultaneously. Some excise taxes are collected from the producer or retailer and not paid directly by the consumer, and as such often remain "hidden" in the price of a product or service, rather than being listed separately.

Santa Fe Natural Tobacco Company is an American tobacco manufacturing company based in Oxford, NC, best known for its production of the premier Natural American Spirit cigarette brand.

Universal Corporation is one of the world's leading tobacco merchants. Incorporated in 1886, Universal is headquarters in Richmond, Virginia, in the United States.

The Tobacco Master Settlement Agreement (MSA) was entered on November 23, 1998, originally between the four largest United States tobacco companies and the attorneys general of 46 states. The states settled their Medicaid lawsuits against the tobacco industry for recovery of their tobacco-related health-care costs. In exchange, the companies agreed to curtail or cease certain tobacco marketing practices, as well as to pay, in perpetuity, various annual payments to the states to compensate them for some of the medical costs of caring for persons with smoking-related illnesses. The money also funds a new anti-smoking advocacy group, called the Truth Initiative, that is responsible for such campaigns as Truth and maintains a public archive of documents resulting from the cases.

Seneca cigarettes are a brand of cigarettes manufactured by Grand River Enterprises in Six Nations, Ontario, Canada. Seneca Cigarettes come in a variety of flavors, such as regular, menthol, menthol smooth, lights, ultra lights, non-filters, and a variety of options from kings to 100s, and a 120-size line. The logo contains a mountain range and a Seneca male with a Gustoweh headdress, which reflects traditional Seneca Culture.

A black market, underground economy, or shadow economy is a clandestine market or series of transactions that has some aspect of illegality or is characterized by noncompliance with an institutional set of rules. If the rule defines the set of goods and services whose production and distribution is prohibited by law, non-compliance with the rule constitutes a black market trade since the transaction itself is illegal. Parties engaging in the production or distribution of prohibited goods and services are members of the illegal economy. Examples include the illegal drug trade, prostitution, illegal currency transactions, and human trafficking. Violations of the tax code involving income tax evasion constitute membership in the unreported economy.

In the United States, cigarettes are taxed at both the federal and state levels, in addition to any state and local sales taxes and local cigarette-specific taxes. Cigarette taxation has appeared throughout American history and is still a contested issue today.

Tobacco politics refers to the politics surrounding the use and distribution of tobacco.

An excise stamp is a type of revenue stamp affixed to some exciseable goods to indicate that the required excise tax has been paid by the manufacturer. They are securities printed by the finance ministry of the relevant country.

A.D. Bedell Wholesale Co., Inc. v. Philip Morris Inc., 263 F.3d 239, was an early appellate case testing the legality of the Tobacco Master Settlement Agreement (MSA), in this instance whether it could properly be alleged to violate the Sherman Antitrust Act.

The Tobacco MSA with New York is the particular version of the Tobacco MSA that was signed in New York City, was enabled by means of legislation in New York State, and has been interpreted since then in New York State courts.

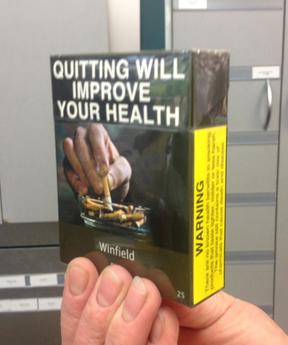

Plain tobacco packaging, also known as generic, neutral, standardised or homogeneous packaging, is packaging of tobacco products, typically cigarettes, without any branding, including only the brand name in a mandated size, font and place on the pack, in addition to the health warnings and any other legally mandated information such as toxic constituents and tax-paid stamps. The appearance of all tobacco packs is standardised, including the colour of the pack.

The Stop Tobacco Smuggling in the Territories Act of 2013 was a bill introduced into the United States House of Representatives in the 113th United States Congress that passed the House with a vote of 421-5. The purpose of the bill is to redefine "state" in the Contraband Cigarette Trafficking Act of 1978 to add American Samoa, the Commonwealth of the Northern Mariana Islands, and Guam, so that United States laws against tobacco smuggling would apply in those places. The 1978 Act makes it a felony to smuggle cigarettes from one area to another without paying the appropriate taxes. Smugglers trafficking in cigarettes transport cigarettes to jurisdictions with high cigarette taxes, avoid paying the taxes, and then sell the smuggled cigarettes with a large profit margin, while still selling their cigarettes for a cheaper price than those that could be purchased legally.

The illicit cigarette trade is defined as “the production, import, export, purchase, sale, or possession of tobacco goods which fail to comply with legislation”. Illicit cigarette trade activities fall under 3 categories:

- Contraband: cigarettes smuggled from abroad without domestic duty paid;

- Counterfeit: cigarettes manufactured without authorization of the rightful owners, with intent to deceive consumers and to avoid paying duty;

- Illicit whites: brands manufactured legitimately in one country, but smuggled and sold in another without duties being paid.

Regulation of electronic cigarettes varies across countries and states, ranging from no regulation to banning them entirely. For instance, e-cigarettes were illegal in Japan, which forced the market to use heat-not-burn tobacco products for cigarette alternatives. Others have introduced strict restrictions and some have licensed devices as medicines such as in the UK. However, as of February 2018, there is no e-cigarette device that has been given a medical license that is commercially sold or available by prescription in the UK. As of 2015, around two thirds of major nations have regulated e-cigarettes in some way. Because of the potential relationship with tobacco laws and medical drug policies, e-cigarette legislation is being debated in many countries. The companies that make e-cigarettes have been pushing for laws that support their interests. In 2016 the US Department of Transportation banned the use of e-cigarettes on commercial flights. This regulation applies to all flights to and from the US. In 2018, the Royal College of Physicians asked that a balance is found in regulations over e-cigarettes that ensure product safety while encouraging smokers to use them instead of tobacco, as well as keep an eye on any effects contrary to the control agencies for tobacco.

References

- ↑ "A.G. Schneiderman Sues Major Contraband Cigarette Dealers For Evading State Taxes" (Press release). New York State Attorney General. March 4, 2013. Retrieved 2016-11-07.

- ↑ "Six Nations Council, General Council Minutes" (PDF). Six Nations Council. January 14, 2014. Archived from the original (PDF) on 2016-03-04. Retrieved 2015-10-09.

- ↑ "Six Nations tobacco giant products hit with counterfeits, offers $25,000 reward". Kahnawake News. October 12, 2011. Archived from the original on 2016-03-04. Retrieved 2015-10-09.