Related Research Articles

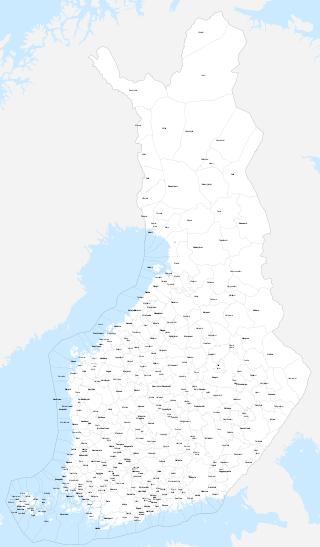

The municipalities represent the local level of administration in Finland and act as the fundamental, self-governing administrative units of the country. The entire country is incorporated into municipalities and legally, all municipalities are equal, although certain municipalities are called cities or towns. Municipalities have the right to levy a flat percentual income tax, which is between 16 and 22 percent, and they provide two thirds of public services. Municipalities control many community services, such as schools, health care and the water supply, and local streets. They do not maintain highways, set laws or keep police forces, which are responsibilities of the central government.

Obwalden or Obwald is one of the 26 cantons forming the Swiss Confederation. It is composed of seven municipalities and the seat of the government and parliament is in Sarnen. It is traditionally considered a "half-canton", the other half being Nidwalden.

Appenzell Innerrhoden, in English sometimes Appenzell Inner-Rhodes, is one of the 26 cantons forming the Swiss Confederation. It is composed of five districts. The seat of the government and parliament is Appenzell. It is traditionally considered a "half-canton", the other half being Appenzell Ausserrhoden.

In Canada, taxation is a prerogative shared between the federal government and the various provincial and territorial legislatures.

In the United Kingdom, taxation may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2023–24, total government revenue was forecast to be £1,139.1 billion, or 40.9 per cent of GDP, with income taxes and National Insurance contributions standing at around £470 billion.

In electoral systems, voter registration is the requirement that a person otherwise eligible to vote must register on an electoral roll, which is usually a prerequisite for being entitled or permitted to vote.

Double taxation is the levying of tax by two or more jurisdictions on the same income, asset, or financial transaction.

A national identification number, national identity number, or national insurance number or JMBG/EMBG is used by the governments of many countries as a means of tracking their citizens, permanent residents, and temporary residents for the purposes of work, taxation, government benefits, health care, and other governmentally-related functions.

In law and conflict of laws, domicile is relevant to an individual's "personal law", which includes the law that governs a person's status and their property. It is independent of a person's nationality. Although a domicile may change from time to time, a person has only one domicile, or residence, at any point in their life, no matter what their circumstances. Domicile is distinct from habitual residence, where there is less focus on future intent.

A church tax is a tax collected by the state from members of some religious denominations to provide financial support of churches, such as the salaries of its clergy and to pay the operating cost of the church. Not all countries have such a tax. In some countries that do, people who are not members of a religious community are exempt from the tax; in others it is always levied, with the payer often entitled to choose who receives it, typically the state or an activity of social interest.

Finnish nationality law details the conditions by which an individual is a national of Finland. The primary law governing these requirements is the Nationality Act, which came into force on 1 June 2003. Finland is a member state of the European Union (EU) and all Finnish nationals are EU citizens. They are entitled to free movement rights in EU and European Free Trade Association (EFTA) countries and may vote in elections to the European Parliament.

The criteria for residence for tax purposes vary considerably from jurisdiction to jurisdiction, and "residence" can be different for other, non-tax purposes. For individuals, physical presence in a jurisdiction is the main test. Some jurisdictions also determine residency of an individual by reference to a variety of other factors, such as the ownership of a home or availability of accommodation, family, and financial interests. For companies, some jurisdictions determine the residence of a corporation based on its place of incorporation. Other jurisdictions determine the residence of a corporation by reference to its place of management. Some jurisdictions use both a place-of-incorporation test and a place-of-management test.

Altdorf is a municipality in the district of Esslingen in Baden-Württemberg in southern Germany. It is 8 kilometres away from the town of Nürtingen.

In Switzerland, the place of origin denotes where a Swiss citizen has their municipal citizenship, usually inherited from previous generations. It is not to be confused with the place of birth or place of residence, although two or all three of these locations may be identical depending on the person's circumstances.

Taxation in Sweden on salaries for an employee involves contributing to three different levels of government: the municipality, the county council, and the central government. Social security contributions are paid to finance the social security system.

Taxes in Switzerland are levied by the Swiss Confederation, the cantons and the municipalities.

A resident register is a government database which contains information on the current residence of persons. In countries where registration of residence is compulsory, the current place of residence must be reported to the registration office or the police within a few days after establishing a new residence. In some countries, residence information may be obtained indirectly from voter registers or registers of driver licenses. Besides a formal resident registers or population registers, residence information needs to be disclosed in many situations, such as voter registration, passport application, and updated in relation to drivers licenses, motor vehicle registration, and many other purposes. The permanent place of residence is a common criterion for taxation including the assessment of a person's income tax.

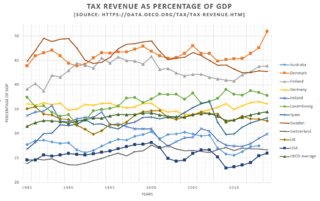

In Austria, taxes are levied by the state and the tax revenue in Austria was 42.7% of GDP in 2016 according to the World Bank The most important revenue source for the government is the income tax, corporate tax, social security contributions, value added tax and tax on goods and services. Another important taxes are municipal tax, real-estate tax, vehicle insurance tax, property tax, tobacco tax. There exists no property tax. The gift tax and inheritance tax were cancelled in 2008. Furthermore, self-employed persons can use a tax allowance of €3,900 per year. The tax period is set for a calendar year. However, there is a possibility of having an exception but a permission of the tax authority must be received. The Financial Secrecy Index ranks Austria as the 35th safest tax haven in the world.

Taxes in Germany are levied at various government levels: the federal government, the 16 states (Länder), and numerous municipalities (Städte/Gemeinden). The structured tax system has evolved significantly, since the reunification of Germany in 1990 and the integration within the European Union, which has influenced tax policies. Today, income tax and Value-Added Tax (VAT) are the primary sources of tax revenue. These taxes reflect Germany's commitment to a balanced approach between direct and indirect taxation, essential for funding extensive social welfare programs and public infrastructure. The modern German tax system accentuate on fairness and efficiency, adapting to global economic trends and domestic fiscal needs.

In the Republic of Austria, the municipality is the administrative division encompassing a single village, town, or city. The municipality has corporate status and local self-government on the basis of parliamentary-style representative democracy: a municipal council elected through a form of party-list system enacts municipal laws, a municipal executive board and a mayor appointed by the council are in charge of municipal administration. Austria is currently partitioned into 2,095 municipalities, ranging in population from about fifty to almost two million. There is no unincorporated territory in Austria.

References

- ↑ help.gv.at - Hauptwohnsitz (German language), accessed 10 August 2009. Archived 2009-02-12 at the Wayback Machine

- ↑ Melderechtsrahmengesetz Archived 2011-03-14 at the Wayback Machine (German language), § 12 (2)

- ↑ Schmidt, Theresa (2022-02-24). "Zweitwohnungssteuer und doppelte Haushaltsführung | Steuern | Haufe". Haufe.de News und Fachwissen (in German). Retrieved 31 March 2023.