Related Research Articles

In the United States, Medicaid is a government program that provides health insurance for adults and children with limited income and resources. The program is partially funded and primarily managed by state governments, which also have wide latitude in determining eligibility and benefits, but the federal government sets baseline standards for state Medicaid programs and provides a significant portion of their funding.

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses.

Health insurance or medical insurance is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses. As with other types of insurance, risk is shared among many individuals. By estimating the overall risk of health risk and health system expenses over the risk pool, an insurer can develop a routine finance structure, such as a monthly premium or payroll tax, to provide the money to pay for the health care benefits specified in the insurance agreement. The benefit is administered by a central organization, such as a government agency, private business, or not-for-profit entity.

A disability pension is a form of pension given to those people who are permanently or temporarily unable to work due to a disability.

A health savings account (HSA) is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan (HDHP). The funds contributed to an account are not subject to federal income tax at the time of deposit. Unlike a flexible spending account (FSA), HSA funds roll over and accumulate year to year if they are not spent. HSAs are owned by the individual, which differentiates them from company-owned Health Reimbursement Arrangements (HRA) that are an alternate tax-deductible source of funds paired with either high-deductible health plans or standard health plans.

Health care in Ireland is delivered through public and private healthcare. The public health care system is governed by the Health Act 2004, which established a new body to be responsible for providing health and personal social services to everyone living in Ireland – the Health Service Executive. The new national health service came into being officially on 1 January 2005; however the new structures are currently in the process of being established as the reform programme continues. In addition to the public-sector, there is also a large private healthcare market.

Whole life insurance, or whole of life assurance, sometimes called "straight life" or "ordinary life", is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date. As a life insurance policy it represents a contract between the insured and insurer that as long as the contract terms are met, the insurer will pay the death benefit of the policy to the policy's beneficiaries when the insured dies.

Switzerland has universal health care, regulated by the Swiss Federal Law on Health Insurance. There are no free state-provided health services, but private health insurance is compulsory for all persons residing in Switzerland.

A Health Reimbursement Arrangement, also known as a Health Reimbursement Account (HRA), is a type of US employer-funded health benefit plan that reimburses employees for out-of-pocket medical expenses and, in limited cases, to pay for health insurance plan premiums.

Critical illness insurance, otherwise known as critical illness cover or a dread disease policy, is an insurance product in which the insurer is contracted to typically make a lump sum cash payment if the policyholder is diagnosed with one of the specific illnesses on a predetermined list as part of an insurance policy.

Dental insurance is a form of health insurance designed to pay a portion of the costs associated with dental care.

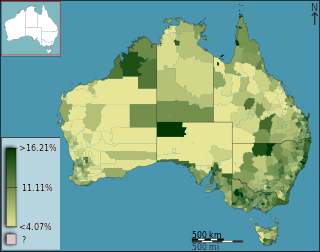

Health care in Australia operates under a shared public-private model underpinned by the Medicare system, the national single-payer funding model. State and territory governments operate public health facilities where eligible patients receive care free of charge. Primary health services, such as GP clinics, are privately owned in most situations, but attract Medicare rebates. Australian citizens, permanent residents, and some visitors and visa holders are eligible for health services under the Medicare system. Individuals are encouraged through tax surcharges to purchase health insurance to cover services offered in the private sector, and further fund health care.

Medicare Advantage is a type of health plan offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage. Under Part C, Medicare pays a sponsor a fixed payment. The sponsor then pays for the health care expenses of enrollees. Sponsors are allowed to vary the benefits from those provided by Medicare's Parts A and B as long as they provide the actuarial equivalent of those programs. The sponsors vary from primarily integrated health delivery systems to unions to other types of non profit charities to insurance companies. The largest sponsor is a hybrid: the non-profit interest group AARP using UnitedHealth.

Healthcare in Singapore is under the purview of the Ministry of Health of the Government of Singapore. It mainly consists of a government-run publicly funded universal healthcare system as well as a significant private healthcare sector. Financing of healthcare costs is done through a mixture of direct government subsidies, compulsory comprehensive savings, national healthcare insurance, and cost-sharing.

Germany has a universal multi-payer health care system paid for by a combination of statutory health insurance and private health insurance.

Disability benefits are a form of financial assistance or welfare designed to support disabled individuals who cannot work due to a chronic illness, disease or injury. Disability benefits are typically provided through various sources, including government programs, group disability insurance provided by employers or associations or private insurance policies typically purchased through a licensed insurance agent or broker, or directly from an insurance company.

Examples of health care systems of the world, sorted by continent, are as follows.

Healthcare in Luxembourg is based on three fundamental principles: compulsory health insurance, free choice of healthcare provider for patients and compulsory compliance of providers in the set fixed costs for the services rendered. Citizens are covered by a healthcare system that provides medical, maternity and illness benefits and, for the elderly, attendance benefits. The extent of the coverage varies depending on the occupation of the individual. Those employed or receiving social security have full insurance coverage, and the self-employed and tradesmen are provided with both medical benefits and attendance benefits. That is all funded by taxes on citizens' incomes, payrolls and wages. However, the government covers the funding for maternity benefits as well as any other sector that needs additional funding. About 75% of the population purchases a complementary healthcare plan. About 99% of the people are covered under the state healthcare system.

Cancer insurance is a type of supplemental health insurance that is meant to manage the risks associated with the cancer disease and its numerous manifestations. Cancer insurance is a relatively new trend within the insurance industry. It is meant to mitigate the costs of cancer treatment and provide policyholders with a degree of financial support. This support is based upon the terms written into a particular policy by an insurance company. As with other forms of insurance, cancer insurance is subject to charges, called premiums, which change depending on the risk associated with covering the disease.

In Switzerland a distinction is made between Social assistance in the broader sense and social assistance in the narrower sense.

References

- ↑ "What is a healthcare cash plan?".

- ↑ Thomas, Owain (2021-12-13). "Cash plan market breaks half a million customers". Healthcare and protection.