NYSE American, formerly known as the American Stock Exchange (AMEX), and more recently as NYSE MKT, is an American stock exchange situated in New York City. AMEX was previously a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange.

The Nasdaq Stock Market is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources.

The New York Stock Exchange is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is the largest stock exchange in the world by market capitalization, exceeding $25 trillion in July 2024. The NYSE is owned by Intercontinental Exchange, an American holding company that it also lists. Previously, it was part of NYSE Euronext (NYX), which was formed by the NYSE's 2007 merger with Euronext. According to a Gallup poll conducted in 2022, approximately 58% of American adults reported having money invested in the stock market, either through individual stocks, mutual funds, or retirement accounts.

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as floating, or going public, a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded.

The National Stock Exchange (NSX) is an electronic stock exchange based in Jersey City, New Jersey. It was founded March 1885 in Cincinnati, Ohio, as the Cincinnati Stock Exchange.

A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a tradable asset held in inventory, hoping to make a profit on the difference, which is called the bid–ask spread or turn. This stabilizes the market, reducing price variation (volatility) by setting a trading price range for the asset.

An electronic communication network (ECN) is a type of computerized forum or network that facilitates the trading of financial products outside traditional stock exchanges. An ECN is generally an electronic system accessed by an electronic trading platform that widely disseminates orders entered by market makers to third parties and permits the orders to be executed against them in whole or in part. The primary products that are traded on ECNs are stocks and currencies. ECNs are generally passive computer-driven networks that internally match limit orders and charge a very small per share transaction fee.

The Arizona Stock Exchange (AZX) was an electronically enabled stock exchange for extended-hours trading. It was founded in 1990 as Wunsch Auction Systems by R. Steven Wunsch, and moved from New York City to Arizona in 1992. It closed in October 2001 due to lack of trading volume.

Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. This type of trading attempts to leverage the speed and computational resources of computers relative to human traders. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. A study in 2019 showed that around 92% of trading in the Forex market was performed by trading algorithms rather than humans.

Tokyo Stock Price Index, commonly known as TOPIX, along with the Nikkei 225, is an important stock market index for the Tokyo Stock Exchange (TSE) in Japan, which tracks the entire market of domestic companies and covers most stocks in the Prime Market and some stocks in the Standard Market. It is calculated and published by the TSE. As of January 2024, there will be 1,716 companies listed on the TSE, since about 400 stocks with low liquidity will be phased out after the TSE reform in 2022.

Open outcry is a method of communication between professionals on a stock exchange or futures exchange, typically on a trading floor. It involves shouting and the use of hand signals to transfer information primarily about buy and sell orders. The part of the trading floor where this takes place is called a pit.

NYSE Euronext, Inc. was a transatlantic multinational financial services corporation that operated multiple securities exchanges, including the New York Stock Exchange, Euronext and NYSE Arca. NYSE merged with Archipelago Holdings on March 7, 2006, forming NYSE Group, Inc. On April 4, 2007, NYSE Group, Inc. merged with Euronext N.V. to form the first global equities exchange, with its headquarters in Lower Manhattan. The corporation was then acquired by Intercontinental Exchange, which subsequently spun off Euronext.

Extended-hours trading is stock trading that happens either before or after the trading day regular trading hours (RTH) of a stock exchange, i.e., pre-market trading or after-hours trading.

Intercontinental Exchange, Inc. (ICE) is an American multinational financial services company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell 1000, the company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada, and Europe; the Liffe futures exchanges in Europe; the New York Stock Exchange; equity options exchanges; and OTC energy, credit, and equity markets.

Ljubljana Stock Exchange or LJSE is a stock exchange located in Ljubljana, Slovenia. It is Slovenia's only stock exchange. The exchange trades shares of Slovenian companies, as well as bonds and commercial papers. The only stockholder of the Ljubljana Stock Exchange is Zagreb Stock Exchange.

In finance, an electronic trading platform, also known as an online trading platform, is a computer software program that can be used to place orders for financial products over a network with a financial intermediary. Various financial products can be traded by the trading platform, over a communication network with a financial intermediary or directly between the participants or members of the trading platform. This includes products such as stocks, bonds, currencies, commodities, derivatives and others, with a financial intermediary such as brokers, market makers, Investment banks or stock exchanges. Such platforms allow electronic trading to be carried out by users from any location and are in contrast to traditional floor trading using open outcry and telephone-based trading. Sometimes the term trading platform is also used in reference to the trading software alone.

The Global Electronic Trading Company (GETCO), or Getco LLC, is an American proprietary algorithmic trading and electronic market making firm based in Chicago, Illinois. In December 2012, the firm agreed to acquire Knight Capital Group; this merger was completed in July 2013, forming the new company KCG Holdings.

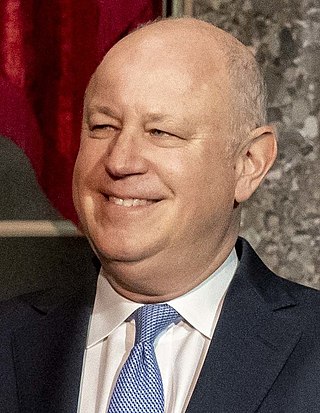

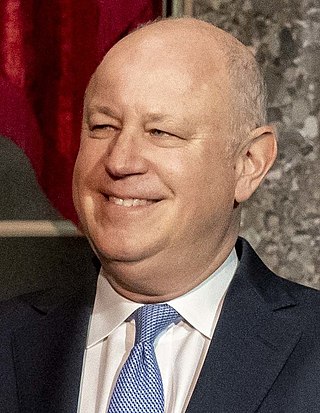

Jeffrey Craig Sprecher is an American businessman, the founder, chairman, and CEO of Intercontinental Exchange, and chairman of the New York Stock Exchange.

Van der Moolen was a Dutch equity trading firm, with its headquarters located in Amsterdam. They were mainly active in the United States and in Europe, particularly in the Netherlands, France, Germany, Switzerland and the United Kingdom. Van der Moolen, which at its peak was one of the largest registered market makers on the New York Stock Exchange, filed for bankruptcy in September 2009 after mounting losses.