Related Research Articles

MCI, Inc. was a telecommunications company. For a time, it was the second-largest long-distance telephone company in the United States, after AT&T. WorldCom grew largely by acquiring other telecommunications companies, including MCI Communications in 1998, and filed for bankruptcy in 2002 after an accounting scandal, in which several executives, including CEO Bernard Ebbers, were convicted of a scheme to inflate the company's assets. In January 2006, the company, by then renamed MCI, was acquired by Verizon Communications and was later integrated into Verizon Business.

Bernard John Ebbers was a Canadian-American businessman and the co-founder and CEO of WorldCom. Under his management, WorldCom grew rapidly but collapsed in 2002 amid revelations of accounting irregularities, making it at the time one of the largest accounting scandals in the United States. Ebbers blamed his subordinates but was convicted of fraud and conspiracy. In December 2019, Ebbers was released from Federal Medical Center, Fort Worth, due to declining health, having served 13 years of his 25-year sentence, and he died just over a month later.

Adelphia Communications Corporation was an American cable television company with headquarters in Coudersport, Pennsylvania. It was founded in 1952 by brothers Gus and John Rigas after the pair purchased a cable television franchise for US$300. Combining various cable properties, the company became one of the most successful in the United States and reached over two million subscribers in 1998. In addition to cable television, Adelphia later started providing high-speed internet, phone services and voice messaging for businesses.

Jeffrey Keith Skilling is an American businessman who in 2006 was convicted of federal felony charges relating to the Enron scandal. Skilling, who was CEO of Enron during the company's collapse, was eventually sentenced to 24 years in prison, of which he served 12 after multiple appeals.

Sherron Watkins is an American former Vice President of Corporate Development at the Enron Corporation. Watkins was called to testify before committees of the U.S. House of Representatives and Senate at the beginning of 2002, primarily about her warnings to Enron's then-CEO Kenneth Lay about accounting irregularities in the financial statements.

John James Rigas was an American businessman who was one of the founders of Adelphia Communications Corporation, which at its peak was one of the largest cable TV companies in the United States. He was also the majority owner of the Buffalo Sabres franchise of the National Hockey League. In 2005, he was convicted on multiple charges of fraud and sentenced to 15 years in prison, serving nine of those years before being released due to declining health.

Richard Marin Scrushy is an American businessman and convicted felon. He is the founder of HealthSouth Corporation, a global healthcare company based in Birmingham, Alabama. In 2004, following an investigation by the Federal Bureau of Investigation (FBI), Scrushy was criminally charged by the U.S. Securities and Exchange Commission (SEC). Scrushy was charged with 36 of the original 85 counts but was acquitted of all charges on June 28, 2005, after a jury trial in Birmingham.

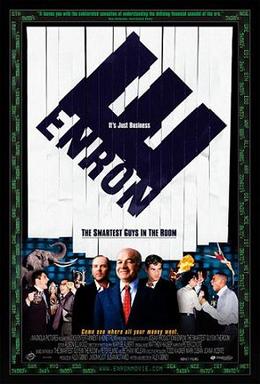

Enron: The Smartest Guys in the Room is a 2005 American documentary film based on the best-selling 2003 book of the same name by Fortune reporters Bethany McLean and Peter Elkind, who are credited as writers of the film alongside the director, Alex Gibney. It examines the 2001 collapse of the Enron Corporation, which resulted in criminal trials for several of the company's top executives during the ensuing Enron scandal, and contains a section about the involvement of Enron traders in the 2000-01 California electricity crisis. Archival footage is used alongside new interviews with McLean and Elkind, several former Enron executives and employees, stock analysts, reporters, and former Governor of California Gray Davis.

Thomas Arthur Mesereau Jr. is an American attorney known for defending Michael Jackson in his 2005 child molestation trial, as well as Mike Tyson, Bill Cosby and, in 2023, Danny Masterson, a case in which Mesereau was sanctioned by the judge.

CUC (Comp-U-Card) International Inc. was a membership-based consumer services conglomerate with travel, shopping, auto, dining, home improvement and financial services offered to more than 60 million customers worldwide based in Stamford, Connecticut, US, and founded in 1973 by Kirk Shelton and Walter Forbes. In 1998, it became involved in a Securities and Exchange Commission investigation into what, at the time, was the biggest accounting scandal in corporate history.

The trial of Kenneth Lay, former chairman and CEO of Enron, and Jeffrey Skilling, former CEO and COO, was presided over by federal district court Judge Sim Lake in the Southern District of Texas in 2006 in response to the Enron scandal.

The NatWest Three, also known as the Enron Three, are the British businessmen Giles Darby, David Bermingham and Gary Mulgrew. In 2002, they were indicted in Houston, Texas, on seven counts of wire fraud against their former employer, Greenwich NatWest, as part of the Enron scandal.

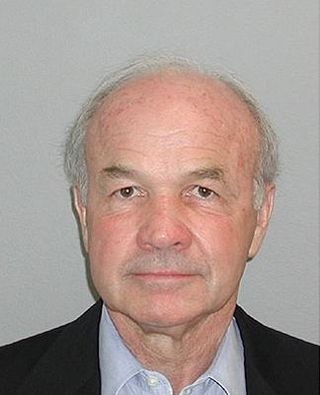

Kenneth Lee Lay was an American businessman who was the founder, chief executive officer and chairman of Enron. He was heavily involved in Enron's accounting scandal that unraveled in 2001 into the largest bankruptcy ever to that date. Lay was indicted by a grand jury and was found guilty of 10 counts of securities fraud at trial. Lay died in July 2006 while vacationing in his house near Aspen, Colorado, three months before his scheduled sentencing. A preliminary autopsy reported Lay died of a heart attack caused by coronary artery disease. His death resulted in a vacated judgment. Conspiracy theories regarding Lay's death surfaced, alleging that it was faked.

The Enron scandal was an accounting scandal involving Enron Corporation, an American energy company based in Houston, Texas. When news of widespread fraud within the company became public in October 2001, the company filed for bankruptcy and its accounting firm, Arthur Andersen—then one of the five largest audit and accountancy partnerships in the world—was effectively dissolved. In addition to being the largest bankruptcy reorganization in U.S. history at that time, Enron was cited as the biggest audit failure.

David G. Friehling is an American accountant who was arrested and charged in March 2009 for his role in the Madoff investment scandal. He subsequently pleaded guilty to rubber-stamping Bernard Madoff's filings with regulators rather than fully reviewing them. His role in covering up Madoff's massive Ponzi scheme makes it the largest accounting fraud in history.

Accounting scandals are business scandals which arise from intentional manipulation of financial statements with the disclosure of financial misdeeds by trusted executives of corporations or governments. Such misdeeds typically involve complex methods for misusing or misdirecting funds, overstating revenues, understating expenses, overstating the value of corporate assets, or underreporting the existence of liabilities; these can be detected either manually, or by the means of deep learning. It involves an employee, account, or corporation itself and is misleading to investors and shareholders.

"Tone at the top" is a term that originated in the field of accounting and is used to describe an organization's general ethical climate, as established by its board of directors, audit committee, and senior management. Having good tone at the top is believed by business ethics experts to help prevent fraud and other unethical practices. The very same idea is expressed in negative terms by the old saying "A fish rots from the head down".

James W. Parkman, III is an American criminal defense lawyer in Birmingham, Alabama. He has been practicing law for over 40 years, and has represented several high-profile clients, most notably former HealthSouth CEO Richard M. Scrushy, Swedish criminal Bo Stefan Eriksson, former Detroit Mayor Kwame Kilpatrick, and Alabama State Senator Harri Anne Smith.

Two related investigations by New York State and City officials were opened by 2020 to determine whether the Trump Organization has committed financial fraud. One of these is a criminal case being conducted by the Manhattan district attorney (DA) and the other is a civil case being conducted by the New York State Attorney General (AG). The DA's case has led to two of the organization's subsidiary companies being found guilty of 17 charges including tax fraud and the indictment of Donald Trump, while the AG has succeeded in imposing an independent monitor to prevent future fraud by the organization.

References

- ↑ O'Brien, Tim (19 January 2005). "'Dumb CEO Defense' Spares Cendant Chairman From Prison". New Jersey Law Journal.

- ↑ Christoffersen, John (31 October 2006). "Jury Finds Ex-Cendant Chairman Guilty". Associated Press.

- ↑ "'I was shocked,' Ebbers says of being told about WorldCom irregularities". The Clarion-Ledger. 28 February 2005.

- ↑ Reeves, Jay (9 March 2005). "Scrushy Defense: Fraud Hidden From Ex-CEO". Associated Press.

- ↑ "Enron's Lay says he was duped, not dumb". Houston Chronicle. 14 March 2005.

Court documents

- United States of America vs. Bernard J Ebbers, United States District Court Southern District of New York, Indictment S3 02 Cr. 1144 (BSJ)

- United States of America vs. Kenneth L. Lay, et al., United States District Court Southern District of Texas Houston Division, Cr. No. H-04-25 (S-2). (7 July 2004)

- United States of America vs. Richard M. Scrushy, United States District Court Northern District of Alabama Southern Division, Case No. CR-03-BE-0530-S. (29 October 2003)

Editorials

- Syre, Steven (18 January 2005). "The 'idiot' defense". The Boston Globe.

- "The Idiot Defense". Los Angeles Times. 6 March 2005.

- Harrigan, Susan (16 March 2005). "'Embattled CEOs wise up to dummy defense". Newsday.