A commodity market is a market that trades in the primary economic sector rather than manufactured products. The primary sector includes agricultural products, energy products, and metals. Soft commodities may be perishable and harvested, while hard commodities are usually mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodities market for centuries for price risk management.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price or delivery price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Non-profit, member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers; they are privately owned. For-profit futures exchanges earn most of their revenue from trading and clearing fees, and are often public corporations.

Nasdaq Nordic is the common name for the subsidiaries of Nasdaq, Inc. that provide financial services and operate marketplaces for securities in the Nordic and Baltic regions of Europe.

The Chicago Mercantile Exchange (CME) is a global derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board, an agricultural commodities exchange. For most of its history, the exchange was in the then common form of a non-profit organization, owned by members of the exchange. The Merc demutualized in November 2000, went public in December 2002, and merged with the Chicago Board of Trade in July 2007 to become a designated contract market of the CME Group Inc., which operates both markets. The chairman and chief executive officer of CME Group is Terrence A. Duffy, Bryan Durkin is president. On August 18, 2008, shareholders approved a merger with the New York Mercantile Exchange (NYMEX) and COMEX. CME, CBOT, NYMEX, and COMEX are now markets owned by CME Group. After the merger, the value of the CME quadrupled in a two-year span, with a market cap of over $25 billion.

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

Aker Solutions ASA is a Norwegian engineering firm headquartered in Oslo. The firm's production is focused on energy infrastructure, including systems and services required to de-carbonize oil and gas production, build wind-to-grid infrastructure and engineer CO2 capture and sequestration.

Oslo Stock Exchange is a stock exchange within the Nordic countries and offers Norway's only regulated markets for securities trading today. The stock exchange offers a full product range including equities, derivatives and fixed income instruments.

The International Exchange, now ICE Futures, based in London, was one of the world's largest energy futures and options exchanges. Its flagship commodity, Brent Crude was a world benchmark for oil prices, but the exchange also handled futures contracts and options on fuel oil, natural gas, electricity, coal contracts and, as of 22 April 2005, carbon emission allowances with the European Climate Exchange (ECX).

Brent Crude may refer to any or all of the components of the Brent Complex, a physically and financially traded oil market based around the North Sea of Northwest Europe; colloquially, Brent Crude usually refers to the price of the ICE Brent Crude Oil futures contract or the contract itself. The original Brent Crude referred to a trading classification of sweet light crude oil first extracted from the Brent oilfield in the North Sea in 1976. As production from the Brent oilfield declined to zero in 2021, crude oil blends from other oil fields have been added to the trade classification. The current Brent blend consists of crude oil produced from the Forties, Oseberg, Ekofisk, Troll oil fields and oil drilled from Midland, Texas in the Permian Basin.

The International Maritime Exchange or Imarex is an Oslo-based exchange for trading forward freight agreements (FFAs). It started trading tanker freight futures contracts in 2001, followed by dry cargo freight futures contracts in 2002. All futures contracts are cleared by the Norwegian Futures and Options Clearing House (NOS). Imarex is owned by Imarex ASA and has subsidiaries in Oslo, Singapore, Genova and Houston (USA).

European Energy Exchange (EEX) AG is a central European electric power and related commodities exchange located in Leipzig, Germany. It develops, operates and connects secure, liquid and transparent markets for energy and related products, including power derivative contracts, emission allowances, agricultural and freight products.

Bonheur ASA is a publicly traded Norwegian holding company headquartered in Oslo. The company is listed on Oslo Stock Exchange and has interests in the energy, real estate, shipping and media sectors, and announced in October 2024 3-month profits of NOK 350m on sales of NOK 3.6bn, with the largest divisions being Renewable energy NOK 529m, Wind Service NOK 1,752m and Cruise NOK 1,016m

Intercontinental Exchange, Inc. (ICE) is an American multinational financial services company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell 1000, the company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada, and Europe; the Liffe futures exchanges in Europe; the New York Stock Exchange; equity options exchanges; and OTC energy, credit, and equity markets.

CME Group Inc. is a financial services company. Headquartered in Chicago, the company operates financial derivatives exchanges including the Chicago Mercantile Exchange, Chicago Board of Trade, New York Mercantile Exchange, and The Commodity Exchange. The company also owns 27% of S&P Dow Jones Indices. It is the world's largest operator of financial derivatives exchanges. Its exchanges are platforms for trading in agricultural products, currencies, energy, interest rates, metals, futures contracts, options, stock indexes, and cryptocurrencies futures.

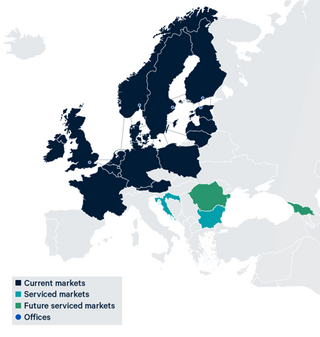

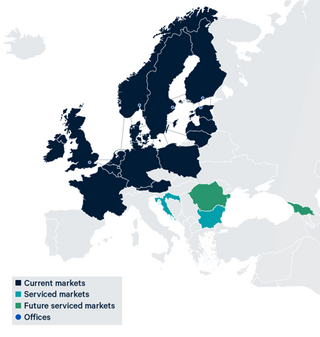

NASDAQ OMX Commodities Europe is a trade name of NASDAQ OMX Oslo ASA, the single financial energy market for Norway, Denmark, Sweden and Finland. Before 1 November 2010, it was known by the name Nord Pool. As of 2008, Nord Pool was the largest power derivatives exchange and the second largest exchange in European Union emission allowances (EUAs) and global certified emission reductions (CERs) trading.

Nord Pool AS is a pan-European power exchange. Nord Pool has its main office in Oslo and further offices in Stockholm, Helsinki, Tallinn and London. The company is owned by the European exchange operator Euronext as well as TSO Holding, which represents the continental Nordic and Baltic countries' transmission system operators. Nord Pool has two subsidiaries, Nord Pool AB and Nord Pool Finland Oy.

European Commodity Clearing (ECC) is the leading clearing house for energy and commodity products in Europe and the central clearing house for the Global Commodity Exchange, EEX Group. ECC assumes the counterparty risk and guarantees the physical and financial settlement of transactions, providing security and cross-margining benefits for its customers. As part of EEX Group, ECC provides clearing services for EEX, EEX Asia and EPEX SPOT with additional services provided to Power Exchange Central Europe (PXE). In addition, ECC also provides clearing services for the partner exchanges HUPX, HUDEX, NOREXECO, SEEPEX and SEMOpx.

Interactive Brokers, Inc. (IB), headquartered in Greenwich, Connecticut, is an American multinational brokerage firm which operates the largest electronic trading platform in the United States by number of daily average revenue trades. In 2023, the platform processed an average of 3 million trades per trading day. Interactive Brokers is the largest foreign exchange market broker and is one of the largest prime brokers servicing commodity brokers. The company brokers stocks, options, futures contracts, exchange of futures for physicals, options on futures, bonds, mutual funds, currency, cryptocurrency, contracts for difference, derivatives, and event-based trading contracts on election and other outcomes. Interactive Brokers offers direct market access, omnibus and non-disclosed broker accounts, and provides clearing services. The firm has operations in 34 countries and 27 currencies and has 2.6 million institutional and individual brokerage customers, with total customer equity of US$426 billion as of December 31, 2023. In addition to its headquarters in Greenwich, on the Gold Coast of Connecticut, the company has offices in major financial centers worldwide. More than half of the company's customers reside outside the United States, in approximately 200 countries.