Related Research Articles

The Parliament of 1614 was the second Parliament of England of the reign of James VI and I and sat between 5 April and 7 June 1614. Lasting only two months and two days, it saw no bills pass and was not even regarded as a parliament by contemporaries. However, for its failure it has been known to posterity as the Addled Parliament.

Ship money was a tax of medieval origin levied intermittently in the Kingdom of England until the middle of the 17th century. Assessed typically on the inhabitants of coastal areas of England, it was one of several taxes that English monarchs could levy by prerogative without the approval of Parliament. The attempt of King Charles I from 1634 onwards to levy ship money during peacetime and extend it to the inland counties of England without parliamentary approval provoked fierce resistance, and was one of the grievances of the English propertied class in the lead-up to the English Civil War.

Sir James Whitelocke SL was an English judge and politician who sat in the House of Commons between 1610 and 1622.

Sir Thomas Fleming was an English judge and politician who sat in the House of Commons at various times between 1581 and 1611. He was judge in the trial of Guy Fawkes following the Gunpowder Plot. He held several important offices, including Lord Chief Justice, Lord Chief Baron of the Exchequer and Solicitor General for England and Wales.

The Tea Act 1773 was an Act of the Parliament of Great Britain. The principal objective was to reduce the massive amount of tea held by the financially troubled British East India Company in its London warehouses and to help the struggling company survive. A related objective was to undercut the price of illegal tea, smuggled into Britain's North American colonies. This was supposed to convince the colonists to purchase Company tea on which the Townshend duties were paid, thus implicitly agreeing to accept Parliament's right of taxation. Smuggled tea was a large issue for Britain and the East India Company, since approximately 86% of all the tea in America at the time was smuggled Dutch tea.

The Personal Rule was the period in England from 1629 to 1640 when King Charles I ruled as an autocratic absolute monarch without recourse to Parliament. Charles claimed that he was entitled to do this under the royal prerogative and that he had a divine right.

The Levant Company was an English chartered company formed in 1592. Elizabeth I of England approved its initial charter on 11 September 1592 when the Venice Company (1583) and the Turkey Company (1581) merged, because their charters had expired, as she was eager to maintain trade and political alliances with the Ottoman Empire. Its initial charter was good for seven years and was granted to Edward Osborne, Richard Staper, Thomas Smith and William Garrard with the purpose of regulating English trade with the Ottoman Empire and the Levant. The company remained in continuous existence until being superseded in 1825. A member of the company was known as a Turkey Merchant.

The concept of virtual representation was that the members of the UK Parliament, including the Lords and the Crown-in-Parliament, reserved the right to speak for the interests of all British subjects, rather than for the interests of only the district that elected them or for the regions in which they held peerages and spiritual sway. Virtual representation was the British response to the First Continental Congress in the American colonies. The Second Continental Congress asked for representation in Parliament in the Suffolk Resolves, also known as the first Olive Branch Petition. Parliament claimed that their members had the well being of the colonists in mind. The patriots in the Colonies rejected this premise.

Tonnage and poundage were English duties and taxes first levied in Edward II's reign on every tun (cask) of imported wine, which came mostly from Spain and Portugal, and on every pound weight of merchandise exported or imported. Traditionally tonnage and poundage was granted by Parliament to the king for life, but this practice did not continue into the reign of Charles I. Tonnage and poundage were swept away by the Customs and Excise Act 1787.

Thomas Egerton, 1st Viscount Brackley,, known as Lord Ellesmere from 1603 to 1616, was an English nobleman, judge and statesman from the Egerton family who served as Lord Keeper and Lord Chancellor for twenty-one years.

The history of the English fiscal system affords the best known example of continuous financial development in terms of both institutions and methods. Although periods of great upheaval occurred from the time of the Norman Conquest to the beginning of the 20th century, the line of connection is almost entirely unbroken. Perhaps, the most revolutionary changes occurred in the 17th century as a result of the Civil War and, later, the Glorious Revolution of 1688; though even then there was no real breach of continuity.

The Boston Tea Party was an American political and mercantile protest on December 16, 1773, by the Sons of Liberty in Boston in colonial Massachusetts. The target was the Tea Act of May 10, 1773, which allowed the East India Company to sell tea from China in American colonies without paying taxes apart from those imposed by the Townshend Acts. The Sons of Liberty strongly opposed the taxes in the Townshend Act as a violation of their rights. In response, the Sons of Liberty, some disguised as Native Americans, destroyed an entire shipment of tea sent by the East India Company.

Letters from a Farmer in Pennsylvania is a series of essays written by the Pennsylvania lawyer and legislator John Dickinson (1732–1808) and published under the pseudonym "A Farmer" from 1767 to 1768. The twelve letters were widely read and reprinted throughout the Thirteen Colonies, and were important in uniting the colonists against the Townshend Acts in the run-up to the American Revolution. According to many historians, the impact of the Letters on the colonies was unmatched until the publication of Thomas Paine's Common Sense in 1776. The success of the letters earned Dickinson considerable fame.

A heerlijkheid was a landed estate that served as the lowest administrative and judicial unit in rural areas in the Dutch-speaking Low Countries before 1800. It originated as a unit of lordship under the feudal system during the Middle Ages. The English equivalents are manor, seigniory and lordship. The German equivalent is Herrschaft. The heerlijkheid system was the Dutch version of manorialism that prevailed in the Low Countries and was the precursor to the modern municipality system in the Netherlands and Flemish Belgium.

Bates's Case or the Case of Impositions (1606) 2 St Tr 371 is a UK constitutional law case of the Court of the Exchequer, which enabled the King to impose duties for trade.

The Case of Proclamations [1610] EWHC KB J22 is an English constitutional law case during the reign of King James I (1603–1625) which defined some limitations on the royal prerogative at that time. Principally, it established that the monarch could make laws only through Parliament. The judgment began to set out the principle in English law that when a case involving an alleged exercise of prerogative power came before the courts, the courts could determine:

The Octavians were a financial commission of eight in the government of Scotland first appointed by James VI on 9 January 1596.

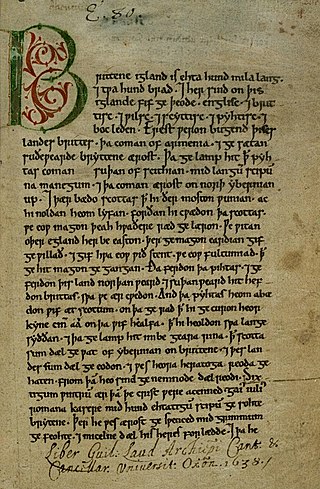

Taxation in medieval England was the system of raising money for royal and governmental expenses. During the Anglo-Saxon period, the main forms of taxation were land taxes, although custom duties and fees to mint coins were also imposed. The most important tax of the late Anglo-Saxon period was the geld, a land tax first regularly collected in 1012 to pay for mercenaries. After the Norman Conquest of England in 1066, the geld continued to be collected until 1162, but it was eventually replaced with taxes on personal property and income.

The Stuart period of British history lasted from 1603 to 1714 during the dynasty of the House of Stuart. The period was plagued by internal and religious strife, and a large-scale civil war which resulted in the execution of King Charles I in 1649. The Interregnum, largely under the control of Oliver Cromwell, is included here for continuity, even though the Stuarts were in exile. The Cromwell regime collapsed and Charles II had very wide support for his taking of the throne in 1660. His brother James II was overthrown in 1689 in the Glorious Revolution. He was replaced by his Protestant daughter Mary II and her Dutch husband William III. Mary's sister Anne was the last of the line. For the next half century James II and his son James Francis Edward Stuart and grandson Charles Edward Stuart claimed that they were the true Stuart kings, but they were in exile and their attempts to return with French aid were defeated. The period ended with the death of Queen Anne and the accession of King George I from the German House of Hanover.

Sir Nicholas Fuller was an English barrister and Member of Parliament. After studying at Christ's College, Cambridge, Fuller became a barrister of Gray's Inn. His legal career there began prosperously—he was employed by the Privy Council to examine witnesses—but was hampered later by his representation of the Puritans, a religious tendency which did not conform with the established Church of England. Fuller was repeatedly in contention with the ecclesiastical courts, including the Star Chamber and Court of High Commission, and was once expelled for the zeal with which he defended his client. In 1593 he was returned as the Member of Parliament for St Mawes, where he campaigned against the extension of recusancy laws. Outside of Parliament, he successfully brought a patents case which not only undermined the right of the Crown to issue patents but accurately predicted the attitude taken by the Statute of Monopolies two decades later.

References

- ↑ James I, Christopher Durston, 1993

- ↑ Sharp, David (2000). "2 James I's reign 1603–25". The Coming of the Civil War, 1603–49. Heinemann Advanced History. Heinemann. p. 30. ISBN 0-435-32713-5.

- ↑ The Stuart Age, 1603–1714, by John Wroughton. Pages 151–152

- ↑ Sharp, David (2000). "2 James I's reign 1603–25". The Coming of the Civil War, 1603–49. Heinemann Advanced History. Heinemann. p. 33. ISBN 0-435-32713-5.