Bumiputera or bumiputra is a term used in Malaysia to describe Malays, the Orang Asli of Peninsular Malaysia, and various indigenous peoples of East Malaysia. The term is sometimes controversial. It is used similarly in the Malay world, Indonesia, and Brunei.

Eminent domain, land acquisition, compulsory purchase, resumption, resumption/compulsory acquisition, or expropriation is the power of a state, provincial, or national government to take private property for public use. It does not include the power to take and transfer ownership of private property from one property owner to another private property owner without a valid public purpose. This power can be legislatively delegated by the state to municipalities, government subdivisions, or even to private persons or corporations, when they are authorized by the legislature to exercise the functions of public character.

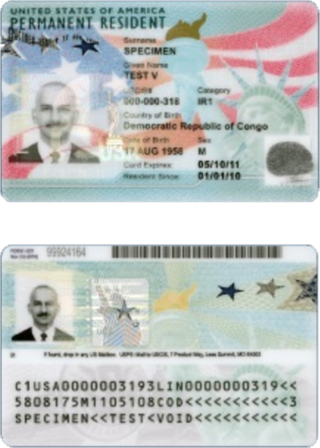

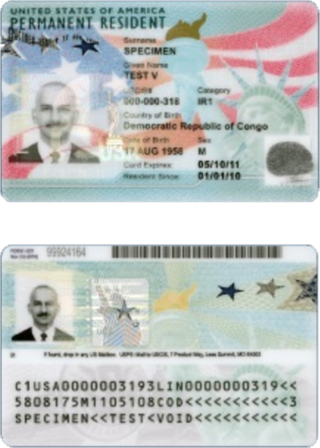

Permanent residency is a person's legal resident status in a country or territory of which such person is not a citizen but where they have the right to reside on a permanent basis. This is usually for a permanent period; a person with such legal status is known as a permanent resident. In the United States, such a person is referred to as a green card holder but more formally as a Lawful Permanent Resident (LPR).

Nationality law is the law of a sovereign state, and of each of its jurisdictions, that defines the legal manner in which a national identity is acquired and how it may be lost. In international law, the legal means to acquire nationality and formal membership in a nation are separated from the relationship between a national and the nation, known as citizenship. Some nations domestically use the terms interchangeably, though by the 20th century, nationality had commonly come to mean the status of belonging to a particular nation with no regard to the type of governance which established a relationship between the nation and its people. In law, nationality describes the relationship of a national to the state under international law and citizenship describes the relationship of a citizen within the state under domestic statutes. Different regulatory agencies monitor legal compliance for nationality and citizenship. A person in a country of which he or she is not a national is generally regarded by that country as a foreigner or alien. A person who has no recognised nationality to any jurisdiction is regarded as stateless.

A condo hotel, also known as a condotel, hotel condo, or a contel, is a building that is legally a condominium but operated as a hotel, offering short-term rentals, and which maintains a front desk.

Marriott Vacation Club is the primary timeshare brand of Marriott Vacations Worldwide Corporation. The brand comprises around 70 Marriott Vacation Club properties throughout the United States, Caribbean, Central America, Europe, and Asia. Marriott Vacation Club resorts consist of one, two, and three-bedroom villas, with more than 400,000 owners.

Indo-Mauritians are Mauritians who trace their ethnic ancestry to the Republic of India or other parts of the Indian subcontinent in South Asia.

A first-time home buyer grant (or first home owners grant) is a grant specifically for/targeted at those buying their first home – perhaps a starter home. Like other grants, the first-time buyer does not hold an obligation to repay the grant. In this respect, it differs from a loan and does not incur debt or interest. Grants can be given out by foundations and governments. Grants to individuals can be a cash subsidy.

Under Section 1031 of the United States Internal Revenue Code, a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property, a process known as a 1031 exchange. In 1979, this treatment was expanded by the courts to include non-simultaneous sale and purchase of real estate, a process sometimes called a Starker exchange.

Turkish nationality law is based primarily on the principle of jus sanguinis. Children who are born to a Turkish mother or a Turkish father are Turkish citizens from birth. The intention to renounce Turkish citizenship is submitted in Turkey by a petition to the highest administrative official in the concerned person's place of residence, and when overseas to the Turkish consulate. Documents processed by these authorities are forwarded to the Ministry of Interior (Turkey) for appropriate action.

The Foreign Investment in Real Property Tax Act of 1980 (FIRPTA), enacted as Subtitle C of Title XI of the Omnibus Reconciliation Act of 1980, Pub. L. No. 96-499, 94 Stat. 2599, 2682, is a United States tax law that imposes income tax on foreign persons disposing of US real property interests. Tax is imposed at regular tax rates for the taxpayer on the amount of gain considered recognized. Purchasers of real property interests are required to withhold tax on payment for the property. Withholding may be reduced from the standard 15% to an amount that will cover the tax liability, upon application in advance of sale to the Internal Revenue Service. FIRPTA overrides most nonrecognition provisions as well as those remaining tax treaties that provide exemption from tax for such gains.

Danish nationality law is governed by the Constitutional Act and the Consolidated Act of Danish Nationality. Danish nationality can be acquired in one of the following ways:

Overseas Citizenship of India (OCI) is a form of permanent residency available to people of Indian origin and their spouses which allows them to live and work in India indefinitely. It allows the cardholders a lifetime entry to the country along with benefits such as being able to own land and make other investments in the country.

Immigrant investor programs are programs that allow individuals to more quickly obtain residence or citizenship of a country in return for making qualifying investments.

Most visitors to Mauritius are visa exempt or can obtain a visa on arrival. However, some countries must obtain a visa in advance before being allowed into the country.

LUX* Resorts & Hotels is a major luxury hotel operator based in Mauritius which owns or part-owns many of its hotels and runs others under management contracts, which typically involve, in addition to management services, design, operations, sales and marketing. It is a wholly owned subsidiary of LUX* Hospitality Ltd., which is listed on the Stock Exchange of Mauritius and is an affiliate member of IBL, the country's 2nd largest conglomerate.

Than Phu YingChanut Piyaoui was a Thai businesswoman and entrepreneur best known as the founder of Thai hospitality group Dusit International. She served as the managing director and chairperson of Dusit International from 1970 to 2014, and held the post of honorary chairman.

Soneva, formerly Soneva Resorts and Residences, is a resort chain founded in Maldives in 1995 by Sonu Shivdasani and his wife Eva Malmström Shivdasani.

Mauritian nationality law is regulated by the Constitution of Mauritius, as amended; the Mauritius Citizenship Act, and its revisions; and various international agreements to which the country is a signatory. These laws determine who is, or is eligible to be, a national of Mauritius. The legal means to acquire nationality, formal legal membership in a nation, differ from the domestic relationship of rights and obligations between a national and the nation, known as citizenship. Nationality describes the relationship of an individual to the state under international law, whereas citizenship is the domestic relationship of an individual within the nation. In Britain and thus the Commonwealth of Nations, though the terms are often used synonymously outside of law, they are governed by different statutes and regulated by different authorities. Mauritian nationality is typically obtained under the principle of jus sanguinis, i.e. by birth in Mauritius or abroad to parents with Mauritian nationality. It can be granted to persons with an affiliation to the country, or to a permanent resident who has lived in the country for a given period of time through naturalisation.

The People's Republic of China Foreign Permanent Resident ID Card (中华人民共和国外国人永久居留身份证) is an identity document for permanent residents in China.