Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor.

Chapter 11 of the United States Bankruptcy Code permits reorganization under the bankruptcy laws of the United States. Such reorganization, known as "Chapter 11 bankruptcy", is available to every business, whether organized as a corporation, partnership or sole proprietorship, and to individuals, although it is most prominently used by corporate entities. In contrast, Chapter 7 governs the process of a liquidation bankruptcy, though liquidation may also occur under Chapter 11; while Chapter 13 provides a reorganization process for the majority of private individuals.

Chapter 7 of Title 11 of the United States Code governs the process of liquidation under the bankruptcy laws of the United States, in contrast to Chapters 11 and 13, which govern the process of reorganization of a debtor. Chapter 7 is the most common form of bankruptcy in the United States.

Title 11 of the United States Code sets forth the statutes governing the various types of relief for bankruptcy in the United States. Chapter 13 of the United States Bankruptcy Code provides an individual with the opportunity to propose a plan of reorganization to reorganize their financial affairs while under the bankruptcy court's protection. The purpose of chapter 13 is to enable an individual with a regular source of income to propose a chapter 13 plan that provides for their various classes of creditors. Under chapter 13, the Bankruptcy Court has the power to approve a chapter 13 plan without the approval of creditors as long as it meets the statutory requirements under chapter 13. Chapter 13 plans are usually three to five years in length and may not exceed five years. Chapter 13 is in contrast to the purpose of Chapter 7, which does not provide for a plan of reorganization, but provides for the discharge of certain debt and the liquidation of non-exempt property. A Chapter 13 plan may be looked at as a form of debt consolidation, but a Chapter 13 allows a person to achieve much more than simply consolidating his or her unsecured debt such as credit cards and personal loans. A chapter 13 plan may provide for the four general categories of debt: priority claims, secured claims, priority unsecured claims, and general unsecured claims. Chapter 13 plans are often used to cure arrearages on a mortgage, avoid "underwater" junior mortgages or other liens, pay back taxes over time, or partially repay general unsecured debt. In recent years, some bankruptcy courts have allowed Chapter 13 to be used as a platform to expedite a mortgage modification application.

Debt restructuring is a process that allows a private or public company or a sovereign entity facing cash flow problems and financial distress to reduce and renegotiate its delinquent debts to improve or restore liquidity so that it can continue its operations.

Trustee is a legal term which, in its broadest sense, is a synonym for anyone in a position of trust and so can refer to any individual who holds property, authority, or a position of trust or responsibility to transfer the title of ownership to the person named as the new owner, in a trust instrument, called a beneficiary. A trustee can also refer to a person who is allowed to do certain tasks but not able to gain income, although that is untrue. Although in the strictest sense of the term a trustee is the holder of property on behalf of a beneficiary, the more expansive sense encompasses persons who serve, for example, on the board of trustees of an institution that operates for a charity, for the benefit of the general public, or a person in the local government.

The United States Trustee Program is a component of the United States Department of Justice that is responsible for overseeing the administration of bankruptcy cases and private trustees. The applicable federal law is found at 28 U.S.C. § 586 and 11 U.S.C. § 101, et seq.

In the United States, bankruptcy is largely governed by federal law, commonly referred to as the "Bankruptcy Code" ("Code"). The United States Constitution authorizes Congress to enact "uniform Laws on the subject of Bankruptcies throughout the United States". Congress has exercised this authority several times since 1801, including through adoption of the Bankruptcy Reform Act of 1978, as amended, codified in Title 11 of the United States Code and the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) is a legislative act that made several significant changes to the United States Bankruptcy Code.

A trustee in bankruptcy is an entity, often an individual, in charge of administering a bankruptcy estate.

A fraudulent conveyance, or fraudulent transfer, is an attempt to avoid debt by transferring money to another person or company. It is generally a civil, not a criminal matter, meaning that one cannot go to jail for it, but in some jurisdictions there is potential for criminal prosecution. It is generally treated as a civil cause of action that arises in debtor/creditor relations, particularly with reference to insolvent debtors. The cause of action is typically brought by creditors or by bankruptcy trustees.

The Bankruptcy and Insolvency Act is one of the statutes that regulates the law on bankruptcy and insolvency in Canada. It governs bankruptcies, consumer and commercial proposals, and receiverships in Canada.

An unfair preference is a legal term arising in bankruptcy law where a person or company transfers assets or pays a debt to a creditor shortly before going into bankruptcy, that payment or transfer can be set aside on the application of the liquidator or trustee in bankruptcy as an unfair preference or simply a preference.

A general assignment or assignment is a concept in bankruptcy law in which an insolvent entity's assets are assigned to someone as an alternative to a bankruptcy. One form is an "assignment for the benefit of creditors", abbreviated ABC or AFBC.

As a legal concept, administration is a procedure under the insolvency laws of a number of common law jurisdictions, similar to bankruptcy in the United States. It functions as a rescue mechanism for insolvent entities and allows them to carry on running their business. The process – in the United Kingdom colloquially called being "under administration" – is an alternative to liquidation or may be a precursor to it. Administration is commenced by an administration order.

The Federal Rules of Bankruptcy Procedure are a set of rules promulgated by the Supreme Court of the United States under the Rules Enabling Act, directing procedures in the United States bankruptcy courts. They are the bankruptcy law counterpart to the Federal Rules of Civil Procedure.

The history of bankruptcy law in the United States refers primarily to a series of acts of Congress regarding the nature of bankruptcy. As the legal regime for bankruptcy in the United States developed, it moved from a system which viewed bankruptcy as a quasi-criminal act, to one focused on solving and repaying debts for people and businesses suffering heavy losses.

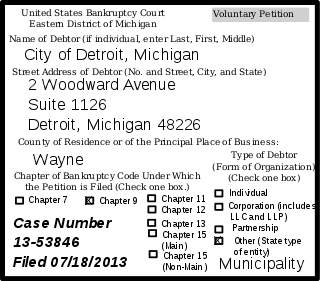

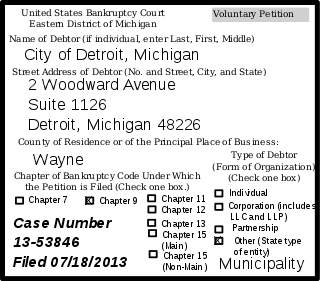

The city of Detroit, Michigan, filed for Chapter 9 bankruptcy on July 18, 2013. It is the largest municipal bankruptcy filing in U.S. history by debt, estimated at $18–20 billion, exceeding Jefferson County, Alabama's $4-billion filing in 2011. Detroit is also the largest city by population in U.S. history to file for Chapter 9 bankruptcy, more than twice as large as Stockton, California, which filed in 2012. While Detroit's population had declined from a peak of 1.8 million in 1950, its July 2013 population was reported by The New York Times as a city of 700,000.

Law v. Siegel, 571 U.S. 415 (2014), is a ruling of the Supreme Court of the United States that describes the extent of the powers of bankruptcy courts in dealing with the bad faith of debtors.

Bankruptcy in Florida is made under title 11 of the United States Code, which is referred to as the Bankruptcy Code. Although bankruptcy is a federal procedure, in certain regards, it looks to state law, such as to exemptions and to define property rights. The Bankruptcy Code provides that each state has the choice whether to "opt in" and use the federal exemptions or to "opt out" and to apply the state law exemptions. Florida is an "opt out" state in regard to exemptions. Bankruptcy in the United States is provided for under federal law as provided in the United States Constitution. Under the federal constitution, there are no state bankruptcy courts. The bankruptcy laws are primarily contained in 11 U.S.C. 101, et seq. The Bankruptcy Code underwent a substantial amendment in 2005 with the "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005", often referred to as "BAPCPA". The Bankruptcy Code provides for a set of federal bankruptcy exemptions, but each states is allowed is choose whether it will "opt in" or "opt out" of the federal exemptions. In the event that a state opts out of the federal exemptions, the exemptions are provided for the particular exemption laws of the state with the application with certain federal exemptions.