The economy of Azerbaijan has completed its post-Soviet transition into a major oil-based economy, from one where the state played the major role. The transition to oil production led to remarkable growth figures as projects came online; reaching 26.4% in 2005 and 34.6% in 2006 before subsiding to 10.8% and 9.3% in 2008 and 2009 respectively. The real GDP growth rate for 2011 was expected at 3.7% but had dropped to 0.1%. Large oil reserves are a major contributor to Azerbaijan's economy. The national currency, the Azerbaijani manat, was stable in 2000, depreciating 3.8% against the dollar. The budget deficit equaled 1.3% of GDP in 2000.

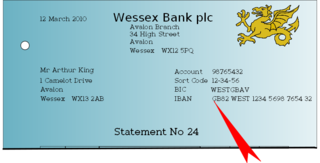

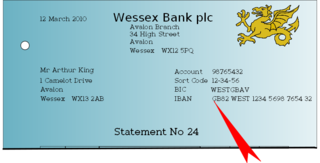

The International Bank Account Number (IBAN) is an internationally agreed system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errors. An IBAN uniquely identifies the account of a customer at a financial institution. It was originally adopted by the European Committee for Banking Standards (ECBS) and since 1997 as the international standard ISO 13616 under the International Organization for Standardization (ISO). The current version is ISO 13616:2020, which indicates the Society for Worldwide Interbank Financial Telecommunication (SWIFT) as the formal registrar. Initially developed to facilitate payments within the European Union, it has been implemented by most European countries and numerous countries in other parts of the world, mainly in the Middle East and the Caribbean. As of May 2020, 77 countries were using the IBAN numbering system.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT), legally S.W.I.F.T. SC, is a Belgian cooperative society providing services related to the execution of financial transactions and payments between banks worldwide. Its principal function is to serve as the main messaging network through which international payments are initiated. It also sells software and services to financial institutions, mostly for use on its proprietary "SWIFTNet", and assigns ISO 9362 Business Identifier Codes (BICs), popularly known as "SWIFT codes".

Financial institutions, sometimes called banking institutions, are business entities that provide services as intermediaries for different types of financial monetary transactions. Broadly speaking, there are three major types of financial institutions:

- Depository institutions – deposit-taking institutions that accept and manage deposits and make loans, including banks, building societies, credit unions, trust companies, and mortgage loan companies;

- Contractual institutions – insurance companies and pension funds

- Investment institutions – investment banks, underwriters, and other different types of financial entities managing investments.

ISO 9362 is an international standard for Business Identifier Codes (BIC), a unique identifier for business institutions, approved by the International Organization for Standardization (ISO). BIC is also known as SWIFT-BIC, SWIFT ID, or SWIFT code, after the Society for Worldwide Interbank Financial Telecommunication (SWIFT), which is designated by ISO as the BIC registration authority. BIC was defined originally as Bank Identifier Code and is most often assigned to financial organizations; when it is assigned to non-financial organization, the code may also be known as Business Entity Identifier (BEI). These codes are used when transferring money between banks, particularly for international wire transfers, and also for the exchange of other messages between banks. The codes can sometimes be found on account statements.

Electronic funds transfer (EFT) is the electronic transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, via computer-based systems, without the direct intervention of bank staff.

The State Oil Company of Azerbaijan Republic, largely known as SOCAR is fully state-owned national oil and gas company headquartered in Baku, Azerbaijan. The company produces oil and natural gas from onshore and offshore fields in the Azerbaijani segment of the Caspian Sea. It operates the country's only oil refinery, one gas processing plant and runs several oil and gas export pipelines throughout the country. It owns fuel filling station networks under the SOCAR brand in Azerbaijan, Turkey, Georgia, Ukraine, Romania and Switzerland.

The Central Bank of Azerbaijan is the central bank of Azerbaijan Republic. The headquarters of the bank is located in the capital city Baku.

TBC Bank is a Georgian bank headquartered in Tbilisi, Georgia. The name, TBC Bank, traces its root to its original name, Tbilisi Business Centre, dating back to 1992. Currently, TBC is registered as the official name of the bank, not just an abbreviation of the original name.

VTB Bank is a Russian majority state-owned bank headquartered in various federal districts of Russia; its legal address is registered in St. Petersburg; as of 2022 company's capital stock was mostly owned by three Russian agencies.

ABB, the largest bank in Azerbaijan, is an open joint-stock company whose shares are owned by the Azerbaijan state.

MT103 is a specific SWIFT message types/format used on the Society for Worldwide Interbank Financial Telecommunication (SWIFT) payment system to send for cross border/international wire transfer messages between financial institutions for customer cash transfers.

Public Join-Stock Company First Investment Bank, commonly known as PJSC First Investment Bank is the Ukrainian bank that offers a full range of banking services to private and corporate customers. The bank was registered on 20 June 1997 with its headquarters at 6 Moskovskiy Avenue, Kyiv. There are over 30 branches in 11 regions of Ukraine.

Jahangir Fevzi oglu Hajiyev is an Azerbaijani former banker and convicted fraudster. He was the chairman of the International Bank of Azerbaijan from 2001 until he resigned in March 2015 citing health concerns. Under his stewardship, the bank had grown to become one of the prominent financial institutions in the Caucasus. On 14 October 2016, the Baku Court for Grave Crimes sentenced Hajiyev to 15 years on charges of fraud, embezzlement, and misappropriation of public funds

IBA-Moscow is a subsidiary bank of the International Bank of Azerbaijan located in Moscow, Russia. IBA-Moscow is a registered Russian limited liability company and employs approximately 300 people.

AzeriCard is an Azerbaijani bank card processing company. The International Bank of Azerbaijan owns 100 percent of AzeriCard.

Mikayil Chingiz oghlu Jabbarov is the current Minister of Economу of the Republic of Azerbaijan, Minister of Taxes of the Republic of Azerbaijan (2017–2019), Minister of Education of the Republic of Azerbaijan (2013–2017), Director of the Administration of Icherisheher State Historical-Architectural Reserve under the Cabinet of Ministers of the Republic of Azerbaijan (2009–2013), Deputy Minister of Economic Development of the Republic of Azerbaijan (2004–2009). President of the Azerbaijan Badminton Federation (2015–2021), President of the Azerbaijan Fencing Federation (2017–2021), President of Azerbaijan Wrestling Federation.

The Cross-Border Interbank Payment System (CIPS) is a payment system which offers clearing and settlement services for its participants in cross-border RMB payments and trade. Backed by the People's Bank of China (PBOC), China launched the CIPS in 2015 to internationalise RMB use. CIPS also counts several foreign banks as shareholders including HSBC, Standard Chartered, the Bank of East Asia, DBS Bank, Citi, Australia and New Zealand Banking Group and BNP Paribas.

Azer-Turk Bank is Azerbaijani state-owned bank that provides retail and commercial banking services. It is an open joint stock company established on May 25, 1995 based on a license issued by the National Bank of Azerbaijan Republic. As of 2017, the bank's total capital exceeded AZN 50 mln.

The Finance system in Azerbaijan consists of government policy and arrangements for borrowing and lending and the transfer of assets. The system is composed of banks, insurance companies, other financial institutions, pension system, financial markets and payment systems.