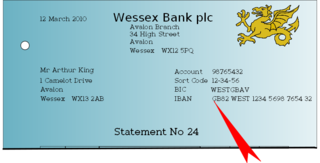

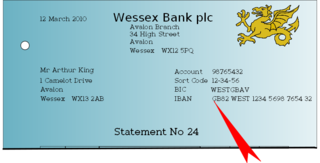

The International Bank Account Number (IBAN) for example LV30RIKO0000083232646 is an internationally agreed upon system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errors. An IBAN uniquely identifies the account of a customer at a financial institution. It was originally adopted by the European Committee for Banking Standards (ECBS) and since 1997 as the international standard ISO 13616 under the International Organization for Standardization (ISO). The current version is ISO 13616:2020, which indicates the Society for Worldwide Interbank Financial Telecommunication (SWIFT) as the formal registrar. Initially developed to facilitate payments within the European Union, it has been implemented by most European countries and numerous countries in other parts of the world, mainly in the Middle East and the Caribbean. By July 2024, 88 countries were using the IBAN numbering system.

Corporate governance refers to the mechanisms, processes, practices, and relations by which corporations are controlled and operated by their boards of directors, managers, shareholders, and stakeholders.

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic action that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

In the United States, the ACH Network is the national automated clearing house (ACH) for electronic funds transfers established in the 1960s and 1970s. It is a financial utility owned by US banks, and is one of the largest payments networks in the United States, both by volume and by customer reach; virtually every bank account in the US, whether personal or commercial, is connected to the network.

Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account, or through a transfer of cash at a cash office.

In general, compliance means conforming to a rule, such as a specification, policy, standard or law. Compliance has traditionally been explained by reference to deterrence theory, according to which punishing a behavior will decrease the violations both by the wrongdoer and by others. This view has been supported by economic theory, which has framed punishment in terms of costs and has explained compliance in terms of a cost-benefit equilibrium. However, psychological research on motivation provides an alternative view: granting rewards or imposing fines for a certain behavior is a form of extrinsic motivation that weakens intrinsic motivation and ultimately undermines compliance.

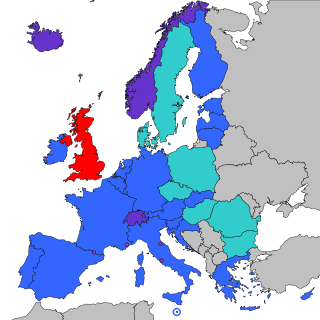

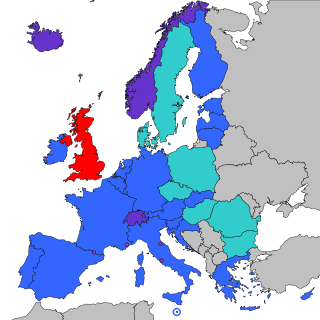

The Single Euro Payments Area (SEPA) is a payment integration initiative of the European Union for simplification of bank transfers denominated in euros. As of 2020, there were 36 members in SEPA, consisting of the 27 member states of the European Union, the four member states of the European Free Trade Association, and the United Kingdom. Some microstates participate in the technical schemes: Andorra, Monaco, San Marino, and Vatican City.

The Global Reporting Initiative is an international independent standards organization that helps businesses, governments, and other organizations understand and communicate their impacts on issues such as climate change, human rights, and corruption.

Canadian Payments Association, carrying on business under the brand name Payments Canada, is an organization that operates a payment clearing and settlement system in Canada. The Canadian Payments Association was established by the Canadian Payments Act in 1980. Among other responsibilities, it regulates and maintains directories of bank routing numbers in Canada.

The European Association for Evolutionary Political Economy (EAEPE) is a pluralist forum of social scientists that brings together institutional and evolutionary economists broadly defined. EAEPE members are scholars working on realistic approaches to economic theory and economic policy. With a membership of about 500, EAEPE is now the foremost European association for heterodox economists and the second-largest association for economists in Europe.

Regulatory capitalism suggests that the operation maintenance and development of the international political economy increasingly depends on administrative rules outside the legislatures and the courts. In other words, it tells us that capitalism is a regulatory institution – one that is being constituted, shaped, constrained and expanded as a historically woven patchwork of regulatory institutions, strategies, and functions.

An environmental audit is a type of evaluation intended to identify environmental compliance and management system implementation gaps, along with related corrective actions. In this way they perform an analogous (similar) function to financial audits. There are generally two different types of environmental audits: compliance audits and management systems audits. Compliance audits tend to be the primary type in the US or within US-based multinationals.

Nacha, originally the National Automated Clearinghouse Association, manages the ACH Network, the backbone for the electronic movement of money and data in the United States, and is an association for the payments industry. The ACH Network serves as a network for direct consumer, business, and government payments, and annually facilitates billions of payments such as Direct Deposit and Direct Payment. The ACH Network is governed by the Nacha Operating Rules.

The Revised Payment Services Directive (PSD2, Directive (EU) 2015/2366, which replaced the Payment Services Directive (PSD), Directive 2007/64/EC) is an EU Directive, administered by the European Commission (Directorate General Internal Market) to regulate payment services and payment service providers throughout the European Union (EU) and European Economic Area (EEA). The PSD's purpose was to increase pan-European competition and participation in the payments industry also from non-banks, and to provide for a level playing field by harmonizing consumer protection and the rights and obligations of payment providers and users. The key objectives of the PSD2 directive are creating a more integrated European payments market, making payments more secure and protecting consumers.

The Electronic Banking Internet Communication Standard (EBICS) is a German transmission protocol developed by the German Banking Industry Committee for sending payment information between banks, as well as between banks and client applications, over the Internet. It grew out of the earlier BCS-FTAM protocol that was developed in 1995, with the aim of being able to use Internet connections and TCP/IP. It is mandated for use by German banks and has also been adopted by France, Switzerland and Austria. Adoptions in different countries have resulted in specific operations being permitted by some banks while being disallowed by others.

Payments as a service (PaaS) is a marketing phrase used to describe software as a service to connect a group of international payment systems. The architecture is represented by a layer – or overlay – that resides on top of these disparate systems and provides for two-way communications between the payment system and the PaaS. Communication is governed by standard APIs created by the PaaS provider.

Multistakeholder governance is a practice of governance that employs bringing multiple stakeholders together to participate in dialogue, decision making, and implementation of responses to jointly perceived problems. The principle behind such a structure is that if enough input is provided by multiple types of actors involved in a question, the eventual consensual decision gains more legitimacy, and can be more effectively implemented than a traditional state-based response. While the evolution of multistakeholder governance is occurring principally at the international level, public-private partnerships (PPPs) are domestic analogues.

In financial services, open banking allows for financial data to be shared between banks and third-party service providers through the use of application programming interfaces (APIs). Traditionally, banks have kept customer financial data within their own closed systems. Open banking allows customers to share their financial information securely and electronically with other banks or other authorized financial organizations such as payment providers, lenders and insurance companies.

The Cross-border Interbank Payment System (CIPS) is a Chinese payment system that offers clearing and settlement services for its participants in cross-border renminbi (RMB) payments and trade. CIPS is backed by the People's Bank of China and was launched in 2015 as part of a policy effort to internationalize the use of China’s currency.

Sustainable finance is the set of practices, standards, norms, regulations and products that pursue financial returns alongside environmental and/or social objectives. It is sometimes used interchangeably with Environmental, Social & Governance (ESG) investing. However, many distinguish between ESG integration for better risk-adjusted returns and a broader field of sustainable finance that also includes impact investing, social finance and ethical investing.