Related Research Articles

Citigroup Inc. or Citi is an American multinational investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking giant Citicorp and financial conglomerate Travelers Group in 1998; Travelers was subsequently spun off from the company in 2002. Citigroup owns Citicorp, the holding company for Citibank, as well as several international subsidiaries. Citigroup is incorporated in Delaware.

London Business School (LBS) is a business school and a constituent college of the federal University of London. LBS was founded in 1964 and awards post-graduate degrees. Its motto is "To have a profound impact on the way the world does business". LBS is consistently ranked amongst the world's best business schools.

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. As of January 1, 2019, AIG companies employed 49,600 people. The company operates through three core businesses: General Insurance, Life & Retirement, and a standalone technology-enabled subsidiary. General Insurance includes Commercial, Personal Insurance, U.S. and International field operations. Life & Retirement includes Group Retirement, Individual Retirement, Life, and Institutional Markets. AIG is a sponsor of the AIG Women's Open golf tournament.

The Bear Stearns Companies, Inc. was a New York City-based global investment bank, securities trading, and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The company's main business areas before its failure were capital markets, investment banking, wealth management, and global clearing services, and it was heavily involved in the subprime mortgage crisis.

TheStreet is a financial news and financial literacy website. It is a subsidiary of The Arena Group. The company provides both free content and subscription services such as Action Alerts Plus a stock recommendation portfolio co-managed by Bob Lang and Chris Versace. Former notable contributors include Jim Cramer, Bob Powell, Aaron Task, Herb Greenberg, and Brett Arends.

Ameriprise Financial, Inc. is a diversified financial services company and bank holding company incorporated in Delaware and headquartered in Minneapolis, Minnesota. It provides financial planning products and services, including wealth management, asset management, insurance, annuities, and estate planning.

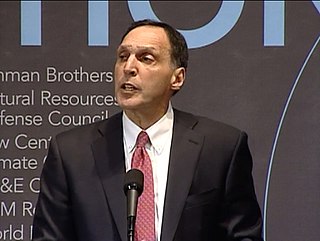

Richard Severin Fuld Jr. is an American banker best known as the final chairman and chief executive officer of investment bank Lehman Brothers. Fuld held this position from the firm's 1994 spinoff from American Express until 2008. Lehman Brothers filed for bankruptcy protection under Chapter 11 on September 15, 2008, and subsequently announced the sale of major operations to parties including Barclays Bank and Nomura Securities.

Martin J. Sullivan, OBE,, is the former deputy chairman of Willis Group Holdings plc and chairman and CEO of its, Willis Global Solutions, which oversees brokerage and risk management advisory services for Willis's multinational and global accounts. He also previously served as president and chief executive officer of American International Group, Inc.

Herbert Monroe Allison, Jr. was an American businessman who oversaw the Troubled Asset Relief Program (TARP) as Assistant Secretary of the Treasury for Financial Stability from 2009 to 2010. His previous positions included president and CEO of Fannie Mae, a post to which he was appointed in September 2008, after Fannie was placed into conservatorship. Prior to that, Allison was chairman, president and chief executive officer of TIAA from 2002 until his retirement in 2008.

The Securities Industry and Financial Markets Association (SIFMA) is a United States industry trade group representing securities firms, banks, and asset management companies. SIFMA was formed on November 1, 2006, from the merger of the Bond Market Association and the Securities Industry Association. It has offices in New York City and Washington, D.C.

Edward "Ed" Liddy is an American businessman who was chairman of the Allstate Corporation from 1999 to 2008.

Gary Lewis Crittenden is an American financial manager. He is currently an executive director of HGGC, where he also previously served as CEO and chairman. He is also the former chairman of Citi Holdings. He has served as chairman of the boards of Citadel, Power Holdings, and iQor; as lead independent director of Pluralsight; and has served on the boards of Extra Space Storage, Staples Inc., Ryerson, Inc., TJX Companies, and Utah Capital Investment Corp. From 2000 to 2007, Crittenden was Executive Vice President and Chief Financial Officer (CFO) of American Express, and from March 2007 to March 2009, he was the chief financial officer of Citigroup.

Vikram Shankar Pandit is an Indian-American banker and investor who was the chief executive officer of Citigroup from December 2007 to 16 October 2012 and is the current chairman and chief executive officer of The Orogen Group.

James Patrick Gorman is an Australian-American financier who is the chairman and chief executive officer of Morgan Stanley. He was formerly Co-President and Co-Head of Strategic Planning at the firm.

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George W. Bush. It was a component of the government's measures in 2009 to address the subprime mortgage crisis.

Marten Hoekstra is an American business executive in the financial industry.

Brewer Investment Group is a wealth management firm founded in 2000 and headquartered in Chicago, Illinois.

Kenneth D. Lewis is the former CEO, president, and chairman of Bank of America, the second largest bank in the United States and twelfth largest by total asset in the world. While CEO of Bank of America, Lewis was noted for purchasing Countrywide Financial and Merrill Lynch resulting in large losses for the bank and necessitating financial assistance from the federal government. On September 30, 2009, Bank of America confirmed that Lewis would be retiring by the end of the year. Lewis was replaced by Brian Moynihan as president and CEO and Walter Massey as chairman of the board.

Walter James "Jim" McNerney Jr. is a business executive who was President and CEO of The Boeing Company, June 2005–July 2015. McNerney was also Chairman from June 2005 until March 1, 2016. McNerney oversaw development of the Boeing 737 MAX.

Rodney O. "Rod" Martin Jr. is an American business executive. He serves as the chairman and chief executive officer of Voya Financial, Inc., a Fortune 500 financial services company based in New York, New York.

References

- ↑ "James Cracchiolo: Executive Profile & Biography - Businessweek". investing.businessweek.com. Retrieved 19 July 2012.

- ↑ "Ameriprise Financial - Our corporate leadership: James M. Cracchiolo". ameriprise.com. Archived from the original on June 26, 2009. Retrieved May 18, 2011.

- ↑ James Cracchiolo Bio Archived 2011-09-30 at the Wayback Machine , ameriprise.com

- ↑ Ameriprise declines federal bailout money Archived 2012-10-16 at the Wayback Machine , startribune.com

- ↑ "Ameriprise Financial, Inc. Completes Columbia Long-Term Asset Management Purchase From Bank of America Corporation". reuters.com. May 3, 2010. Retrieved May 18, 2011.

- ↑ "200 Minnesotans You Should Know: James Cracchiolo". tcbmag.com. Archived from the original on September 21, 2011. Retrieved May 18, 2011.

- ↑ "US-based financial planning major enters India". timesofindia.indiatimes.com. Jan 12, 2012. Retrieved Jan 20, 2012.

- ↑ 2010 CEO Compensation for James M. Cracchiolo, forbes.com

- ↑ "Ameriprise CEO took home $64.7 million in 2017". 19 March 2018.

- ↑ 20 to Watch in 2006: Minnesota's new business leaders, new companies, and new newsmakers Archived 2010-10-03 at the Wayback Machine , tcbmag.com

- ↑ "The Ten to Watch 2005: Learning to Live With the New Normal". registeredrep.com. Aug 1, 2005. Archived from the original on July 15, 2011. Retrieved May 18, 2011.

- ↑ The Power 100 List 2010, thepower100.com

- ↑ "Members | Minnesota Business Partnership". mnbp.com. Retrieved 2019-08-19.

- ↑ "ACLI elects 2011 Board of Directors at Annual conference". www.acli.com. Retrieved 2019-08-19.

- ↑ "Boards, Committees and Chapters" (PDF). March Of Dimes. Retrieved 2019-08-19.