In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster. In the United States, it is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales". In the United Kingdom, it is defined as a negative economic growth for two consecutive quarters.

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0%. Inflation reduces the value of currency over time, but sudden deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from disinflation, a slow-down in the inflation rate, i.e. when inflation declines to a lower rate but is still positive.

In economics and political science, fiscal policy is the use of government revenue collection and expenditure to influence a country's economy. The use of government revenues and expenditures to influence macroeconomic variables developed as a result of the Great Depression, when the previous laissez-faire approach to economic management became unpopular. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorized that government changes in the levels of taxation and government spending influences aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation and to increase employment. Additionally, it is designed to try to keep GDP growth at 2%–3% and the unemployment rate near the natural unemployment rate of 4%–5%. This implies that fiscal policy is used to stabilize the economy over the course of the business cycle.

The Bank of Japan is the central bank of Japan. The bank is often called Nichigin (日銀) for short. It has its headquarters in Chūō, Tokyo.

The Bank of Korea is the central bank of the Republic of Korea and issuer of Korean Republic won. It was established on 12 June 1950 in Seoul, South Korea.

The Japanese asset price bubble was an economic bubble in Japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. In early 1992, this price bubble burst and Japan's economy stagnated. The bubble was characterized by rapid acceleration of asset prices and overheated economic activity, as well as an uncontrolled money supply and credit expansion. More specifically, over-confidence and speculation regarding asset and stock prices were closely associated with excessive monetary easing policy at the time. Through the creation of economic policies that cultivated the marketability of assets, eased the access to credit, and encouraged speculation, the Japanese government started, prolonged and exacerbated the Japanese asset price bubble.

Quantitative easing (QE) is a monetary policy whereby a central bank purchases predetermined amounts of government bonds or other financial assets in order to inject money into the economy to expand economic activity. Quantitative easing is considered to be an unconventional form of monetary policy, which is usually used when inflation is very low or negative, and when standard monetary policy instruments have become ineffective.

The Great Recession was a period of marked general decline (recession) observed in national economies globally that occurred between 2007 and 2009. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. One result was a serious disruption of normal international relations.

The 2008–09 Chinese economic stimulus plan is a RMB¥ 4 trillion stimulus package announced by the State Council of the People's Republic of China on 9 November 2008 as an attempt to minimize the impact of the financial crisis of 2007–2008 on the economy of China. Critics of China's stimulus package have blamed it for causing a surge in Chinese debt since 2009, particularly among local governments and state-owned enterprises.

While beginning in the United States, the Great Recession spread to Asia rapidly and has affected much of the region.

The Lost Decades refers to a period of economic stagnation in Japan caused by the asset price bubble's collapse in late 1991. The term originally referred to the years from 1991 to 2001, but the decade from 2001 to 2011 and the decade from 2011 to 2021 have been included by commentators.

In economics, stimulus refers to attempts to use monetary policy or fiscal policy to stimulate the economy. Stimulus can also refer to monetary policies such as lowering interest rates and quantitative easing.

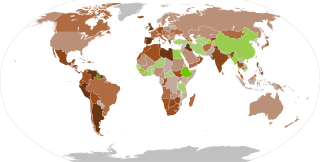

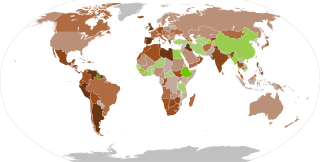

Beginning in 2008 many nations of the world enacted fiscal stimulus plans in response to the Great Recession. These nations used different combinations of government spending and tax cuts to boost their sagging economies. Most of these plans were based on the Keynesian theory that deficit spending by governments can replace some of the demand lost during a recession and prevent the waste of economic resources idled by a lack of demand. The International Monetary Fund recommended that countries implement fiscal stimulus measures equal to 2% of their GDP to help offset the global contraction. In subsequent years, fiscal consolidation measures were implemented by some countries in an effort to reduce debt and deficit levels while at the same time stimulating economic recovery.

The Great Recession in the United States was a severe financial crisis combined with a deep recession. While the recession officially lasted from December 2007 to June 2009, it took many years for the economy to recover to pre-crisis levels of employment and output. This slow recovery was due in part to households and financial institutions paying off debts accumulated in the years preceding the crisis along with restrained government spending following initial stimulus efforts. It followed the bursting of the housing bubble, the housing market correction and subprime mortgage crisis.

An economic recovery is the phase of the business cycle following a recession. The overall business outlook for an industry looks optimistic during the economic recovery phase.

As of 2021, the Japanese public debt is estimated to be approximately US$13.11 trillion US Dollars, or 266% of GDP, and is the highest of any developed nation. 45% of this debt is held by the Bank of Japan.

Abenomics refers to the economic policies implemented by the Government of Japan led by the Liberal Democratic Party (LDP) since the December 2012 general election. They are named after Shinzō Abe, who served a second stint as Prime Minister of Japan from 2012 to 2020. After Abe resigned in September 2020, his successor, Yoshihide Suga, has stated that his premiership will focus on continuing the policies and goals of the Abe administration, including the Abenomics suite of economic policies.

A balance sheet recession is a type of economic recession that occurs when high levels of private sector debt cause individuals or companies to collectively focus on saving by paying down debt rather than spending or investing, causing economic growth to slow or decline. The term is attributed to economist Richard Koo and is related to the debt deflation concept described by economist Irving Fisher. Recent examples include Japan's recession that began in 1990 and the U.S. recession of 2007-2009.

The 2020 stock market crash was a major and sudden global stock market crash that began on 20 February 2020 and ended on 7 April.

The COVID-19 recession is a global economic recession caused by the COVID-19 pandemic. The recession began in most countries in February 2020.