Reaganomics, or Reaganism, refers to the neoliberal economic policies promoted by U.S. President Ronald Reagan during the 1980s. These policies are commonly associated with and characterized as supply-side economics, trickle-down economics, or voodoo economics by opponents, while Reagan and his advocates preferred to call it free-market economics.

In economics, stagflation or recession-inflation is a situation in which the inflation rate is high, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for economic policy, since actions intended to lower inflation may exacerbate unemployment.

In economics, inflation refers to a general progressive increase in prices of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualised percentage change in a general price index.

The Phillips curve is a single-equation economic model, named after William Phillips, hypothesizing an inverse relationship between rates of unemployment and corresponding rates of rises in wages that result within an economy. Stated simply, decreased unemployment, in an economy will correlate with higher rates of wage rises. Phillips did not himself state there was any relationship between employment and inflation; this notion was a trivial deduction from his statistical findings. Paul Samuelson and Robert Solow made the connection explicit and subsequently Milton Friedman and Edmund Phelps put the theoretical structure in place. In so doing, Friedman was to successfully predict the imminent collapse of Phillips' a-theoretic correlation.

The Organization of the Petroleum Exporting Countries is an intergovernmental organization or cartel of 13 countries. Founded on 14 September 1960 in Baghdad by the first five members, it has since 1965 been headquartered in Vienna, Austria, although Austria is not an OPEC member state. As of September 2018, the 13 member countries accounted for an estimated 44 percent of global oil production and 81.5 percent of the world's "proven" oil reserves, giving OPEC a major influence on global oil prices that were previously determined by the so-called "Seven Sisters" grouping of multinational oil companies.

Supply-side economics is a macroeconomic theory that postulates economic growth can be most effectively fostered by lowering taxes, decreasing regulation, and allowing free trade. According to supply-side economics, consumers will benefit from greater supplies of goods and services at lower prices, and employment will increase.

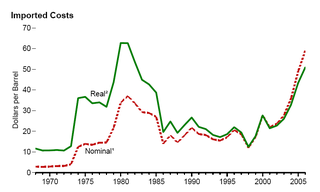

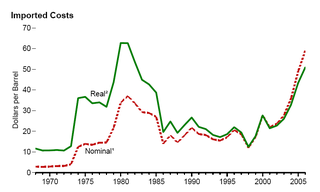

The 1973 oil crisis or first oil crisis began in October 1973 when the members of the Organization of Arab Petroleum Exporting Countries led by Saudi Arabia proclaimed an oil embargo. The embargo was targeted at nations that had supported Israel during the Yom Kippur War. The initial nations targeted were Canada, Japan, the Netherlands, the United Kingdom and the United States with the embargo also later extended to Portugal, Rhodesia and South Africa. By the end of the embargo in March 1974, the price of oil had risen nearly 300%, from US$3 per barrel ($19/m3) to nearly $12 per barrel ($75/m3) globally; US prices were significantly higher. The embargo caused an oil crisis, or "shock", with many short- and long-term effects on global politics and the global economy. It was later called the "first oil shock", followed by the 1979 oil crisis, termed the "second oil shock".

The 1979Oil Crisis, also known as the 1979 Oil Shock or Second Oil Crisis, was an energy crisis caused by a drop in oil production in the wake of the Iranian Revolution. Although the global oil supply only decreased by approximately four percent, the oil markets' reaction raised the price of crude oil drastically over the next 12 months, more than doubling it to $39.50 per barrel ($248/m3). The spike in price caused fuel shortages and long lines at gas stations similar to the 1973 oil crisis.

Think Big was an interventionist state economic strategy of the Third National Government of New Zealand, promoted by the Prime Minister Robert Muldoon (1975–1984) and his National government in the early 1980s. The Think Big schemes saw the government borrow heavily overseas, running up a large external deficit, and using the funds for large-scale industrial projects. Petrochemical and energy related projects figured prominently, designed to utilize New Zealand's abundant natural gas to produce ammonia, urea fertilizer, methanol and petrol.

Trickle-down economics, was a term coined by political satirist Will Rogers, also known as the horse and sparrow theory; it is a pejorative characterization of the economic proposition that taxes on businesses and the wealthy in society should be reduced as a means to stimulate business investment in the short term and benefit society at large in the long term. In each of the aforementioned tax reforms, taxes were cut across all income brackets, but the biggest reductions were given to the highest income earners, In recent history, the term has been used by critics of supply-side economic policies, such as "Reaganomics". Whereas general supply-side theory favors lowering taxes overall, trickle-down theory more specifically advocates for a lower tax burden on the upper end of the economic spectrum. Empirical evidence shows that the proposition is regressive and has never managed to achieve all of its stated goals as described by the Reagan administration.

Incomes policies in economics are economy-wide wage and price controls, most commonly instituted as a response to inflation, and usually seeking to establish wages and prices below free market level.

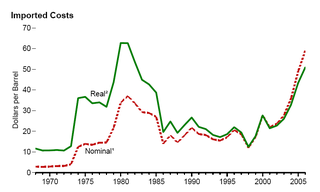

From the mid-1980s to September 2003, the inflation-adjusted price of a barrel of crude oil on NYMEX was generally under US$25/barrel in 2008 dollars. During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147.30 in July 2008. Commentators attributed these price increases to many factors, including Middle East tension, soaring demand from China, the falling value of the U.S. dollar, reports showing a decline in petroleum reserves, worries over peak oil, and financial speculation.

The price of oil, or the oil price, generally refers to the spot price of a barrel of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC Reference Basket, Tapis crude, Bonny Light, Urals oil, Isthmus and Western Canadian Select (WCS). There is a differential in the price of a barrel of oil based on its grade—determined by factors such as its specific gravity or API gravity and its sulfur content—and its location—for example, its proximity to tidewater and refineries. Heavier, sour crude oils lacking in tidewater access—such as Western Canadian Select—are less expensive than lighter, sweeter oil—such as WTI.

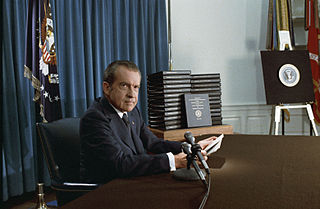

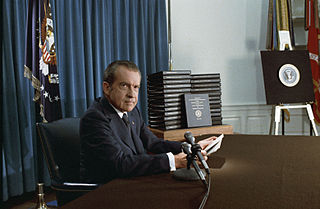

Nixonomics, a portmanteau of the words "Nixon" and "economics", refers to U.S. President Richard Nixon's economic performance. Nixon is the first president to have his surname combined with the word "economics".

The 1980s oil glut was a serious surplus of crude oil caused by falling demand following the 1970s energy crisis. The world price of oil had peaked in 1980 at over US$35 per barrel ; it fell in 1986 from $27 to below $10. The glut began in the early 1980s as a result of slowed economic activity in industrial countries due to the crises of the 1970s, especially in 1973 and 1979, and the energy conservation spurred by high fuel prices. The inflation-adjusted real 2004 dollar value of oil fell from an average of $78.2 in 1981 to an average of $26.8 per barrel in 1986.

In United States politics, the gas tax holiday or the gas tax loophole was a proposal made by presidential contenders Arizona Senator John McCain and New York Senator Hillary Clinton to suspend the federal excise tax on gasoline from Memorial Day to Labor Day in the year 2008. Proponents argued that this could potentially reduce the price of gas at the pump by about 18.4 cents a gallon for regular unleaded gasoline and 24.4 cents a gallon for diesel. If it were done, it was estimated the gas tax holiday would save consumers roughly $30 over the three-month period it would be instated. However, Barack Obama and others argued that the oil companies would not significantly lower prices and would instead pocket most of the tax cut, effectively turning the cut into a tax loophole.

The proven oil reserves in Saudi Arabia are the reportedly 2nd largest in the world, estimated to be 268 billion barrels, including 2.5 Gbbl in the Saudi–Kuwaiti neutral zone. In the oil industry, an oil barrel is defined as 42 US gallons, which is about 159 litres, or 35 imperial gallons. They are predominantly found in the Eastern Province. These reserves were apparently the largest in the world until Venezuela announced they had increased their proven reserves to 297 Gbbl in January 2011. The Saudi reserves are about one-fifth of the world's total conventional oil reserves. A large fraction of these reserves comes from a small number of very large oil fields, and past production amounts to 40% of the stated reserves.

The 1970s energy crisis occurred when the Western world, particularly the United States, Canada, Western Europe, Australia, and New Zealand, faced substantial petroleum shortages as well as elevated prices. The two worst crises of this period were the 1973 oil crisis and the 1979 energy crisis, when the Yom Kippur War and the Iranian Revolution triggered interruptions in Middle Eastern oil exports.

The Reagan Era or Age of Reagan is a periodization of recent American history used by historians and political observers to emphasize that the conservative "Reagan Revolution" led by President Ronald Reagan in domestic and foreign policy had a lasting impact. It overlaps with what political scientists call the Sixth Party System. Definitions of the Reagan Era universally include the 1980s, while more extensive definitions may also include the late 1970s, the 1990s, the 2000s, the 2010s, and even the 2020s. In his 2008 book, The Age of Reagan: A History, 1974–2008, historian and journalist Sean Wilentz argues that Reagan dominated this stretch of American history in the same way that Franklin D. Roosevelt and his New Deal legacy dominated the four decades that preceded it.

The No Oil Producing and Exporting Cartels Act (NOPEC) was a U.S. Congressional bill, never enacted, known as H.R. 2264 and then as part of H.R. 6074. NOPEC was designed to remove the state immunity shield and to allow the international oil cartel, OPEC, and its national oil companies to be sued under U.S. antitrust law for anti-competitive attempts to limit the world's supply of petroleum and the consequent impact on oil prices. Despite popular sentiment against OPEC, legislative proposals to limit the organization's sovereign immunity have so far been unsuccessful. "Varied forms of a NOPEC bill have been introduced some 16 times since 2000, only to be vehemently resisted by the oil industry and its allied oil interests like the American Petroleum Institute and their legion of “K” Street Lobbyists."