In the United States,Social Security is the commonly used term for the federal Old-Age,Survivors,and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935,and the existing version of the Act,as amended,encompasses several social welfare and social insurance programs.

Supplemental Security Income (SSI) is a means-tested program that provides cash payments to disabled children,disabled adults,and individuals aged 65 or older who are citizens or nationals of the United States. SSI was created by the Social Security Amendments of 1972 and is incorporated in Title 16 of the Social Security Act. The program is administered by the Social Security Administration (SSA) and began operations in 1974.

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

The United States Social Security Administration (SSA) is an independent agency of the U.S. federal government that administers Social Security,a social insurance program consisting of retirement,disability and survivor benefits. To qualify for most of these benefits,most workers pay Social Security taxes on their earnings;the claimant's benefits are based on the wage earner's contributions. Otherwise benefits such as Supplemental Security Income (SSI) are given based on need.

Social Security Disability Insurance is a payroll tax-funded federal insurance program of the United States government. It is managed by the Social Security Administration and designed to provide monthly benefits to people who have a medically determinable disability that restricts their ability to be employed. SSDI does not provide partial or temporary benefits but rather pays only full benefits and only pays benefits in cases in which the disability is "expected to last at least one year or result in death." Relative to disability programs in other countries in the Organisation for Economic Co-operation and Development (OECD),the SSDI program in the United States has strict requirements regarding eligibility.

The Office of the Chief Actuary is a government agency that has responsibility for actuarial estimates regarding social welfare programs. In Canada,the Office of the Chief Actuary works with the Canada Pension Plan and the Old Age Security Program. In the United States,the Social Security Administration has an Office of the Chief Actuary that deals with Social Security,and the Centers for Medicare and Medicaid Services have an Office of the Actuary that deals with Medicare and Medicaid. A similar agency in the United Kingdom is called the Government Actuary's Department (GAD).

William A. Halter Jr is an American politician who served as the 18th lieutenant governor of Arkansas from 2007 to 2011. A member of the Democratic Party,he was elected to succeed the late Republican Winthrop Paul Rockefeller in 2006,defeating Republican challenger Jim Holt.

Michael James Astrue is an American lawyer and,under the pen name A. M. Juster,a poet and critic. He served as the 15th Commissioner of the Social Security Administration from 2007 to 2013. Astrue was Poetry Editor of First Things from 2018 to 2020,and became Poetry Editor of Plough Quarterly in 2020.

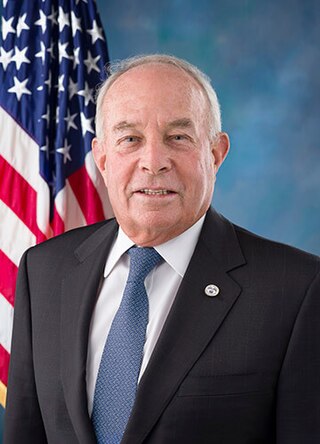

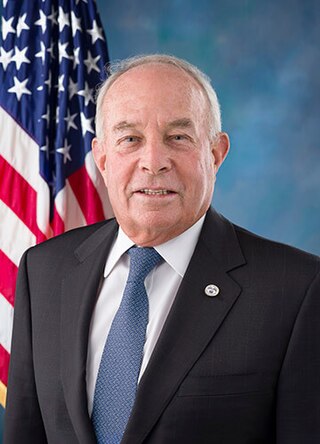

Andrew Marshall Saul is an American businessman and political candidate who served as the 16th commissioner of the United States Social Security Administration from 2019 to 2021. Saul was fired from the position by President Joe Biden on July 9,2021,after refusing to offer his requested resignation. Saul stated that his discharge was illegal.

The Windfall Elimination Provision was a statutory provision in United States law which affects benefits paid by the Social Security Administration under Title II of the Social Security Act. It reduced the Primary Insurance Amount (PIA) of a person's Retirement Insurance Benefits (RIB) or Disability Insurance Benefits (DIB) when that person is eligible or entitled to a pension based on a job which did not contribute to the Social Security Trust Fund. When it was in effect,it also affected the benefits of others claiming on the same social security record. It was repealed by the Social Security Fairness Act in 2025.

The Primary Insurance Amount (PIA) is a component of Social Security provision in the United States. Eligibility for receiving Social Security benefits,for all persons born after 1929,requires accumulating a minimum of 40 Social Security credits. Typically this is accomplished by earning income from work on which Federal Insurance Contributions Act (FICA) tax is assessed,up to a maximum taxable earnings threshold. For the purposes of the United States Social Security Administration,PIA is used as the beginning point in calculating the annuity payment of benefits that is provided to an eligible recipient each month during retirement until the recipient's death. Generally,the more a person pays in FICA taxes during their life,the higher their PIA will be. However,specific rules in its computation may deviate from this general rule.

Robert Myers Ball was an American Social Security official,who served under three presidents,from 1962 to 1973,as the 5th Commissioner of Social Security. He is the longest-serving head of the Social Security Administration to date. He also founded the National Academy for Social Insurance. He graduated from Wesleyan University in 1935,and in 1936 received a master's degree in economics from the same institution.

The United States Social Security Administration's Ticket to Work and Self-Sufficiency Program is the centerpiece of the Ticket to Work and Work Incentives Improvement Act of 1999.

The Foster Care Independence Act of 1999 aims to assist youth aging out of foster care in the United States in obtaining and maintaining independent living skills. Youth aging out of foster care,or transitioning out of the formal foster care system,are one of the most vulnerable and disadvantaged populations. As youth age out of the foster care system at age 18,they are expected to become self-sufficient immediately,even though on average youth in the United States are not expected to reach self-sufficiency until age 26.

Disability benefits are a form of financial assistance or welfare designed to support disabled individuals who cannot work due to a chronic illness,disease or injury. Disability benefits are typically provided through various sources,including government programs,group disability insurance provided by employers or associations or private insurance policies typically purchased through a licensed insurance agent or broker,or directly from an insurance company.

A limited form of the Social Security program began as a measure to implement "social insurance" during the Great Depression of the 1930s,when poverty rates among senior citizens exceeded 50 percent.

Substantial gainful activity is a term used in the United States by the Social Security Administration (SSA). Being incapable of substantial gainful employment is one of the criteria for eligibility for Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI) benefits. It is known as the "SGA requirement," and is defined in Section 520 of the Social Security Act.

Dorcas Ruth Hardy Spagnolo was an American healthcare specialist. She served as the 10th Commissioner of the Social Security Administration (SSA) from 1986 to 1989. She was the first woman to serve as SSA Commissioner. Hardy held conservative views and remained active in politics after her tenure.

Shirley Sears Chater is an American nurse,educational administrator and government official who served as the 12th commissioner of the Social Security Administration from 1993 until 1997. In the 1970s and 1980s,Chater held faculty appointments in nursing and education at the University of California,San Francisco (UCSF) and the University of California,Berkeley,respectively. She worked as an administrator at UCSF and then worked for two national education councils.

The Social Security Advisory Board (SSAB) is an independent,bipartisan board of the United States federal government. It was created by Congress and is appointed by the President and the Congress to advise the President,the Congress,and the Commissioner of Social Security on matters related to the Social Security and Supplemental Security Income programs.