A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Non-profit, member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers; they are privately owned. For-profit futures exchanges earn most of their revenue from trading and clearing fees, and are often public corporations.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

The Chicago Board of Trade (CBOT), established on April 3, 1848, is one of the world's oldest futures and options exchanges. On July 12, 2007, the CBOT merged with the Chicago Mercantile Exchange (CME) to form CME Group. CBOT and three other exchanges now operate as designated contract markets (DCM) of the CME Group.

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

A binary option is a financial exotic option in which the payoff is either some fixed monetary amount or nothing at all. The two main types of binary options are the cash-or-nothing binary option and the asset-or-nothing binary option. The former pays some fixed amount of cash if the option expires in-the-money while the latter pays the value of the underlying security. They are also called all-or-nothing options, digital options, and fixed return options (FROs).

Blair Hull is an American businessman, investor, and Democratic politician.

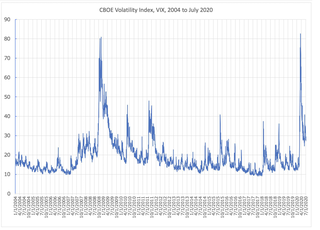

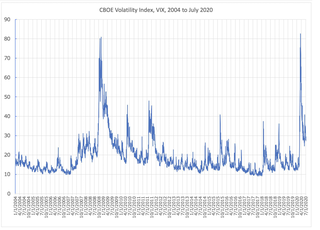

VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's expectation of volatility based on S&P 500 index options. It is calculated and disseminated on a real-time basis by the CBOE, and is often referred to as the fear index or fear gauge.

Options Clearing Corporation (OCC) is a United States clearing house based in Chicago. It specializes in equity derivatives clearing, providing central counterparty (CCP) clearing and settlement services to 16 exchanges. It was started by Wayne Luthringshausen and carried on by Michael Cahill. Its instruments include options, financial and commodity futures, security futures, and securities lending transactions.

A commodity broker is a firm or an individual who executes orders to buy or sell commodity contracts on behalf of the clients and charges them a commission. A firm or individual who trades for his own account is called a trader. Commodity contracts include futures, options, and similar financial derivatives. Clients who trade commodity contracts are either hedgers using the derivatives markets to manage risk, or speculators who are willing to assume that risk from hedgers in hopes of a profit.

Mark Andrew Ritchie is a Chicago Board of Trade and Chicago Mercantile Exchange commodities trader. A twenty-year veteran of the financial industry, Mark is one of the original founding partners of Chicago Research and Trading (CRT) which was once the largest options firm in the industry. He is also the author of two books, God in the Pits and Spirit of the Rainforest.

In finance, an option is a contract which conveys to its owner, the holder, the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option.

PTI Securities & Futures is a money management, securities and discount brokerage firm with offices in Chicago, Illinois and Peoria, Arizona. Established in 1991, PTI Securities provides investors, fund managers and pension funds in the United States with investment consulting services.

R. Scott Morris is an American author, financial engineer and quantitative consultant. He is president of Morris Consulting, LLC, Chief Investment Strategist of Blackthorne Capital Management, LLC, and was CEO of the Boston Options Exchange from 2006 to 2008. He has also was a Managing Director of Goldman Sachs and Partner at Hull Trading Company.

The Chicago Research and Trading Group was a futures and options trading firm. It was founded in 1977, by Joe Ritchie and was bought out by NationsBank in 1993.

OneChicago was a US-based all-electronic futures exchange with headquarters in Chicago, Illinois. The exchange offered approximately 12,509 single-stock futures (SSF) products with names such as IBM, Apple and Google. All trading was cleared through Options Clearing Corporation (OCC). The OneChicago exchange closed in September 2020.

Interactive Brokers, Inc. (IB), headquartered in Greenwich, Connecticut, is an American multinational brokerage firm which operates the largest electronic trading platform in the United States by number of daily average revenue trades. In 2023, the platform processed an average of 3 million trades per trading day. Interactive Brokers is the largest foreign exchange market broker and is one of the largest prime brokers servicing commodity brokers. The company brokers stocks, options, futures contracts, exchange of futures for physicals, options on futures, bonds, mutual funds, currency, cryptocurrency, contracts for difference, derivatives, and event-based trading contracts on election and other outcomes. Interactive Brokers offers direct market access, omnibus and non-disclosed broker accounts, and provides clearing services. The firm has operations in 34 countries and 27 currencies and has 2.6 million institutional and individual brokerage customers, with total customer equity of US$426 billion as of December 31, 2023. In addition to its headquarters in Greenwich, on the Gold Coast of Connecticut, the company has offices in major financial centers worldwide. More than half of the company's customers reside outside the United States, in approximately 200 countries.

Optiver Holding B.V. is a proprietary trading firm and market maker for various exchange-listed financial instruments. Its name derives from the Dutch optieverhandelaar, or "option trader". The company is privately owned. Optiver trades listed derivatives, cash equities, exchange-traded funds, bonds, and foreign exchange.

Cboe Global Markets, Inc. is an American company that owns the Chicago Board Options Exchange and the stock exchange operator BATS Global Markets.

Anthony "Tony" J. Saliba is a trader, author, and entrepreneur in Chicago, Illinois, who currently serves as CEO of Liquid Mercury, Vice Chairman of The Board of Managers at Matrix Executions, CEO of Option Technologies Solutions International, and Founder and CEO of Fortify Technologies.

Miami International Holdings, Inc. (MIH) is an American company formed in 2007 that operates global financial exchanges and execution services.