Related Research Articles

Morgan Stanley is an American multinational investment bank and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in 41 countries and more than 90,000 employees, the firm's clients include corporations, governments, institutions, and individuals. Morgan Stanley ranked No. 61 in the 2023 Fortune 500 list of the largest United States corporations by total revenue and in the same year ranked #30 in Forbes Global 2000.

The Charles Schwab Corporation is an American multinational financial services company. It offers banking, commercial banking, investing and related services including consulting, and wealth management advisory services to both retail and institutional clients. It has over 380 branches, primarily in financial centers in the United States and the United Kingdom. It is on the list of largest banks in the United States by assets. As of December 31, 2023, it had $8.5 trillion in client assets, 34.8 million active brokerage accounts, 5.2 million corporate retirement plan participants, and 1.8 million banking accounts. It also offers a donor advised fund for clients seeking to donate securities. It was founded in San Francisco, California, and is headquartered in Westlake, Texas.

Sallie L. Krawcheck is an American business executive who is the former head of Bank of America's Global Wealth and Investment Management division and is currently the CEO and co-founder of Ellevest, a digital financial advisor for women launched in 2016. She has been called "the most powerful woman on Wall Street."

Raymond James Financial, Inc. is an American multinational independent investment bank and financial services company providing financial services to individuals, corporations, and municipalities through its subsidiary companies that engage primarily in investment and financial planning, in addition to investment banking and asset management. The company is headquartered in St. Petersburg, Florida.

Front running, also known as tailgating, is the practice of entering into an equity (stock) trade, option, futures contract, derivative, or security-based swap to capitalize on advance, nonpublic knowledge of a large ("block") pending transaction that will influence the price of the underlying security. In essence, it means the practice of engaging in a personal or proprietary securities transaction in advance of a transaction in the same security for a client's account. Front running is considered a form of market manipulation in many markets. Cases typically involve individual brokers or brokerage firms trading stock in and out of undisclosed, unmonitored accounts of relatives or confederates. Institutional and individual investors may also commit a front running violation when they are privy to inside information. A front running firm either buys for its own account before filling customer buy orders that drive up the price, or sells for its own account before filling customer sell orders that drive down the price. Front running is prohibited since the front-runner profits come from nonpublic information, at the expense of its own customers, the block trade, or the public market.

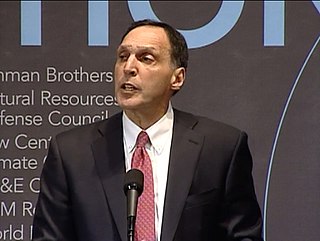

Richard Severin Fuld Jr. is an American banker best known as the final chairman and chief executive officer of investment bank Lehman Brothers. Fuld held this position from April 1, 1994 after the firm's spinoff from American Express until September 15, 2008. Lehman Brothers filed for bankruptcy protection under Chapter 11 on September 15, 2008, and subsequently announced the sale of major operations to parties including Barclays Bank and Nomura Securities.

Stratton Oakmont, Inc. was a Long Island, New York, over-the-counter brokerage house founded in 1989 by Jordan Belfort and Danny Porush. It defrauded many shareholders, leading to the arrest and incarceration of several executives and the closing of the firm in 1996.

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Association of Securities Dealers, Inc. (NASD) as well as to the member regulation, enforcement, and arbitration operations of the New York Stock Exchange. The U.S. government agency that acts as the ultimate regulator of the U.S. securities industry, including FINRA, is the U.S. Securities and Exchange Commission (SEC).

Shearson was the name of a series of investment banking and retail brokerage firms from 1902 until 1994, named for Edward Shearson and the firm he founded, Shearson Hammill & Co. Among Shearson's most notable incarnations were Shearson / American Express, Shearson Lehman / American Express, Shearson Lehman Brothers, Shearson Lehman Hutton and finally Smith Barney Shearson.

Mary Lovelace Schapiro served as the 29th Chair of the U.S. Securities and Exchange Commission (SEC). She was appointed by President Barack Obama, unanimously confirmed by the U.S. Senate, and assumed the Chairship on January 27, 2009. She is the first woman to be the permanent Chair of the SEC. In 2009, Forbes ranked her the 56th most powerful woman in the world.

Anastasios P. “Thomas” Belesis is the founder and CEO of the now-defunct John Thomas Financial, a New York City-based financial services company that was expelled from the securities industry in 2015. Belesis later settled fraud charges with regulators and agreed to a lifetime ban from the securities industry.

Merrill Lynch, Pierce, Fenner & Smith Incorporated, doing business as Merrill, and previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment banking arm, both firms engage in prime brokerage and broker-dealer activities. The firm is headquartered in New York City, and once occupied the entire 34 stories of 250 Vesey Street, part of the Brookfield Place complex in Manhattan. Merrill employs over 14,000 financial advisors and manages $2.8 trillion in client assets. The company also operates Merrill Edge, a division for investment and related services, including call center counsultancy.

BGC Group, Inc. is an American global financial services company based in New York City and London. Originally formed as part of the larger Cantor Fitzgerald organization, BGC Partners became its own entity in 2004.

Benjamin Wey is a Chinese-born US Wall Street financier and CEO of New York Global Group (NYGG). He began his financial career as an investment advisor and broker in Oklahoma in the late 1990s. Wey and NYGG were among the most active "facilitators and promoters" of reverse takeovers, which created Special-Purpose Acquisition Companies (SPAC) and allowed small Chinese companies to raise capital on U.S. markets, until reverse takeovers became the subject of a U.S. Securities and Exchange Commission investigation in 2011.

Daniel Ivandjiiski is a Bulgarian-born, U.S.-based former investment banker and capital-markets trader, and currently financial blogger, who founded the website Zero Hedge in January 2009, and remains its publisher and main editor.

Guy Gentile is an American business executive, entrepreneur, and high-frequency trading expert. He is best known for founding two high-frequency trading firms. In 2012 he was arrested by the FBI for an alleged pump and dump scheme but the charges were dropped 3 days later after he agreed to work as an undercover operative for the FBI.

Cetera Financial Group is an independent wealth hub and financial services provider comprising, among other companies, one of the largest families of independent registered investment advisers and broker-dealers in the United States. As such, Cetera provides financial advisors, tax professionals, and financial institutions with market and investment research, client-service platforms and technologies, trade execution and portfolio management services, and back-office support.

Thomas C. Naratil is an American business executive in the financial industry. After serving as president of both UBS Wealth Management Americas and UBS Americas since early 2016, Naratil was appointed CEO of UBS Americas Holding LLC and became co-president of Global Wealth Management of UBS Group AG and UBS AG in early 2018.

Citadel Securities LLC is an American market making firm providing liquidity and trade execution to retail and institutional clients, headquartered in Miami. The firm also trades futures, equities, credit, options, currencies, and Treasury bonds. It is the largest designated market maker on the New York Stock Exchange.

Brett Harrison is an American businessman and software developer. He is the founder and CEO of brokerage and trading technology firm Architect Financial Technologies.

References

- ↑ Kelly, Bruce (15 January 2015). "Goodbye, Tommy Belesis. We won't miss you". Investment News.

- ↑ LEVIN, BESS (14 June 2013). "Cold Call Where John Thomas Financial Hath Cold Called!". Deal Breaker.

- ↑ Faux, Zeke (1 August 2013). "Belesis Brothers Join New Broker After John Thomas Closes". Bloomberg. Retrieved 4 October 2013.

- 1 2 Whitehouse, Kaja (10 July 2013). "Financial finale | New York Post". New York Post. Retrieved 5 December 2013.

- ↑ "In the news: John Thomas Financial Announces Major Expansion Plans". John Thomas Financial. 27 July 2009. Retrieved 4 March 2011.

- ↑ "John Thomas Financial CEO Thomas Belesis Reveals His Plans for Expansion in an Exclusive Interview With CNBC". MarketWire. Retrieved 7 June 2011.

- ↑ "John Thomas Financial Chief Economist Says Investors Should Maintain a Bullish Posture". BusinessWire. Retrieved 3 June 2011.

- ↑ "Urbealis named President of JTF Private Wealth Management". WealthAdviser. Retrieved 7 June 2011.

- ↑ TKACIK, MOE (11 February 2010). "Revenge of the Wall Street Traders: The Fat Cats Strike Back". AOL .

- ↑ "Restore Wall Street". Restore Wall Street. Archived from the original on 3 February 2011. Retrieved 4 March 2011.

- ↑ Kleinfeld, N. R. (27 January 2010). "New Embattled Minority: Wall Street Brokers". The New York Times. Retrieved 4 March 2011.

- ↑ Whitehouse, Kaja (6 April 2012). "Shady Past for Wall Street Mr. Clean". New York Post.

- ↑ Whitehouse, Kaja (7 February 2013). "John Thomas Financial being probed by brokerage industry, SEC and FBI". New York Post.

- ↑ Whitehouse, Kaja (14 February 2013). "Cameo Calamity II: Belesis in cross hairs". New York Post.

- ↑ Faux, Zeke (28 February 2013). "John Thomas Financial: The Other Side of Wall Street". Bloomberg L.P.

- ↑ "Disciplinary and Other FINRA Actions" (PDF). April 2015.