Related Research Articles

In legal terminology, a complaint is any formal legal document that sets out the facts and legal reasons that the filing party or parties believes are sufficient to support a claim against the party or parties against whom the claim is brought that entitles the plaintiff(s) to a remedy. For example, the Federal Rules of Civil Procedure (FRCP) that govern civil litigation in United States courts provide that a civil action is commenced with the filing or service of a pleading called a complaint. Civil court rules in states that have incorporated the Federal Rules of Civil Procedure use the same term for the same pleading.

A lawsuit is a proceeding by one or more parties against one or more parties in a civil court of law. The archaic term "suit in law" is found in only a small number of laws still in effect today. The term "lawsuit" is used with respect to a civil action brought by a plaintiff who requests a legal remedy or equitable remedy from a court. The defendant is required to respond to the plaintiff's complaint or else risk default judgment. If the plaintiff is successful, judgment is entered in favor of the plaintiff, and the Court may impose the legal and/or equitable remedies available against the defendant (respondent). A variety of court orders may be issued in connection with or as part of the judgment to enforce a right, award damages or restitution, or impose a temporary or permanent injunction to prevent an act or compel an act. A declaratory judgment may be issued to prevent future legal disputes.

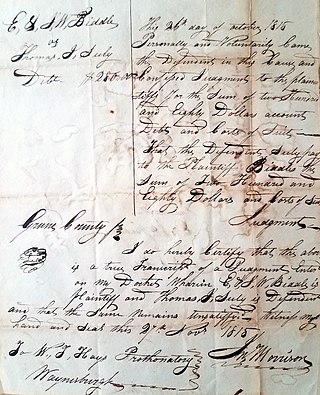

In law, a judgment is a decision of a court regarding the rights and liabilities of parties in a legal action or proceeding. Judgments also generally provide the court's explanation of why it has chosen to make a particular court order.

A debtors' prison is a prison for people who are unable to pay debt. Until the mid-19th century, debtors' prisons were a common way to deal with unpaid debt in Western Europe. Destitute people who were unable to pay a court-ordered judgment would be incarcerated in these prisons until they had worked off their debt via labour or secured outside funds to pay the balance. The product of their labour went towards both the costs of their incarceration and their accrued debt. Increasing access and lenience throughout the history of bankruptcy law have made prison terms for unaggravated indigence obsolete over most of the world.

A warrant of execution is a form of writ of execution used in the County Court in England and Wales (only). It is a method of enforcing judgments and empowers a County Court bailiff to attend a judgment debtor’s address to take goods for sale. The closest equivalent in Scotland is a charge for payment, executed by sheriff officers after a decree is granted in a sheriff court in favour of a pursuer (claimant) seeking recovery of a debt or other sum due.

Debt collection is the process of pursuing payments of money or other agreed-upon value owed to a creditor. The debtors may be individuals or businesses. An organization that specializes in debt collection is known as a collection agency or debt collector. Most collection agencies operate as agents of creditors and collect debts for a fee or percentage of the total amount owed. Historically, debtors could face debt slavery, debtor's prison, or coercive collection methods. In the 21st century in many countries, legislation regulates debt collectors, and limits harassment and practices deemed unfair.

A supersedeas bond, also known as a defendant's appeal bond, is a type of surety bond that a court requires from an appellant who wants to delay payment of a judgment until an appeal is over.

Default judgment is a binding judgment in favor of either party based on some failure to take action by the other party. Most often, it is a judgment in favor of a plaintiff when the defendant has not responded to a summons or has failed to appear before a court of law. The failure to take action is the default. The default judgment is the relief requested in the party's original petition.

Summary jurisdiction, in the widest sense of the phrase, in English law includes the power asserted by courts of record to deal brevi manu with contempts of court without the intervention of a jury. Probably the power was originally exercisable only when the fact was notorious, i.e. done in presence of the court. But it has long been exercised as to extra curial contempts.

In English and American law, a judgment debtor is a person against whom a judgment ordering him to pay a sum of money has been obtained and remains unsatisfied. Such a person may be examined as to their assets, and if the judgment debt is of the necessary amount he may be made bankrupt if he fails to comply with a bankruptcy notice served on him by the judgment creditors.

Audita querela is a writ, stemming from English common law, that serves to permit a defendant who has had a judgment rendered against him or her to seek relief of the consequences of such a judgment where there is some new evidence or legal defense that was not previously available. The writ is thus generally used to prevent a judgment from being executed where enforcement of that judgment would be "contrary to justice". At common law, the writ may be useful where a creditor engages in fraud before the judgment is rendered, or because the debt had been discharged, paid or otherwise satisfied after the judgment is rendered.

Diligence is a term in Scots Law with no single definition, but is commonly used to describe debt collection and debt recovery proceedings against a debtor by a creditor in Scottish courts. The law of diligence is part of the law of actions in Scots private law. Accordingly, it is within the devolved competence of the Scottish Parliament.

The Debtors Act 1869 was an Act of the Parliament of the United Kingdom of Great Britain and Ireland that aimed to reform the powers of courts to detain debtors.

Bankruptcy in Irish Law is a legal process, supervised by the High Court whereby the assets of a personal debtor are realised and distributed amongst his or her creditors in cases where the debtor is unable or unwilling to pay his debts.

Standard Bank of South Africa Ltd v Saunderson and Others is an important case in South African property law and civil procedure. It was heard in the Supreme Court of Appeal on 23 November 2005 and decided on 15 December 2005. In a unanimous judgment written by Judges of Appeal Edwin Cameron and Robert Nugent, the court dealt with the proper application of Jaftha v Schoeman.

Civil procedure in South Africa is the formal rules and standards that courts follow in that country when adjudicating civil suits. The legal realm is divided broadly into substantive and procedural law. Substantive law is that law which defines the contents of rights and obligations between legal subjects; procedural law regulates how those rights and obligations are enforced. These rules govern how a lawsuit or case may be commenced, and what kind of service of process is required, along with the types of pleadings or statements of case, motions or applications, and orders allowed in civil cases, the timing and manner of depositions and discovery or disclosure, the conduct of trials, the process for judgment, various available remedies, and how the courts and clerks are to function.

Coetzee v Government of the Republic of South Africa; Matiso and Others v Commanding Officer, Port Elizabeth Prison, and Others is an important case in South African law, with an especial bearing on civil procedure and constitutional law. It concerned the constitutional validity of certain provisions of the Magistrates' Courts Act. It was heard, March 6, 1995, in the Constitutional Court by Chaskalson P, Mahomed DP, Ackermann J, Didcott J, Kentridge AJ, Kriegler J, Langa J, Madala J, Mokgoro J, O'Regan J and Sachs J. They delivered judgment on September 22. The applicant's attorneys were the Legal Resources Centres of Cape Town, Port Elizabeth and Johannesburg. Attorneys for the first and second respondents in the Coetzee application were the State Attorneys of Cape Town and Johannesburg, and Du Plessis & Eksteen for the Association of Law Societies. IMS Navsa SC appeared for the applicants in both matters, D. Potgieter for the first and second respondents in the Coetzee matter, and JC du Plessis for the Association of Law Societies.

Insolvency in South African law refers to a status of diminished legal capacity imposed by the courts on persons who are unable to pay their debts, or whose liabilities exceed their assets. The insolvent's diminished legal capacity entails deprivation of certain of his important legal capacities and rights, in the interests of protecting other persons, primarily the general body of existing creditors, but also prospective creditors. Insolvency is also of benefit to the insolvent, in that it grants him relief in certain respects.

An emoluments attachment order in South African law is a court order whereby the judgment creditor is able to attach part of the salary or wages of the judgment debtor. Once an emoluments attachment order has been granted, the employer of the judgment debtor is obliged to pay a certain portion of the judgment debtor's salary or wages to the judgment creditor.

Credit agreements in South Africa are agreements or contracts in South Africa in terms of which payment or repayment by one party to another is deferred. This entry discusses the core elements of credit agreements as defined in the National Credit Act, and the consequences of concluding a credit agreement in South Africa.

References

- 1 2 3 4 One or more of the preceding sentences incorporates text from a publication now in the public domain : Chisholm, Hugh, ed. (1911). "Judgment Summons". Encyclopædia Britannica . Vol. 15 (11th ed.). Cambridge University Press. p. 541.

- ↑ CPR Part 71

- ↑ CCR O. 28 r. 2(3)

- ↑ Form N342

- ↑ "Civil court fees (EX50)". GOV.UK. Retrieved June 3, 2024.