The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

The monetary policy of the United States is the set of policies which the Federal Reserve follows to achieve its twin objectives of high employment and stable inflation.

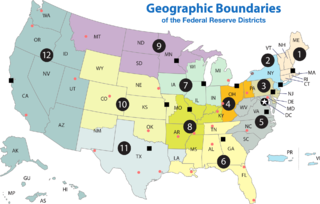

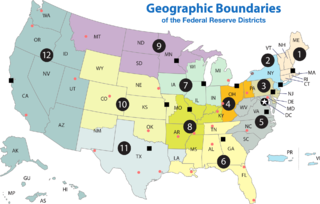

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve Act of 1913. The banks are jointly responsible for implementing the monetary policy set forth by the Federal Open Market Committee, and are divided as follows:

The Federal Open Market Committee (FOMC) is a committee within the Federal Reserve System that is charged under United States law with overseeing the nation's open market operations. This Federal Reserve committee makes key decisions about interest rates and the growth of the United States money supply. Under the terms of the original Federal Reserve Act, each of the Federal Reserve banks was authorized to buy and sell in the open market bonds and short term obligations of the United States Government, bank acceptances, cable transfers, and bills of exchange. Hence, the reserve banks were at times bidding against each other in the open market. In 1922, an informal committee was established to execute purchases and sales. The Banking Act of 1933 formed an official FOMC.

Stanley Fischer is an American economist who served as the 20th vice chair of the Federal Reserve from 2014 to 2017. Fischer previously served as the 8th governor of the Bank of Israel from 2005 to 2013. Born in Northern Rhodesia, he holds dual citizenship in Israel and the United States. He previously served as First Deputy Managing Director of the International Monetary Fund and as Chief Economist of the World Bank. On January 10, 2014, President Barack Obama nominated Fischer to the position of Vice Chair of the Federal Reserve. He is a senior advisor at BlackRock. On September 6, 2017, Stanley Fischer announced that he was resigning as Vice-Chair for personal reasons effective October 13, 2017.

The Federal Reserve System, commonly known as "the Fed," has faced various criticisms since its establishment in 1913. Critics have questioned its effectiveness in managing inflation, regulating the banking system, and stabilizing the economy. Notable critics include Nobel laureate economist Milton Friedman and his fellow monetarist Anna Schwartz, who argued that the Fed's policies exacerbated the Great Depression. More recently, former Congressman Ron Paul has advocated for the abolition of the Fed and a return to a gold standard.

Money creation, or money issuance, is the process by which the money supply of a country, or an economic or monetary region, is increased. In most modern economies, money is created by both central banks and commercial banks. Money issued by central banks is a liability, typically called reserve deposits, and is only available for use by central bank account holders, which are generally large commercial banks and foreign central banks.

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the monetary policy of the United States. Governors are appointed by the president of the United States and confirmed by the Senate for staggered 14-year terms. It is headquartered in the Eccles Building on Constitution Avenue, N.W. in Washington, D.C.

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is responsible for the Second District of the Federal Reserve System, which encompasses the State of New York, the 12 northern counties of New Jersey, Fairfield County in Connecticut, Puerto Rico, and the U.S. Virgin Islands. Located at 33 Liberty Street in Lower Manhattan, it is the largest, the most active, and the most influential of the Reserve Banks.

Jeffrey M. Lacker is an American economist and was president of the Federal Reserve Bank of Richmond until April 4, 2017. He was a Distinguished Professor in the Department of Economics at the Virginia Commonwealth University School of Business in Richmond, Virginia.

Quantitative easing (QE) is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary policy that came into wide application after the 2007–2008 financial crisis. It is used to mitigate an economic recession when inflation is very low or negative, making standard monetary policy ineffective. Quantitative tightening (QT) does the opposite, where for monetary policy reasons, a central bank sells off some portion of its holdings of government bonds or other financial assets.

This is a list of historical rate actions by the United States Federal Open Market Committee (FOMC). The FOMC controls the supply of credit to banks and the sale of treasury securities.

The System Open Market Account (SOMA) is a securities portfolio managed by the Federal Reserve Bank of New York, that holds the assets it has purchased through open market operations (OMOs) in the course of carrying out monetary policy. Through SOMA transactions, the Federal Reserve System influences interest rates and the amount of reserves in the US banking system. Income from SOMA assets also provides funding for the Federal Reserve's activities, which are not funded by Congress. The Federal Open Market Committee (FOMC) instructs the Reserve Bank of New York as to how it should use the SOMA to support monetary policy.

Vincent Raymond Reinhart is the Chief Economist for BNY Mellon Asset Management.

Sarah Bloom Raskin is an American attorney and financial markets policymaker who served as the 13th United States Deputy Secretary of the Treasury from 2014 to 2017. Raskin previously served as a member of the Federal Reserve Board of Governors from 2010 to 2014. She also was Maryland Commissioner of Financial Regulation. She was a Rubenstein Fellow at Duke University. She is currently the Colin W. Brown Distinguished Professor of the Practice of Law at Duke Law School. She is also a Senior Fellow at the Duke Center on Risk. She also serves as a Partner at Kaya Partners, Ltd., a climate advisory firm.

Richard Harris Clarida is an American economist who served as the 21st Vice Chair of the Federal Reserve from 2018 to 2022. Clarida resigned his post on January 14, 2022, to return from public service leave to teach at Columbia University for the spring term of 2022. He is the C. Lowell Harriss Professor of Economics and International Affairs at Columbia University and, from 2006 until September 2018 and from October 2022 to the present, a Global Strategic Advisor for PIMCO. He is notable for his contributions to dynamic stochastic general equilibrium theory and international monetary economics. He is a former Assistant Secretary of the Treasury for Economic Policy and is a recipient of the Treasury Medal. He also was a proponent of the theory that inflation was transitory during the COVID-19 pandemic.

Mary Colleen Daly is an American economist, who became the 13th President and chief executive officer of the Federal Reserve Bank of San Francisco on October 1, 2018. She serves on the Federal Reserve's rate-setting Federal Open Market Committee on a rotating basis. Previously, Daly was the Executive Vice President and Director of Research of the Federal Reserve Bank of San Francisco, which she joined as an economist in 1996.

Philip Nathan Jefferson is an American economist who has been serving as 23rd Vice Chair of the Federal Reserve since September 2023. He has been a member of the Federal Reserve Board of Governors since 2022. He was nominated for the position by President Joe Biden in January 2022, and was confirmed by the Senate in May 2022. Upon taking office, he became the fourth Black man to serve on the board.

Christopher J. Waller is an American economist who has been a member of the Federal Reserve Board of Governors since 2020. A nominee of then-President Donald Trump, he was confirmed by the Senate in December 2020, to serve through January 2030.

Lorie K. Logan is president and CEO of the Federal Reserve Bank of Dallas.