The economy of South Korea is a highly developed mixed economy. By nominal GDP, the economy was worth ₩2.61 quadrillion. It has the 4th largest economy in Asia and the 12th largest in the world as of 2024. South Korea is notable for its rapid economic development from an underdeveloped nation to a developed, high-income country in a few decades. This economic growth has been described as the Miracle on the Han River, which has allowed it to join the OECD and the G20. It is included in the group of Next Eleven countries as having the potential to play a dominant role in the global economy by the middle of the 21st century. Among OECD members, South Korea has a highly efficient and strong social security system; social expenditure stood at roughly 15.5% of GDP. South Korea spends around 4.93% of GDP on advance research and development across various sectors of the economy.

Citigroup Inc. or Citi is an American multinational investment bank and financial services company based in New York City. The company was formed in 1998 by the merger of Citicorp, the bank holding company for Citibank, and Travelers; Travelers was spun off from the company in 2002.

Daewoo also known as the Daewoo Group, was a major South Korean chaebol and automobile manufacturer.

Dynegy Inc. is an electric company based in Houston, Texas. It owns and operates a number of power stations in the U.S., all of which are powered by fossil fuels. Dynegy was acquired by Vistra Corp on April 9, 2018. The company is located at 601 Travis Street in Downtown Houston. The company was founded in 1984 as Natural Gas Clearinghouse. It was originally an energy brokerage, buying and selling natural gas supplies. It changed its name to NGC Corporation in 1995 after entering the electrical power generation business.

A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of bankruptcy. A bailout differs from the term bail-in under which the bondholders or depositors of global systemically important financial institutions (G-SIFIs) are forced to participate in the recapitalization process but taxpayers are not. Some governments also have the power to participate in the insolvency process; for instance, the U.S. government intervened in the General Motors bailout of 2009–2013. A bailout can, but does not necessarily, avoid an insolvency process. The term bailout is maritime in origin and describes the act of removing water from a sinking vessel using a bucket.

SK Hynix Inc. is a South Korean supplier of dynamic random-access memory (DRAM) chips and flash memory chips. SK Hynix is one of the world's largest semiconductor vendors.

Shinhan Bank Co., Ltd. is a bank headquartered in Seoul, South Korea. It was founded under that name in 1982, but through its merger with Chohung Bank in 2006, traces its origins to the Hanseong Bank, one of the first banks to be established in Korea. It is part of the Shinhan Financial Group, along with Jeju Bank. As of June 30, 2016, Shinhan Bank had total assets of ₩298.945 trillion, total deposits of ₩221.047 trillion and loans of ₩212.228 trillion. Shinhan Bank is the main subsidiary of Shinhan Financial Group (SFG).

Debt settlement is a settlement negotiated with a debtor's unsecured creditor. Commonly, creditors agree to forgive a large part of the debt: perhaps around half, though results can vary widely. When settlements are finalized, the terms are put in writing. It is common that the debtor makes one lump-sum payment in exchange for the creditor agreeing that the debt is now cancelled and the matter closed. Some settlements are paid out over a number of months. In either case, as long as the debtor does what is agreed in the negotiation, no outstanding debt will appear on the former debtor's credit report.

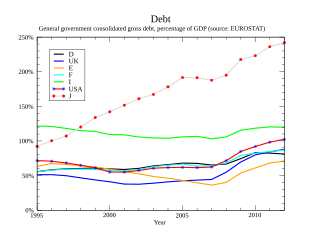

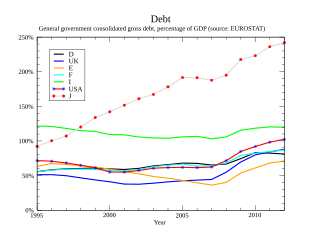

Global debt refers to the total amount of money owed by all sectors, including governments, businesses, and households worldwide.

A debt buyer is a company, sometimes a collection agency, a private debt collection law firm, or a private investor, that purchases delinquent or charged-off debts from a creditor or lender for a percentage of the face value of the debt based on the potential collectibility of the accounts. The debt buyer can then collect on its own, utilize the services of a third-party collection agency, repackage and resell portions of the purchased portfolio, or use any combination of these options.

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. The crisis led to a severe economic recession, with millions losing their jobs and many businesses going bankrupt. The U.S. government intervened with a series of measures to stabilize the financial system, including the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act (ARRA).

The subprime mortgage crisis impact timeline lists dates relevant to the creation of a United States housing bubble, the 2005 housing bubble burst and the subprime mortgage crisis which developed during 2007 and 2008. It includes United States enactment of government laws and regulations, as well as public and private actions which affected the housing industry and related banking and investment activity. It also notes details of important incidents in the United States, such as bankruptcies and takeovers, and information and statistics about relevant trends. For more information on reverberations of this crisis throughout the global financial system see 2007–2008 financial crisis.

The Financial Supervisory Service (FSS) is South Korea's integrated financial regulator that examines and supervises financial institutions under the broad oversight of the Financial Services Commission (FSC), the government regulatory authority staffed by civil servants.

The Emergency Economic Stabilization Act of 2008, also known as the "bank bailout of 2008" or the "Wall Street bailout", was a United States federal law enacted during the Great Recession, which created federal programs to "bail out" failing financial institutions and banks. The bill was proposed by Treasury Secretary Henry Paulson, passed by the 110th United States Congress, and was signed into law by President George W. Bush. It became law as part of Public Law 110-343 on October 3, 2008. It created the $700 billion Troubled Asset Relief Program (TARP), which utilized congressionally appropriated taxpayer funds to purchase toxic assets from failing banks. The funds were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases.

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George W. Bush. It was a component of the government's measures in 2009 to address the subprime mortgage crisis.

The Term Asset-Backed Securities Loan Facility (TALF) is a program created by the U.S. Federal Reserve to spur consumer credit lending. The program was announced on November 25, 2008, and was to support the issuance of asset-backed securities (ABS) collateralized by student loans, auto loans, credit card loans, and loans guaranteed by the Small Business Administration (SBA). Under TALF, the Federal Reserve Bank of New York authorized up to $200 billion of loans on a non-recourse basis to holders of certain AAA-rated ABS backed by newly and recently originated consumer and small business loans. As TALF money did not originate from the U.S. Treasury, the program did not require congressional approval to disburse funds, but an act of Congress forced the Fed to reveal how it lent the money. The TALF began operation in March 2009 and was closed on June 30, 2010. TALF 2 was initiated in 2020 during the COVID-19 pandemic.

Cardif is an international insurance company based in France with a presence worldwide. The company is part of the BNP Paribas Group.

Debt crisis is a situation in which a government loses the ability of paying back its governmental debt. When the expenditures of a government are more than its tax revenues for a prolonged period, the government may enter into a debt crisis. Various forms of governments finance their expenditures primarily by raising money through taxation. When tax revenues are insufficient, the government can make up the difference by issuing debt.

In South Korea, the gold-collecting campaign was a national sacrificial movement in early 1998 to repay its debt to the International Monetary Fund. At the time, South Korea had about $304 billion in foreign-exchange debt. The campaign, involving about 3.51 million people nationwide, collected about 227 tons of gold worth about $2.13 billion.

The national debt of Pakistan, or simply Pakistani debt, is the total public debt, or unpaid borrowed funds carried by the Government of Pakistan, which includes measurement as the face value of the currently outstanding treasury bills (T-bills) that have been issued by the federal government.