Related Research Articles

Neoclassical economics is an approach to economics in which the production, consumption and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good or service is determined through a hypothetical maximization of utility by income-constrained individuals and of profits by firms facing production costs and employing available information and factors of production. This approach has often been justified by appealing to rational choice theory, a theory that has come under considerable question in recent years.

Post-Keynesian economics is a school of economic thought with its origins in The General Theory of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney Weintraub, Paul Davidson, Piero Sraffa and Jan Kregel. Historian Robert Skidelsky argues that the post-Keynesian school has remained closest to the spirit of Keynes' original work. It is a heterodox approach to economics.

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics.

Robert Emerson Lucas Jr. is an American economist at the University of Chicago, where he is currently the John Dewey Distinguished Service Professor Emeritus in Economics and the College. Widely regarded as the central figure in the development of the new classical approach to macroeconomics, he received the Nobel Prize in Economics in 1995 "for having developed and applied the hypothesis of rational expectations, and thereby having transformed macroeconomic analysis and deepened our understanding of economic policy". He has been characterized by N. Gregory Mankiw as "the most influential macroeconomist of the last quarter of the 20th century." As of 2020, he ranks as the 11th most cited economist in the world.

Edward Christian Prescott was an American economist. He received the Nobel Memorial Prize in Economics in 2004, sharing the award with Finn E. Kydland, "for their contributions to dynamic macroeconomics: the time consistency of economic policy and the driving forces behind business cycles". This research was primarily conducted while both Kydland and Prescott were affiliated with the Graduate School of Industrial Administration at Carnegie Mellon University. According to the IDEAS/RePEc rankings, he was the 19th most widely cited economist in the world in 2013. In August 2014, Prescott was appointed an Adjunct Distinguished Economic Professor at the Australian National University (ANU) in Canberra, Australia. Prescott died of cancer on November 6, 2022, at the age of 81.

Robert Joseph Barro is an American macroeconomist and the Paul M. Warburg Professor of Economics at Harvard University. Barro is considered one of the founders of new classical macroeconomics, along with Robert Lucas, Jr. and Thomas J. Sargent. He is currently a senior fellow at Stanford University's Hoover Institution and co-editor of the influential Quarterly Journal of Economics.

John Brian Taylor is the Mary and Robert Raymond Professor of Economics at Stanford University, and the George P. Shultz Senior Fellow in Economics at Stanford University's Hoover Institution.

Thomas John Sargent is an American economist and the W.R. Berkley Professor of Economics and Business at New York University. He specializes in the fields of macroeconomics, monetary economics, and time series econometrics. As of 2020, he ranks as the 29th most cited economist in the world. He was awarded the Nobel Memorial Prize in Economics in 2011 together with Christopher A. Sims for their "empirical research on cause and effect in the macroeconomy".

The policy-ineffectiveness proposition (PIP) is a new classical theory proposed in 1975 by Thomas J. Sargent and Neil Wallace based upon the theory of rational expectations, which posits that monetary policy cannot systematically manage the levels of output and employment in the economy.

Robert JamesGordon is an American economist. He is the Stanley G. Harris Professor of the Social Sciences at Northwestern University. Gordon is one of the world’s leading experts on inflation, unemployment, and long-term economic growth. His recent work asking whether U.S. economic growth is “almost over” has been widely cited, and in 2016 he was named as one of Bloomberg’s top 50 most influential people in the world.

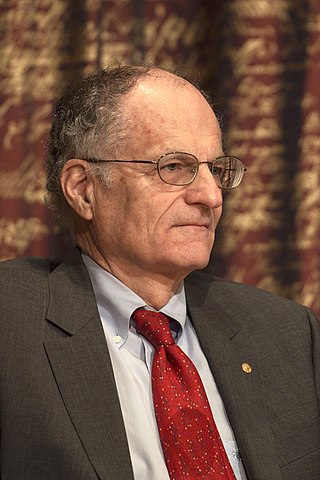

Lars Peter Hansen is an American economist. He is the David Rockefeller Distinguished Service Professor in Economics, Statistics, and the Booth School of Business, at the University of Chicago and a 2013 recipient of the Nobel Memorial Prize in Economics.

William Arnold Barnett is an American economist, whose current work is in the fields of chaos, bifurcation, and nonlinear dynamics in socioeconomic contexts, econometric modeling of consumption and production, and the study of the aggregation problem and the challenges of measurement in economics.

Robert Graham King is an American macroeconomist. He is currently professor at the Department of Economics at Boston University, editor of the Journal of Monetary Economics, research consultant to the Federal Reserve Bank of Richmond, and a member of the National Bureau of Economic Research.

New classical macroeconomics, sometimes simply called new classical economics, is a school of thought in macroeconomics that builds its analysis entirely on a neoclassical framework. Specifically, it emphasizes the importance of rigorous foundations based on microeconomics, especially rational expectations.

Rajnish Mehra is an Indian American financial economist. He currently holds the E.N. Basha Arizona Heritage Endowed Chair at the Arizona State University and is a Professor of Economics Emeritus at the University of California, Santa Barbara.

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle.

Neil Wallace is an American economist and professor of economics at Penn State University. He is considered one of the main proponents of new classical macroeconomics in the field of economics.

Harald Friedrich Hans Volker Sigmar Uhlig is a German macroeconomist and the Bruce Allen and Barbara Ritzenthaler Professor of Economics at the University of Chicago, where he was the chairman of the Department of Economics from 2009 to 2012.

Truman Fassett Bewley is an American economist. He is the Alfred Cowles Professor of Economics at Yale University. Originally specializing in mathematical economics and general equilibrium theory, since the late 1990s Bewley has gained renown for his work on sticky wages. In Bewley's 1999 book Why Wages Don't Fall During a Recession, hundreds of interviews with executives, labor leaders, and other professionals establish morale as an important factor in why businesses are reluctant to decrease employee compensation at times of low demand.

Douglas W. "Doug" Mitchell was an American economist and polymath who made significant contributions in a wide variety of areas in economics and finance as well as in statistics and mathematics.

References

- ↑ Ljungqvist's faculty page Archived 2011-12-29 at the Wayback Machine