History

Originally in Scotland, imprisonment for debt was enforceable only in certain cases, but a custom gradually grew up of taking the debtor's oath to pay. If the debtor broke his oath, he became liable to the discipline of the Church. The civil power could step in to aid the ecclesiastical, denouncing the debtor as an outlaw, imprisoning his person and confiscating his goods. The method of declaring a person an outlaw was by giving three blasts on a horn and publicly proclaiming the fact; hence the expression "put to the horn".

The subsequent process, a warrant directing a messenger-at-arms to charge the debtor to pay or perform in terms of the letters, was called letters of horning. This system of execution was simplified by the Debtors (Scotland) Act 1838 (1 & 2 Vict. c. 114), and execution was thereafter usually by diligence (see writ of execution).

The granting of letters of horning, letters of horning and poinding, letters of poinding, and letters of caption all ceased to be competent following the passage of the Debtors (Scotland) Act 1987. [1] The Register of Hornings is kept by Registers of Scotland.

A notary public of the common law is a public officer constituted by law to serve the public in non-contentious matters usually concerned with general financial transactions, estates, deeds, powers-of-attorney, and foreign and international business. A notary's main functions are to validate the signature of a person ; administer oaths and affirmations; take affidavits and statutory declarations, including from witnesses; authenticate the execution of certain classes of documents; take acknowledgments ; provide notice of foreign drafts; provide exemplifications and notarial copies; and, to perform certain other official acts depending on the jurisdiction. Such transactions are known as notarial acts, or more commonly, notarizations. The term notary public only refers to common-law notaries and should not be confused with civil-law notaries.

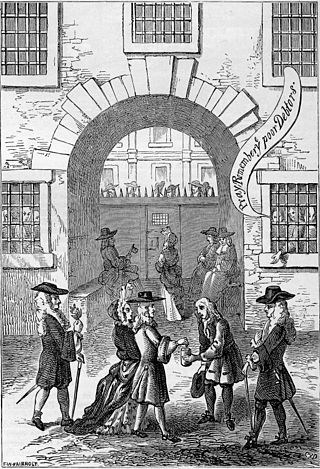

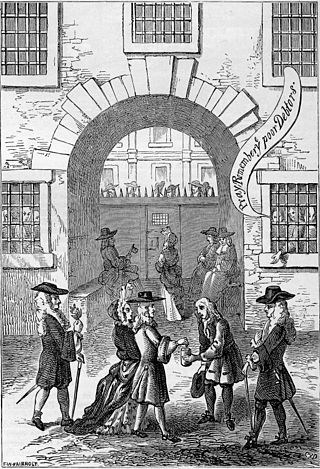

Fleet Prison was a notorious London prison by the side of the River Fleet. The prison was built in 1197, was rebuilt several times, and was in use until 1844. It was demolished in 1846.

A debtor or debitor is a legal entity that owes a debt to another entity. The entity may be an individual, a firm, a government, a company or other legal person. The counterparty is called a creditor. When the counterpart of this debt arrangement is a bank, the debtor is more often referred to as a borrower.

A debtors' prison is a prison for people who are unable to pay debt. Until the mid-19th century, debtors' prisons were a common way to deal with unpaid debt in Western Europe. Destitute people who were unable to pay a court-ordered judgment would be incarcerated in these prisons until they had worked off their debt via labour or secured outside funds to pay the balance. The product of their labour went towards both the costs of their incarceration and their accrued debt. Increasing access and lenience throughout the history of bankruptcy law have made prison terms for unaggravated indigence obsolete over most of the world.

In accounting, insolvency is the state of being unable to pay the debts, by a person or company (debtor), at maturity; those in a state of insolvency are said to be insolvent. There are two forms: cash-flow insolvency and balance-sheet insolvency.

Distraint or distress is "the seizure of someone’s property in order to obtain payment of rent or other money owed", especially in common law countries. Distraint is the act or process "whereby a person, traditionally even without prior court approval, seizes the personal property of another located upon the distrainor's land in satisfaction of a claim, as a pledge for performance of a duty, or in reparation of an injury." Distraint typically involves the seizure of goods (chattels) belonging to the tenant by the landlord to sell the goods for the payment of the rent. In the past, distress was often carried out without court approval. Today, some kind of court action is usually required, the main exception being certain tax authorities – such as HM Revenue and Customs in the United Kingdom and the Internal Revenue Service in the United States – and other agencies that retain the legal power to levy assets without a court order.

A guarantee is a form of transaction in which one person, to obtain some trust, confidence or credit for another, agrees to be answerable for them. It may also designate a treaty through which claims, rights or possessions are secured. It is to be differentiated from the colloquial "personal guarantee" in that a guarantee is a legal concept which produces an economic effect. A personal guarantee, by contrast, is often used to refer to a promise made by an individual which is supported by, or assured through, the word of the individual. In the same way, a guarantee produces a legal effect wherein one party affirms the promise of another by promising to themselves pay if default occurs.

Debt collection or cash collection is the process of pursuing payments of money or other agreed-upon value owed to a creditor. The debtors may be individuals or businesses. An organization that specializes in debt collection is known as a collection agency or debt collector. Most collection agencies operate as agents of creditors and collect debts for a fee or percentage of the total amount owed. Historically, debtors could face debt slavery, debtor's prison, or coercive collection methods. In the 21st century in many countries, legislation regulates debt collectors, and limits harassment and practices deemed unfair.

Bankruptcy in the United Kingdom is divided into separate local regimes for England and Wales, for Northern Ireland, and for Scotland. There is also a UK insolvency law which applies across the United Kingdom, since bankruptcy refers only to insolvency of individuals and partnerships. Other procedures, for example administration and liquidation, apply to insolvent companies. However, the term 'bankruptcy' is often used when referring to insolvent companies in the general media.

Registers of Scotland (RoS) is the non-ministerial department of the Scottish Government responsible for compiling and maintaining records relating to property and other legal documents. They currently maintain 21 public registers. The official responsible with maintaining the Registers of Scotland is the Keeper of the Registers of Scotland. By ex officio, the Keeper of the Registers of Scotland is also the Deputy Keeper of the Great Seal of Scotland. The Keeper of the Registers of Scotland should not be confused with the Keeper of the Records of Scotland.

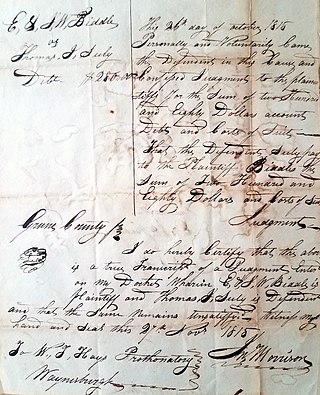

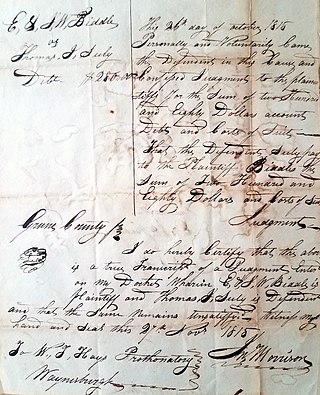

In English and American law, a judgment debtor is a person against whom a judgment ordering him to pay a sum of money has been obtained and remains unsatisfied. Such a person may be examined as to their assets, and if the judgment debt is of the necessary amount he may be made bankrupt if he fails to comply with a bankruptcy notice served on him by the judgment creditors.

Judgment summons, in English law, a summons issued under the Debtors' Act 1869 on the application of a creditor who has obtained a judgment for the payment of a sum of money by instalments or otherwise, where the order for payment has not been complied with. The judgment summons cites the defendant to appear personally in court, and be examined on oath as to the means he has, or has had, since the date of the order or judgment made against him, to pay the same, and to show cause why he should not be committed to prison for his default. An order of commitment obtained in a judgment summons remains in force for a year only, and the extreme term of imprisonment is six weeks, dating from the time of lodging in prison.

Diligence is a term in Scots Law with no single definition, but is commonly used to describe debt collection and debt recovery proceedings against a debtor by a creditor in Scottish courts. The law of diligence is part of the law of actions in Scots private law. Accordingly, it is within the devolved competence of the Scottish Parliament.

In Scots law, poinding is that diligence whereby a debtor's property is carried directly to a creditor. This type of diligence has now been abolished after the enactment of the Abolition of Poindings and Warrant Sales Act 2001.

A warrant sale was a statutory means of collecting debts in Scotland until 2001. Legal procedure for warrant sales was governed by the Debtors (Scotland) Act 1987. The practice was controversial, those who opposed it were concerned that it affected the poorest section of society who genuinely were unable to pay a debt, others claimed the legislation was needed to ensure people paid their debts.

Bankruptcy in Irish Law is a legal process, supervised by the High Court whereby the assets of a personal debtor are realised and distributed amongst his or her creditors in cases where the debtor is unable or unwilling to pay his debts.

Civil procedure in South Africa is the formal rules and standards that courts follow in that country when adjudicating civil suits. The legal realm is divided broadly into substantive and procedural law. Substantive law is that law which defines the contents of rights and obligations between legal subjects; procedural law regulates how those rights and obligations are enforced. These rules govern how a lawsuit or case may be commenced, and what kind of service of process is required, along with the types of pleadings or statements of case, motions or applications, and orders allowed in civil cases, the timing and manner of depositions and discovery or disclosure, the conduct of trials, the process for judgment, various available remedies, and how the courts and clerks are to function.

Insolvency in South African law refers to a status of diminished legal capacity imposed by the courts on persons who are unable to pay their debts, or whose liabilities exceed their assets. The insolvent's diminished legal capacity entails deprivation of certain of his important legal capacities and rights, in the interests of protecting other persons, primarily the general body of existing creditors, but also prospective creditors. Insolvency is also of benefit to the insolvent, in that it grants him relief in certain respects.

An emoluments attachment order in South African law is a court order whereby the judgment creditor is able to attach part of the salary or wages of the judgment debtor. Once an emoluments attachment order has been granted, the employer of the judgment debtor is obliged to pay a certain portion of the judgment debtor's salary or wages to the judgment creditor.

Debtors' Prison Relief Act of 1792 was a United States federal statute enacted into law by the first President of the United States George Washington on May 5, 1792. The Act of Congress established penal regulations and restrictions for persons jailed for property debt, tax evasion, and tax resistance. The indebtedness penalty was governed as a forbidding act for citizens indebted to colonial provinces. The public law granted a sunset provision limiting the term of the federal statute for the colonial domains.