Related Research Articles

Microeconomics is a branch of economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms.

A monopoly exists when a specific person or enterprise is the only supplier of a particular commodity. This contrasts with a monopsony which relates to a single entity's control of a market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic competition to produce the good or service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb monopolise or monopolize refers to the process by which a company gains the ability to raise prices or exclude competitors. In economics, a monopoly is a single seller. In law, a monopoly is a business entity that has significant market power, that is, the power to charge overly high prices, which is associated with a decrease in social surplus. Although monopolies may be big businesses, size is not a characteristic of a monopoly. A small business may still have the power to raise prices in a small industry.

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In theoretical models where conditions of perfect competition hold, it has been demonstrated that a market will reach an equilibrium in which the quantity supplied for every product or service, including labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum.

Price discrimination is a microeconomic pricing strategy where identical or largely similar goods or services are sold at different prices by the same provider in different markets. Price discrimination is distinguished from product differentiation by the more substantial difference in production cost for the differently priced products involved in the latter strategy. Price differentiation essentially relies on the variation in the customers' willingness to pay and in the elasticity of their demand. For price discrimination to succeed, a firm must have market power, such as a dominant market share, product uniqueness, sole pricing power, etc. All prices under price discrimination are higher than the equilibrium price in a perfectly-competitive market. However, some prices under price discrimination may be lower than the price charged by a single-price monopolist.

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that lead to the highest profit. Neoclassical economics, currently the mainstream approach to microeconomics, usually models the firm as maximizing profit.

A price is the quantity of payment or compensation given by one party to another in return for one unit of goods or services. In some situation, the price of production has a different name. If the product is a "good" in the commercial exchange, the price of this product will likely to be called "price". However, if the product is "service", there will be other possible names for this product's name. For example, the graph on the bottom will show some situations A price is influenced by production costs, supply of the desired item, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions.

In economics, economic equilibrium is a situation in which economic forces such as supply and demand are balanced and in the absence of external influences the values of economic variables will not change. For example, in the standard text perfect competition, equilibrium occurs at the point at which quantity demanded and quantity supplied are equal. Market equilibrium in this case is a condition where a market price is established through competition such that the amount of goods or services sought by buyers is equal to the amount of goods or services produced by sellers. This price is often called the competitive price or market clearing price and will tend not to change unless demand or supply changes, and quantity is called the "competitive quantity" or market clearing quantity. But the concept of equilibrium in economics also applies to imperfectly competitive markets, where it takes the form of a Nash equilibrium.

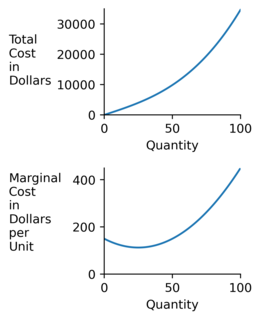

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is incremented, the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced.

A Pigovian tax is a tax on any market activity that generates negative externalities. The tax is intended to correct an undesirable or inefficient market outcome, and does so by being set equal to the external marginal cost of the negative externalities. Social cost includes private cost and external cost. However, in the presence of negative externalities, the social cost of a market activity is not covered by the private cost of the activity. In such a case, the market outcome is not efficient and may lead to over-consumption of the product. Often-cited examples of such externalities are environmental pollution, and increased public healthcare costs associated with tobacco and sugary drink consumption.

Social cost in neoclassical economics is the sum of the private costs resulting from a transaction and the costs imposed on the consumers as a consequence of being exposed to the transaction for which they are not compensated or charged. In other words, it is the sum of private and external costs. This might be applied to any number of economic problems: for example, social cost of carbon has been explored to better understand the costs of carbon emissions for proposed economic solutions such as a carbon tax.

Prices of production is a concept in Karl Marx's critique of political economy, defined as "cost-price + average profit". A production price can be thought of as a type of supply price for products; it refers to the price levels at which newly produced goods and services would have to be sold by the producers, in order to reach a normal, average profit rate on the capital invested to produce the products.

Productive and unproductive labour are concepts that were used in classical political economy mainly in the 18th and 19th centuries, which survive today to some extent in modern management discussions, economic sociology and Marxist or Marxian economic analysis. The concepts strongly influenced the construction of national accounts in the Soviet Union and other Soviet-type societies.

Net output is an accounting concept used in national accounts such as the United Nations System of National Accounts (UNSNA) and the NIPAs, and sometimes in corporate or government accounts. The concept was originally invented to measure the total net addition to a country's stock of wealth created by production during an accounting interval. The concept of net output is basically "gross revenue from production less the value of goods and services used up in that production". The idea is that if one deducts intermediate expenditures from the annual flow of income generated by production, one obtains a measure of the net new value in the new products created.

Production is the process of combining various material inputs and immaterial inputs in order to make something for consumption (output). It is the act of creating an output, a good or service which has value and contributes to the utility of individuals. The area of economics that focuses on production is referred to as production theory, which is intertwined with the consumption theory of economics.

An economic profit is the difference between the revenue a commercial entity has received from its outputs and the opportunity costs of its inputs. Unlike an accounting profit, an economic profit takes into account both a firm's implicit and explicit costs, whereas an accounting profit only relates to the explicit costs which appear on a firm's financial statements. Because it includes additional implicit costs, the economic profit usually differs from the accounting profit.

In economics, a factor market is a market where factors of production are bought and sold. Factor market allocates factors of production, including land, labour and capital, and distribute income to the owners of productive resources, such as wages, rents, etc.

In any technical subject, words commonly used in everyday life acquire very specific technical meanings, and confusion can arise when someone is uncertain of the intended meaning of a word. This article explains the differences in meaning between some technical terms used in economics and the corresponding terms in everyday usage.

The socially optimal firm size is the size for a company in a given industry at a given time which results in the lowest production costs per unit of output.

In Marxian economics, surplus value is the difference between the amount raised through a sale of a product and the amount it cost to the owner of that product to manufacture it: i.e. the amount raised through sale of the product minus the cost of the materials, plant and labour power. The concept originated in Ricardian socialism, with the term "surplus value" itself being coined by William Thompson in 1824; however, it was not consistently distinguished from the related concepts of surplus labor and surplus product. The concept was subsequently developed and popularized by Karl Marx. Marx's formulation is the standard sense and the primary basis for further developments, though how much of Marx's concept is original and distinct from the Ricardian concept is disputed. Marx's term is the German word "Mehrwert", which simply means value added, and is cognate to English "more worth".

This glossary of economics is a list of definitions of terms and concepts used in economics, its sub-disciplines, and related fields.

References

- ↑ United Nations, System of National Accounts 2008, Pre-edited version of Volume 1, p. 75.