Related Research Articles

Investment banking is an advisory-based financial service for institutional investors, corporations, governments, and similar clients. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities, FICC services or research. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket, Middle Market, and boutique market.

The Bank of America Corporation is an American multinational investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North Carolina, with investment banking and auxiliary headquarters in Manhattan. The bank was founded by the merger of NationsBank and Bank of America in 1998. It is the second-largest banking institution in the United States and the second-largest bank in the world by market capitalization, both after JPMorgan Chase. Bank of America is one of the Big Four banking institutions of the United States. It serves about 10 percent of all American bank deposits, in direct competition with JPMorgan Chase, Citigroup, and Wells Fargo. Its primary financial services revolve around commercial banking, wealth management, and investment banking.

A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of bankruptcy. A bailout differs from the term bail-in under which the bondholders or depositors of global systemically important financial institutions (G-SIFIs) are forced to participate in the recapitalization process but taxpayers are not. Some governments also have the power to participate in the insolvency process; for instance, the U.S. government intervened in the General Motors bailout of 2009–2013. A bailout can, but does not necessarily, avoid an insolvency process. The term bailout is maritime in origin and describes the act of removing water from a sinking vessel using a bucket.

Herbert Monroe Allison, Jr. was an American businessman who oversaw the Troubled Asset Relief Program (TARP) as Assistant Secretary of the Treasury for Financial Stability from 2009 to 2010. His previous positions included president and CEO of Fannie Mae, a post to which he was appointed in September 2008, after Fannie was placed into conservatorship. Prior to that, Allison was chairman, president and chief executive officer of TIAA from 2002 until his retirement in 2008.

Vikram Shankar Pandit is an Indian-American banker and investor who was the chief executive officer of Citigroup from December 2007 to 16 October 2012 and is the current chairman and chief executive officer of The Orogen Group.

The Emergency Economic Stabilization Act of 2008, also known as the "bank bailout of 2008" or the "Wall Street bailout", was a United States federal law enacted during the Great Recession, which created federal programs to "bail out" failing financial institutions and banks. The bill was proposed by Treasury Secretary Henry Paulson, passed by the 110th United States Congress, and was signed into law by President George W. Bush. It became law as part of Public Law 110-343 on October 3, 2008. It created the $700 billion Troubled Asset Relief Program (TARP), which utilized congressionally appropriated taxpayer funds to purchase toxic assets from failing banks. The funds were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases.

The government interventions during the subprime mortgage crisis were a response to the 2007–2009 subprime mortgage crisis and resulted in a variety of government bailouts that were implemented to stabilize the financial system during late 2007 and early 2008.

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George W. Bush. It was a component of the government's measures in 2009 to address the subprime mortgage crisis.

Neel Tushar Kashkari is an American banker, economist and politician who is the president of the Federal Reserve Bank of Minneapolis. As interim Assistant Secretary of the Treasury for Financial Stability from October 2008 to May 2009, he oversaw the Troubled Asset Relief Program (TARP) that was a major component of the U.S. government's response to the Financial crisis of 2007–2008. A Republican, he unsuccessfully ran for Governor of California in the 2014 election.

The Term Asset-Backed Securities Loan Facility (TALF) is a program created by the U.S. Federal Reserve to spur consumer credit lending. The program was announced on November 25, 2008, and was to support the issuance of asset-backed securities (ABS) collateralized by student loans, auto loans, credit card loans, and loans guaranteed by the Small Business Administration (SBA). Under TALF, the Federal Reserve Bank of New York authorized up to $200 billion of loans on a non-recourse basis to holders of certain AAA-rated ABS backed by newly and recently originated consumer and small business loans. As TALF money did not originate from the U.S. Treasury, the program did not require congressional approval to disburse funds, but an act of Congress forced the Fed to reveal how it lent the money. The TALF began operation in March 2009 and was closed on June 30, 2010. TALF 2 was initiated in 2020 during the COVID-19 pandemic.

The Emergency Economic Stabilization Act created the Troubled Asset Relief Program to administer up to $700 billion. Several oversight mechanisms are established by the bill, including the Congressional Oversight Panel, the Special Inspector General for TARP (SIGTARP), the Financial Stability Oversight Board, and additional requirements for the Government Accountability Office (GAO) and the Congressional Budget Office (CBO).

The Capital Purchase Program or CPP is an America government preferred stock and equity warrant purchase program conducted by the US Treasury Office of Financial Stability as part of Troubled Asset Relief Program that was launched in 2008. According to the first congressionally mandated oversight report published by GAO, "[TARP's] primary focus was expected to be the purchase of mortgage-backed securities (MBS) and whole loans... [but] within 2 weeks of enactment... the Treasury announced that it would make $250 billion of the $700 billion available to U.S. financial institutions through purchases of preferred stock." This followed a model initiated by the United Kingdom bank rescue package announced on October 8, 2008.

The Capital Assistance Program is a U.S. Treasury program that provides capital injections in exchange for mandatory convertible preferred stock and warrants to bank holding companies.

On March 23, 2009, the United States Federal Deposit Insurance Corporation (FDIC), the Federal Reserve, and the United States Treasury Department announced the Public–Private Investment Program for Legacy Assets. The program is designed to provide liquidity for so-called "toxic assets" on the balance sheets of financial institutions. This program is one of the initiatives coming out of the implementation of the Troubled Asset Relief Program (TARP) as implemented by the U.S. Treasury under Secretary Timothy Geithner. The major stock market indexes in the United States rallied on the day of the announcement rising by over six percent with the shares of bank stocks leading the way. As of early June 2009, the program had not been implemented yet and was considered delayed. Yet, the Legacy Securities Program implemented by the Federal Reserve has begun by fall 2009 and the Legacy Loans Program is being tested by the FDIC. The proposed size of the program has been drastically reduced relative to its proposed size when it was rolled out.

The subprime mortgage crisis reached a critical stage during the first week of September 2008, characterized by severely contracted liquidity in the global credit markets and insolvency threats to investment banks and other institutions.

Indiana State Police Pension Trust v. Chrysler LLC was a lawsuit brought in United States federal court June 2009 by several pension funds against Chrysler LLC and the United States Department of the Treasury, to block the planned sale of Chrysler LLC assets to a "New Chrysler" entity in the Chrysler bankruptcy.

Inside Job is a 2010 American documentary film, directed by Charles Ferguson, about the late-2000s financial crisis. Ferguson, who began researching in 2008, said the film is about "the systemic corruption of the United States by the financial services industry and the consequences of that systemic corruption", amongst them conflicts of interest of academic research, which led to improved disclosure standards by the American Economic Association. In five parts, the film explores how changes in the policy environment and banking practices helped create the financial crisis.

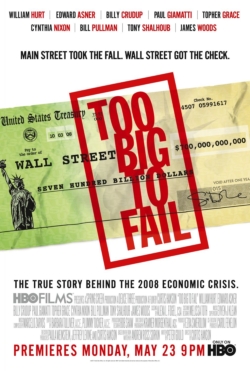

Too Big to Fail is a 2011 American biographical drama television film directed by Curtis Hanson and written by Peter Gould, based on Andrew Ross Sorkin's 2009 non-fiction book Too Big to Fail. The film aired on HBO on May 23, 2011. It received 11 nominations at the 63rd Primetime Emmy Awards; Paul Giamatti's portrayal of Ben Bernanke earned him the Screen Actors Guild Award for Outstanding Performance by a Male Actor in a Miniseries or Television Movie at the 18th Screen Actors Guild Awards.

Philadelphia financier Jay Cooke established the first modern American investment bank during the Civil War era. However, private banks had been providing investment banking functions since the beginning of the 19th century and many of these evolved into investment banks in the post-bellum era. However, the evolution of firms into investment banks did not follow a single trajectory. For example, some currency brokers such as Prime, Ward & King and John E. Thayer and Brother moved from foreign exchange operations to become private banks, taking on some investment bank functions. Other investment banks evolved from mercantile firms such as Thomas Biddle and Co. and Alexander Brothers.

United States policy responses to the late-2000s recession explores legislation, banking industry and market volatility within retirement plans.

References

- 1 2 3 "MediaRoom - Board of Directors| Ally Financial". Media.ally.com. 2013-07-11. Retrieved 2013-08-19.

- ↑ "A top US bailout official to step down - The Boston Globe". Boston.com. 2011-03-22. Retrieved 2013-08-19.

- ↑ "Troubled Asset Relief Program : Four Year Retrospective Report" (PDF). Treasury.gov. Retrieved 2013-08-19.

- ↑ "Treasury Appoints Former Official Mathew Pendo to Ally Financial's Board - WSJ.com". Online.wsj.com. 2013-04-25. Retrieved 2013-08-19.

- ↑ "Matt Pendo". www.oaktreecapital.com. Retrieved 2018-05-22.

- ↑ "Princeton Alumni Weekly". 1984.

{{cite journal}}: Cite journal requires|journal=(help)