Related Research Articles

Proposition 13 is an amendment of the Constitution of California enacted during 1978, by means of the initiative process. The initiative was approved by California voters on June 6, 1978. It was upheld as constitutional by the United States Supreme Court in the case of Nordlinger v. Hahn, 505 U.S. 1 (1992). Proposition 13 is embodied in Article XIII A of the Constitution of the State of California.

An ad valorem tax is a tax whose amount is based on the value of a transaction or of a property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ad valorem tax may also be imposed annually, as in the case of a real or personal property tax, or in connection with another significant event. In some countries, a stamp duty is imposed as an ad valorem tax.

Proposition 2½ is a Massachusetts statute that limits property tax assessments and, secondarily, automobile excise tax levies by Massachusetts municipalities. The name of the initiative refers to the 2.5% ceiling on total property taxes annually as well as the 2.5% limit on property tax increases. It was passed by ballot measure, specifically called an initiative petition within Massachusetts state law for any form of referendum voting, in 1980 and went into effect in 1982. The effort to enact the proposition was led by the anti-tax group Citizens for Limited Taxation. It is similar to other "tax revolt" measures passed around the same time in other parts of the United States. This particular proposition followed the movements of states such as California.

Proposition 218 is an adopted initiative constitutional amendment which revolutionized local and regional government finance and taxation in California. Named the "Right to Vote on Taxes Act," it was sponsored by the Howard Jarvis Taxpayers Association as a constitutional follow-up to the landmark property tax reduction initiative constitutional amendment, Proposition 13, approved in 1978. Proposition 218 was approved and adopted by California voters during the November 5, 1996, statewide general election.

In the United States, a special assessment is a charge that public authorities can assess against real estate parcels for certain public projects. This charge is levied in a specific geographic area known as a special assessment district (SAD). A special assessment may only be levied against parcels of real estate which have been identified as having received a direct and unique "benefit" from the public project.

The Howard Jarvis Taxpayers Association is a California-based nonprofit lobbying and policy organization that advocates for Proposition 13 and Proposition 218. Officially nonpartisan, the organization also advocates against raising taxes in California.

The 2007 Texas Constitutional Amendment Election took place 6 November 2007.

East Garrison planned community is in an unincorporated community in Monterey County, California. It is located on Reservation Road east of Marina and west of the Salinas River on the former Fort Ord. East Garrison is part of Monterey County's Fourth District and, as of January 5, 2021, is represented by Supervisor Wendy Root Askew.

Taxes in California are among the highest in the United States and are imposed by the state and by local governments.

The parcel tax is a form of real estate tax. Unlike most real estate taxes or a land value tax, it is not directly based on property value. It funds K–12 public education and community facilities districts, which are usually known as "Mello-Roos" districts. The California parcel tax, in its typical form as a flat tax, is regressive.

Business improvement districts (BIDs), also known as local improvement districts (LIDs), are special districts within a city that are overseen by a nonprofit entity. In the United States, BIDs are typically funded by an additional tax assessment, with the tax increase going toward improvements of the area. BIDs have been used in nearly 1,000 major cities and small towns throughout the United States, including most major U.S. cities that have multiple BIDs. New York City alone has 76 BIDs.

Municipal elections were held in San Diego in 2016 for mayor, city attorney, city council, and ballot measures. The primary election was held on Tuesday, June 7, 2016, and the general election was held on Tuesday, November 8, 2016. Five of the nine council seats were contested. Two city council incumbents ran for reelection.

Proposition 218 is an adopted initiative constitutional amendment in the state of California that appeared on the November 5, 1996, statewide election ballot. Proposition 218 revolutionized local and regional government finance in California. Called the “Right to Vote on Taxes Act,” Proposition 218 was sponsored by the Howard Jarvis Taxpayers Association as a constitutional follow-up to the landmark Proposition 13 property tax revolt initiative constitutional amendment approved by California voters on June 6, 1978. Proposition 218 was drafted by constitutional attorneys Jonathan Coupal and Jack Cohen.

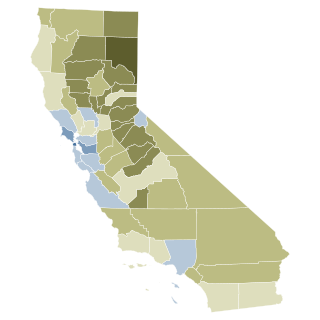

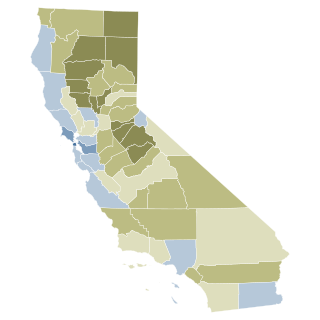

The California state elections in 2020 were held on Tuesday, November 3, 2020. Unlike previous election cycles, the primary elections were held on Super Tuesday, March 3, 2020.

Special districts in Illinois are forms of local government that are responsible for a narrow set of responsibilities, as opposed to counties, townships, and municipal governments which have a wide range of responsibilities. School districts and community college boards are not usually considered special-purpose governments despite their narrow focus on education.

Proposition 13 was a failed California ballot proposition on the March 3, 2020, ballot that would have authorized the issuance of $15 billion in bonds to finance capital improvements for public and charter schools statewide. The proposition would have also raised the borrowing limit for some school districts and eliminated school impact fees for multifamily housing near transit stations.

California Proposition 15 was a failed citizen-initiated proposition on the November 3, 2020, ballot. It would have provided $6.5 billion to $11.5 billion in new funding for public schools, community colleges, and local government services by creating a "split roll" system that increased taxes on large commercial properties by assessing them at market value, without changing property taxes for small business owners or residential properties for homeowners or renters. The measure failed by a small margin of about four percentage points.

California Proposition 19 (2020), also referred to as Assembly Constitutional Amendment No. 11, is an amendment of the Constitution of California that was narrowly approved by voters in the general election on November 3, 2020, with just over 51% of the vote. The legislation increases the property tax burden on owners of inherited property to provide expanded property tax benefits to homeowners ages 55 years and older, disabled homeowners, and victims of natural disasters and fund wildfire response. According to the California Legislative Analyst, Proposition 19 is a large net tax increase "of hundreds of millions of dollars per year."

References

- ↑ "It's Time To Draw The Line" (PDF). California Senate. Archived from the original (PDF) on 2013-02-03.

{{cite journal}}: Cite journal requires|journal=(help) - 1 2 "What is Mello-Roos?" (PDF). mello-roos.com. Archived from the original (PDF) on 2003-04-03. Retrieved 2009-01-04.

- ↑ "Orange County Mello Roos Taxes". Orange County Castles. Retrieved 2010-10-10.

- ↑ (PDF). Internal Revenue Service https://www.irs.gov/pub/irs-wd/12-0018.pdf . Retrieved 2014-11-25.

{{cite web}}: Missing or empty|title=(help) - ↑ "Understanding the Real Estate Tax Deduction". California Franchise Tax Board. Retrieved 2014-11-25.

- ↑ Fulton, William. "How We Pay For Growth". www.planetizen.com. Retrieved 2009-01-04.

- ↑ Prop. 218, § 1.

- ↑ Cal. Const., art. XIII C, § 3.