Related Research Articles

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

The Central Florida Tourism Oversight District (CFTOD), formerly the Reedy Creek Improvement District (RCID), is the governing jurisdiction and special taxing district for the land of Walt Disney World Resort. It includes 39.06 sq mi (101.2 km2) within Orange and Osceola counties in Florida. It acts with most of the same authority and responsibility as a county government. It includes the cities of Bay Lake and Lake Buena Vista, as well as unincorporated land.

The Villages is a census-designated place (CDP) in Sumter and Marion counties in the U.S. state of Florida. It shares its name with a broader master-planned, age-restricted community that spreads into portions of Lake County. The overall development lies in central Florida, approximately 20 miles (32 km) south of Ocala and approximately 45 miles (72 km) northwest of Orlando. As of the 2020 census, the population of the CDP was 79,077.

A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and special districts. In the United States, interest income received by holders of municipal bonds is often, but not always, exempt from federal and state income taxation. Typically, only investors in the highest tax brackets benefit from buying tax-exempt municipal bonds instead of taxable bonds. Taxable equivalent yield calculations are required to make fair comparisons between the two categories.

A homeowner association, or a homeowner community, is a private association-like entity in the United States, Canada, The Philippines and certain other countries often formed either ipso jure in a building with multiple owner-occupancies, or by a real estate developer for the purpose of marketing, managing, and selling homes and lots in a residential subdivision. The developer will typically transfer control of the association to the homeowners after selling a predetermined number of lots.

The Low-Income Housing Tax Credit (LIHTC) is a federal program in the United States that awards tax credits to housing developers in exchange for agreeing to reserve a certain fraction of rent-restricted units for lower-income households. The program was created under the Tax Reform Act of 1986 (TRA86) to incentivize the use of private equity in developing affordable housing. Projects developed with LIHTC credits must maintain a certain percentage of affordable units for a set period of time, typically 30 years, though there is a "qualified contract" process that can allow property owners to opt out after 15 years. The maximum rent that can be charged for designated affordable units is based on Area Median Income (AMI); over 50% of residents in LIHTC properties are considered Extremely Low-Income. Less than 10% of current credit expenditures are claimed by individual investors.

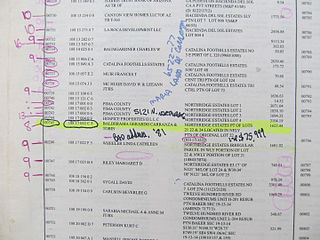

A tax lien is a lien which is imposed upon a property by law in order to secure the payment of taxes. A tax lien may be imposed for the purpose of collecting delinquent taxes which are owed on real property or personal property, or it may be imposed as a result of a failure to pay income taxes or it may be imposed as a result of a failure to pay other taxes.

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios.

Tax increment financing (TIF) is a public financing method that is used as a subsidy for redevelopment, infrastructure, and other community-improvement projects in many countries, including the United States. The original intent of a TIF program is to stimulate private investment in a blighted area that has been designated to be in need of economic revitalization. Similar or related value capture strategies are used around the world.

A revenue bond is a special type of municipal bond distinguished by its guarantee of repayment solely from revenues generated by a specified revenue-generating entity associated with the purpose of the bonds, rather than from a tax. Unlike general obligation bonds, only the revenues specified in the legal contract between the bond holder and bond issuer are required to be used for repayment of the principal and interest of the bonds; other revenues and the general credit of the issuing agency are not so encumbered. Because the pledge of security is not as great as that of general obligation bonds, revenue bonds may carry a slightly higher interest rate than G.O. bonds; however, they are usually considered the second-most secure type of municipal bonds.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An Alternative Minimum Tax (AMT) applies at the federal and some state levels.

SouthWood is a planned community located in Tallahassee, Florida. The community is located on the southeast side of Tallahassee. In the community is located the State of Florida Capital Circle Office Complex, Florida State University School, and John Paul II Catholic High School.

Community Facilities Districts (CFDs), more commonly known as Mello-Roos, are special districts established by local governments in California as a means of obtaining additional public funding. Counties, cities, special districts, joint powers authority, and school districts in California use these financing districts to pay for public works and some public services.

The 2007 Texas constitutional amendment election took place 6 November 2007.

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act.

The November 2004 San Francisco general elections were held on November 2, 2004, in San Francisco, California. The elections included seven seats to the San Francisco Board of Supervisors, four seats to the San Francisco Community College Board, four seats to the San Francisco Board of Education, and fourteen San Francisco ballot measures.

Non-profit housing developers build affordable housing for individuals under-served by the private market. The non-profit housing sector is composed of community development corporations (CDC) and national and regional non-profit housing organizations whose mission is to provide for the needy, the elderly, working households, and others that the private housing market does not adequately serve. Of the total 4.6 million units in the social housing sector, non-profit developers have produced approximately 1.547 million units, or roughly one-third of the total stock. Since non-profit developers seldom have the financial resources or access to capital that for-profit entities do, they often use multiple layers of financing, usually from a variety of sources for both development and operation of these affordable housing units.

The Government of Los Angeles County is defined and authorized under the California Constitution, California law, and the Charter of the County of Los Angeles. Much of the Government of California is in practice the responsibility of county governments, such as the Government of Los Angeles County. The County government provides countywide services such as elections and voter registration, law enforcement, jails, vital records, property records, tax collection, public health, health care, and social services. In addition the County serves as the local government for all unincorporated areas.

The administrative divisions of Ohio are counties, municipalities, townships, special districts, and school districts.

Special districts in Illinois are forms of local government that are responsible for a narrow set of responsibilities, as opposed to counties, townships, and municipal governments which have a wide range of responsibilities. School districts and community college boards are not usually considered special-purpose governments despite their narrow focus on education.

References

- 1 2 3 "Chapter 190 Community Development Districts". State of Florida. Retrieved 5 June 2012.

- 1 2 3 4 "Understanding a CDD". Florida Home Realty Professionals. Retrieved 7 June 2012.

- ↑ Lehmann, Richard. "Florida CDD Report Overview". Income Securities Advisors. Archived from the original on 20 August 2012. Retrieved 6 June 2012.

- 1 2 3 Bergemann, Jan. "Taxation without Representation?". Cyber Citizens for Justice Foundation. Retrieved 8 June 2012.

- ↑ "190.012 Special powers; public improvements and community facilities". State if Florida Senate Archives. Retrieved 8 June 2012.

- ↑ Richie, Lauren (May 31, 2009). "'What ifs' for The Villages in IRS fight". Orlando Sentinel. Retrieved 10 June 2012.