Sequoia Capital Operations, LLC is an American venture capital firm headquartered in Menlo Park, California which specializes in seed stage, early stage, and growth stage investments in private companies across technology sectors. As of 2022, the firm had approximately US$85 billion in assets under management.

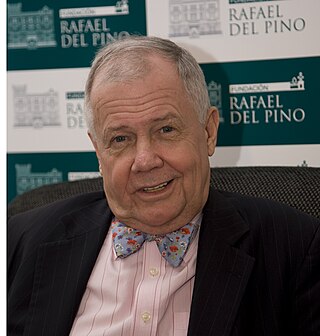

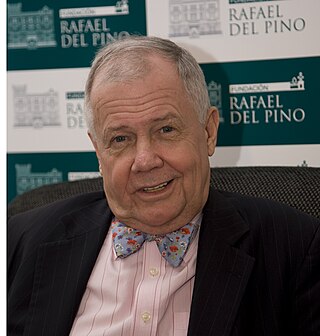

James Beeland Rogers Jr. is an American investor and financial commentator based in Singapore. He is the chairman of Beeland Interests, Inc. He was the co-founder of the Quantum Fund and Soros Fund Management. He was also the creator of the Rogers International Commodities Index (RICI).

Masayoshi Son is a Japanese billionaire technology entrepreneur, investor and philanthropist. A third-generation Zainichi Korean, he naturalized as a Japanese citizen in 1990. He is the founder, representative director, corporate officer, chairman and CEO of SoftBank Group Corp. (SBG), a technology-focused investment holding company, as well as chairman of UK-based Arm Holdings.

James Joseph Cramer is an American television personality, author, entertainer, and former hedge fund manager. He is the host of Mad Money on CNBC, and an anchor on Squawk on the Street. After graduating from Harvard College and Harvard Law School, he worked for Goldman Sachs and then became a hedge fund manager, founder, and senior partner of Cramer Berkowitz. He co-founded TheStreet, which he wrote for from 1996 to 2021. Cramer hosted Kudlow & Cramer from 2002 to 2005. Mad Money with Jim Cramer first aired on CNBC in 2005. Cramer has written several books, including Confessions of a Street Addict (2002), Jim Cramer's Real Money: Sane Investing in an Insane World (2005), Jim Cramer's Mad Money: Watch TV, Get Rich (2006), and Jim Cramer's Get Rich Carefully (2013).

BlackRock, Inc. is an American multinational investment company. Founded in 1988, initially as an enterprise risk management and fixed income institutional asset manager, BlackRock is the world's largest asset manager, with US$11.5 trillion in assets under management as of December 31, 2023. Headquartered in New York City, BlackRock has 70 offices in 30 countries, and clients in 100 countries.

Citadel LLC is an American multinational hedge fund and financial services company. Founded in 1990 by Ken Griffin, it has more than $63 billion in assets under management as of June 2024. The company has over 2,800 employees, with corporate headquarters in Miami, Florida, and offices throughout North America, Asia, and Europe. Founder, CEO and Co-CIO Griffin owns approximately 85% of the firm. As of December 2022, Citadel is one of the most profitable hedge funds in the world, posting $74 billion in net gains since its inception in 1990, making it the most successful hedge fund in history, according to CNBC.

Raymond Thomas Dalio is an American investor and hedge fund manager, who has served as co-chief investment officer of the world's largest hedge fund, Bridgewater Associates, since 1985. He founded Bridgewater in 1975 in New York.

Denise Kay Shull is a performance coach who uses neuroeconomics and modern psychoanalysis in her work with hedge funds and professional athletes. She is also the founder of The ReThink Group. Shull focuses on the positive contribution of feelings and emotion in high-pressure decisions. She is the author of Market Mind Games which explains how Wall Street traders act out Freudian transferences in reaction to market moves. Shull postulates that human perception contains fractal elements in the same manner as the fractal geometry of nature.

Michael W. Covel is an American author, entrepreneur, and film director. In 1996, he co-founded TurtleTrader.com, later expanded into TrendFollowing.com, a popular online resource focused on investment style known as trend following, which allows investors to profit in both up and down markets.

Michael James Burry is an American investor and hedge fund manager. He founded the hedge fund Scion Capital, which he ran from 2000 until 2008 before closing it to focus on his personal investments. He is best known for being among the first investors to predict and profit from the subprime mortgage crisis that occurred between 2007 and 2010.

John J. Murphy is an American financial market analyst, and is considered a proponent of inter-market technical analysis, a field pioneered by Michael E.S. Gayed in his 1990 book. He later revised and broadened this book into Technical Analysis of the Financial Markets.

Pershing Square Capital Management is an American hedge fund management company founded and run by Bill Ackman, headquartered in New York City.

Barry Ritholtz is an American author, newspaper columnist, blogger, equities analyst, founder and CIO of Ritholtz Wealth Management, and guest commentator on Bloomberg Television. Ritholtz is the host of the Bloomberg Podcast Masters in Business in which he interviews influential figures on markets, investing and business. He is also a former contributor to CNBC and TheStreet.com.

Robinhood Markets, Inc. is an American financial services company headquartered in Menlo Park, California. The company provides an electronic trading platform accessible via mobile app that facilitates commission-free trades of stocks, exchange-traded funds and cryptocurrency, as well as cryptocurrency wallets, credit cards and other banking services. The company's revenue comes from transaction-based revenues, net interest income, and subscription fees. The company has 24.3 million funded customers, 11.0 million monthly active users, and $152 billion in assets under custody.

Joshua Morgan Brown is an American author, columnist, blogger, commentator on CNBC, and CEO of New York City-based Ritholtz Wealth Management, an independent investment advisory firm he founded with Barry Ritholtz. He is also a contributing columnist to Yahoo! Finance, Business Insider, and serves on the board of advisors for Brightscope and Upside. "Downtown" Josh Brown was ranked the No. 1 financial Twitter follow by The Wall Street Journal in 2013. Brown also co-hosts a weekly podcast with Michael Batnick entitled The Compound & Friends.

TipRanks is a financial technology company that uses artificial intelligence to analyze financial big data to provide stock market research tools for retail investors. The TipRanks Financial Accountability Engine scans and analyzes financial websites, corporate filings submitted to the SEC, and analyst ratings, to rank financial experts in real time.

Salient Partners was a private equity firm based in Houston, Texas, with offices in New York City, San Francisco and Newport Beach. The firm's strategies included emerging markets, real estate investment trusts (REITs), master limited partnership (MLPs) investments, managed futures, risk parity funds, and liquid alternative investments. The firm was acquired by Westwood Holdings Group in 2022.

The expression "everything bubble" refers to the correlated impact of monetary easing by the Federal Reserve on asset prices in most asset classes, namely equities, housing, bonds, many commodities, and even exotic assets such as cryptocurrencies and SPACs. The policy itself and the techniques of direct and indirect methods of quantitative easing used to execute it are sometimes referred to as the Fed put. Modern monetary theory advocates the use of such tools, even in non-crisis periods, to create economic growth through asset price inflation. The term "everything bubble" first came in use during the chair of Janet Yellen, but it is most associated with the subsequent chair of Jerome Powell, and the 2020–2021 period of the coronavirus pandemic.

ARK Investment Management LLC is an American investment management firm based in St. Petersburg, Florida, that manages several actively managed exchange-traded funds (ETFs). It was founded by Cathie Wood in 2014. At the height of February 2021, the company had US$50 billion in assets under management. As of October 2023, assets had dropped to $6.71 billion, after a period of poor performance.

Nathan E. "Ned" Davis, is an American financial analyst, finance author, and co-founder of the Ned Davis Research Group (NDRG), a data-driven investment research company based in Venice, Florida.