Microcredit is the extension of very small loans (microloans) to impoverished borrowers who typically lack collateral, steady employment, or a verifiable credit history. It is designed to support entrepreneurship and alleviate poverty. Many recipients are illiterate, and therefore unable to complete paperwork required to get conventional loans. As of 2009 an estimated 74 million people held microloans that totaled US$38 billion. Grameen Bank reports that repayment success rates are between 95 and 98 percent.

Microfinance is a category of financial services targeting individuals and small businesses who lack access to conventional banking and related services. Microfinance includes microcredit, the provision of small loans to poor clients; savings and checking accounts; microinsurance; and payment systems, among other services. Microfinance services are designed to reach excluded customers, usually poorer population segments, possibly socially marginalized, or geographically more isolated, and to help them become self-sufficient. ID Ghana is an example of a microfinance institution.

Grameen Bank is a microfinance organization and community development bank founded in Bangladesh. It makes small loans to the impoverished without requiring collateral.

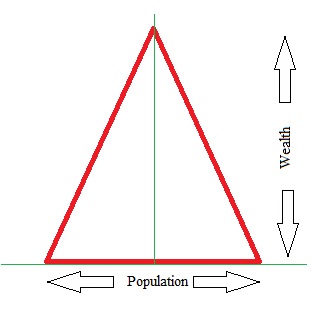

The bottom of the pyramid, bottom of the wealth pyramid, bottom of the income pyramid or the base of the pyramid is the largest, but poorest socio-economic group. In global terms, this is the 2.7 billion people who live on less than $2.50 a day.

Social entrepreneurship is an approach by individuals, groups, start-up companies or entrepreneurs, in which they develop, fund and implement solutions to social, cultural, or environmental issues. This concept may be applied to a wide range of organizations, which vary in size, aims, and beliefs. For-profit entrepreneurs typically measure performance using business metrics like profit, revenues and increases in stock prices. Social entrepreneurs, however, are either non-profits, or they blend for-profit goals with generating a positive "return to society". Therefore, they use different metrics. Social entrepreneurship typically attempts to further broad social, cultural and environmental goals often associated with the voluntary sector in areas such as poverty alleviation, health care and community development.

A micro-enterprise is generally defined as a small business employing nine people or fewer, and having a balance sheet or turnover less than a certain amount. The terms microenterprise and microbusiness have the same meaning, though traditionally when referring to a small business financed by microcredit the term microenterprise is often used. Similarly, when referring to a small, usually legal business that is not financed by microcredit, the term microbusiness is often used. Internationally, most microenterprises are family businesses employing one or two persons. Most microenterprise owners are primarily interested in earning a living to support themselves and their families. They only grow the business when something in their lives changes and they need to generate a larger income. According to information found on the Census.gov website, microenterprises make up 95% of the 28 million US companies tracked by the census.

Opportunity International is a 501(c)(3) nonprofit organization chartered in the United States. Through a network of 47 program and support partners, Opportunity International provides small business loans, savings, insurance and training to more than 14 million people in the developing world. It has clients in more than 20 countries and works with fundraising partners in the United States, Australia, Canada, Germany, Switzerland, Singapore, Hong Kong and the United Kingdom. Opportunity International has 501(c)(3) status as a tax-exempt charitable organization in the United States under the US Internal Revenue Code.

Acumen is a nonprofit impact investment fund based in the U.S. that focuses on investing in social enterprises that serve low-income individuals. Acumen was founded in April 2001 by Jacqueline Novogratz. It aims to demonstrate that small amounts of philanthropic capital, combined with business acumen, can result in thriving enterprises that serve vast numbers of the poor. Over the years, Acumen has invested $115 million in 113 companies and has had a successful track record in sourcing and executing investment opportunities in the clean energy, health care and agriculture sectors.

Freedom from Hunger is an international development organization working in nineteen countries. Freedom from Hunger focuses on providing small loans and business education to poor women. It is a nonprofit organization classified by the IRS as a 501(c)(3) charity. It was evaluated in 2011 by GiveWell, who found their programs had little to no lasting impact.

Kiva Microfunds is a 501(c)(3) non-profit organization headquartered in San Francisco, California. Kiva's mission is "to expand financial access to help underserved communities thrive."

LAPO is a Nigerian organisation with a microfinance bank dedicated to self-employment through microfinance and an NGO, a non-governmental, non-profit community development organization focused on the empowerment of the poor and the vulnerable.

The Grameen family of organizations has grown beyond Grameen Bank into a multi-faceted group of both commercial and non-profit ventures. It was first established by Muhammad Yunus, the Nobel Peace Prize-winning founder of Grameen Bank. Most of the organizations in the Grameen group have central offices at the Grameen Bank Complex in Mirpur, Dhaka, Bangladesh. The Grameen Bank started to diversify in the late 1980s when it began attending to unutilized or underutilized fishing ponds, as well as irrigation pumps like deep tubewells. In 1989, these diversified interests started growing into separate organizations, as the fisheries project became Grameen Fisheries Foundation and the irrigation project became Grameen Krishi Foundation.

The MicroConsignment Model (MCM) establishes profitable income generating opportunities for primarily women that to date are selling products such as wood-burning stoves, reading glasses, water filters, seeds and gardening techniques and energy efficient lightbulbs to villagers. Through the MCM local individuals with entrepreneurial qualities can start their own business through “sweat equity” and realize profits from inception. Although it rarely works in practice, the model allows for collaboration with local strategic partner organizations to adapt local solutions and train and support local entrepreneurs who serve rural communities within designated territories. What drives the model is an interdisciplinary, intuitive and non-linear approach whereby all stakeholders add value. The model utilizes a rotating capital mechanism with low start-up costs that are continually reinvested. In essence, the MCM strives to intervene at all levels by creating an “ecosystem” whereby problems are diagnosed and products are encountered/designed which are then inserted into the distribution model via the locally trained and supported entrepreneurs.

Jason Fairbourne is a United States business consultant and educator. He is the founder of the Fairbourne Consulting Group, and is a Peery Fellow at the Ballard Center for Economic Self-Reliance at Brigham Young University’s Marriott School of Management. He is an advocate for microfranchising, defined as the systematization and replication of microenterprises in developing markets.

Warner P. Woodworth is a global social entrepreneur and professor emeritus in the Department of Management in the Marriott School of Business at Brigham Young University (BYU). He is a leading advocate of development of microcredit and has been involved in researching as well as developing such programs.

The impact of microcredit is a subject of much controversy. Proponents state that it reduces poverty through higher employment and higher incomes. This is expected to lead to improved nutrition and improved education of the borrowers' children. Some argue that microcredit empowers women. In the US and Canada, it is argued that microcredit helps recipients to graduate from welfare programs. Critics say that microcredit has not increased incomes, but has driven poor households into a debt trap, in some cases even leading to suicide. They add that the money from loans is often used for durable consumer goods or consumption instead of being used for productive investments, that it fails to empower women, and that it has not improved health or education.

The Uganda National Entrepreneurship Development Institute (UNEDI) is a privately owned national resource development institution in Uganda whose focus area is entrepreneurship education, training and research. The institute provides training techniques, faculty support, consultancy, research as well as teaching and development of entrepreneurship training materials.

Kashf Foundation is a non-profit organization, founded by Roshaneh Zafar in 1996. Kashf is regarded as the first microfinance institution (MFI) of Pakistan that uses village banking methodology in microcredit to alleviate poverty by providing affordable financial and non-financial services to low income households - particularly for women, to build their capacity and enhance their economic role. With headquarters in Lahore, Punjab, Kashf has regional offices in five major cities and over 200 branches across the Pakistan.

Social entrepreneurship in South Asia involves business activities that have a social benefit, often for people at the bottom of the pyramid. It is an emerging area of entrepreneurship that is supported by both the public sector and the private sector.