The economy of Alberta is the sum of all economic activity in Alberta, Canada's fourth largest province by population. Alberta's GDP in 2018 was CDN$338.2 billion.

Oil sands, tar sands, crude bitumen, or bituminous sands, are a type of unconventional petroleum deposit. Oil sands are either loose sands or partially consolidated sandstone containing a naturally occurring mixture of sand, clay, and water, soaked with bitumen, a dense and extremely viscous form of petroleum.

The Athabasca oil sands, also known as the Athabasca tar sands, are large deposits of bitumen, a heavy and viscous form of petroleum, in northeastern Alberta, Canada. These reserves are one of the largest sources of unconventional oil in the world, making Canada a significant player in the global energy market.

The National Energy Program was an energy policy of the Canadian federal government from 1980 to 1985. The economically nationalist policy sought to secure Canadian energy independence, though was strongly opposed by the private sector and the oil-producing Western Canadian provinces, most notably Alberta.

Petroleum production in Canada is a major industry which is important to the overall economy of North America. Canada has the third largest oil reserves in the world and is the world's fourth largest oil producer and fourth largest oil exporter. In 2019 it produced an average of 750,000 cubic metres per day (4.7 Mbbl/d) of crude oil and equivalent. Of that amount, 64% was upgraded from unconventional oil sands, and the remainder light crude oil, heavy crude oil and natural-gas condensate. Most of the Canadian petroleum production is exported, approximately 600,000 cubic metres per day (3.8 Mbbl/d) in 2019, with 98% of the exports going to the United States. Canada is by far the largest single source of oil imports to the United States, providing 43% of US crude oil imports in 2015.

The 2008 Alberta general election was held on March 3, 2008, to elect members of the Legislative Assembly of Alberta.

Connacher Oil and Gas Limited is a Calgary-based exploration, development and production company active in the production and sale of bitumen in the Athabasca oil sands region. Connacher's shares used to trade on the Toronto Stock Exchange, but it was de-listed in 2016, after filing for insolvency.

Dilbit is a bitumen diluted with one or more lighter petroleum products, typically natural-gas condensates such as naphtha. Diluting bitumen makes it much easier to transport, for example in pipelines. Per the Alberta Oil Sands Bitumen Valuation Methodology, "Dilbit Blends" means "Blends made from heavy crudes and/or bitumens and a diluent, usually natural-gas condensate, for the purpose of meeting pipeline viscosity and density specifications, where the density of the diluent included in the blend is less than 800 kg/m3." If the diluent density is greater than or equal to 800 kg/m3, the diluent is typically synthetic crude and accordingly the blend is called synbit.

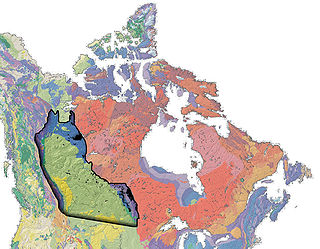

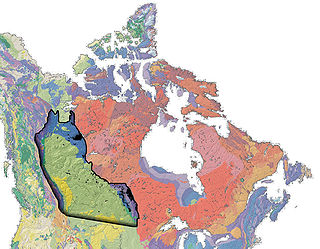

The Western Canadian Sedimentary Basin (WCSB) underlies 1.4 million square kilometres (540,000 sq mi) of Western Canada including southwestern Manitoba, southern Saskatchewan, Alberta, northeastern British Columbia and the southwest corner of the Northwest Territories. This vast sedimentary basin consists of a massive wedge of sedimentary rock extending from the Rocky Mountains in the west to the Canadian Shield in the east. This wedge is about 6 kilometres (3.7 mi) thick under the Rocky Mountains, but thins to zero at its eastern margins. The WCSB contains one of the world's largest reserves of petroleum and natural gas and supplies much of the North American market, producing more than 450 million cubic metres per day of gas in 2000. It also has huge reserves of coal. Of the provinces and territories within the WCSB, Alberta has most of the oil and gas reserves and almost all of the oil sands.

Canada's oil sands and heavy oil resources are among the world's great petroleum deposits. They include the vast oil sands of northern Alberta, and the heavy oil reservoirs that surround the small city of Lloydminster, which sits on the border between Alberta and Saskatchewan. The extent of these resources is well known, but better technologies to produce oil from them are still being developed.

Canada has access to all main sources of energy including oil and gas, coal, hydropower, biomass, solar, geothermal, wind, marine and nuclear. It is the world's second largest producer of uranium, third largest producer of hydro-electricity, fourth largest natural gas producer, and the fifth largest producer of crude oil. In 2006, only Russia, the People's Republic of China, the United States and Saudi Arabia produce more total energy than Canada.

The Alberta Heritage Savings Trust Fund(HSTF) is a sovereign wealth fund established in 1976 by the Government of Alberta under then-Premier Peter Lougheed. The Heritage Savings Trust Fund was created with three objectives: "to save for the future, to strengthen or diversify the economy, and to improve the quality of life of Albertans." The operations of the Heritage Savings Trust Fund are subject to the Alberta Heritage Savings Trust Fund Act and with the goal of providing "prudent stewardship of the savings from Alberta's non-renewable resources by providing the greatest financial returns on those savings for current and future generations of Albertans." Between 1976 and 1983 the Government of Alberta deposited a portion of oil revenue into the fund. The Heritage Savings Trust Fund used oil revenues to invest for the long term in such areas as health care, education and research and as a way of ensuring that the development of non-renewable resources would be of long-term benefit to Alberta. The strategy and goals of the fund have changed through successive provincial governments which moved away from direct investments in Alberta to a diversified approach, which now includes stocks, bonds, real estate and other ventures.

The 2007 Alberta Royalty Review was an independent panel, chaired by William M. Hunter, established by the government of Alberta to review the level of resource royalties collected by the provincial government from petroleum and natural gas companies.

The Shell Scotford Upgrader is an oilsand upgrader, a facility which processes crude bitumen from oil sands into a wide range of synthetic crude oils. The upgrader is owned by Athabasca Oil Sands Project (AOSP), a joint venture of Shell Canada Energy (60%), Marathon Oil Sands L.P. (20%) and Chevron Canada Limited (20%). The facility is located in the industrial development of Scotford, just to the northeast of Fort Saskatchewan, Alberta in the Edmonton Capital Region.

Obsidian Energy Ltd. is a mid-sized Canadian oil and natural gas production company based in Calgary, Alberta.

Oil reserves in Canada were estimated at 172 billion barrels as of the start of 2015 . This figure includes the oil sands reserves that are estimated by government regulators to be economically producible at current prices using current technology. According to this figure, Canada's reserves are third only to Venezuela and Saudi Arabia. Over 95% of these reserves are in the oil sands deposits in the province of Alberta. Alberta contains nearly all of Canada's oil sands and much of its conventional oil reserves. The balance is concentrated in several other provinces and territories. Saskatchewan and offshore areas of Newfoundland in particular have substantial oil production and reserves. Alberta has 39% of Canada's remaining conventional oil reserves, offshore Newfoundland 28% and Saskatchewan 27%, but if oil sands are included, Alberta's share is over 98%.

Although there are numerous oil companies operating in Canada, as of 2009, the majority of production, refining and marketing was done by fewer than 20 of them. According to the 2013 edition of Forbes Global 2000, canoils.com and any other list that emphasizes market capitalization and revenue when sizing up companies, as of March 31, 2014 these are the largest Canada-based oil and gas companies.

Western Canadian Select (WCS) is a heavy sour blend of crude oil that is one of North America's largest heavy crude oil streams and, historically, its cheapest. It was established in December 2004 as a new heavy oil stream by EnCana, Canadian Natural Resources, Petro-Canada and Talisman Energy. It is composed mostly of bitumen blended with sweet synthetic and condensate diluents and 21 existing streams of both conventional and unconventional Alberta heavy crude oils at the large Husky Midstream General Partnership terminal in Hardisty, Alberta. Western Canadian Select—the benchmark for heavy, acidic crudes—is one of many petroleum products from the Western Canadian Sedimentary Basin oil sands. Calgary-based Husky Energy, now a subsidiary of Cenovus, had joined the initial four founders in 2015.

The Canadian province of Alberta faces a number of environmental issues related to natural resource extraction—including oil and gas industry with its oil sands—endangered species, melting glaciers in banff, floods and droughts, wildfires, and global climate change. While the oil and gas industries generates substantial economic wealth, the Athabasca oil sands, which are situated almost entirely in Alberta, are the "fourth most carbon intensive on the planet behind Algeria, Venezuela and Cameroon" according to an August 8, 2018 article in the American Association for the Advancement of Science's journal Science. This article details some of the environmental issues including past ecological disasters in Alberta and describes some of the efforts at the municipal, provincial and federal level to mitigate the risks and impacts.

The Sturgeon Refinery also NWR Sturgeon Refinery is an 80,000 bbl/d (13,000 m3/d) crude oil upgrader—built and operated by North West Redwater Partnership (NWRP) in a public-private partnership with the Alberta provincial government. It is located in Sturgeon County northeast of Edmonton, Alberta, in Alberta's Industrial Heartland. Premier Jason Kenney announced on July 6, 2021, that the province of Alberta had acquired NWRP's equity stake, representing 50% of the $10-billion project, with the other 50% owned by Canadian Natural Resources.