The Goldman Sachs Group, Inc. is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many international financial centers. Goldman Sachs is the second-largest investment bank in the world by revenue and is ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue. In the Forbes Global 2000 of 2024, Goldman Sachs ranked 23rd. It is considered a systemically important financial institution by the Financial Stability Board.

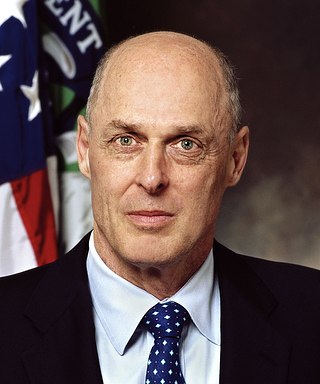

Henry "Hank" Merritt Paulson Jr. is an American investment banker and financier who served as the 74th United States Secretary of the Treasury from 2006 to 2009. Prior to his role in the Department of the Treasury, Paulson was the chairman and chief executive officer (CEO) of major investment bank Goldman Sachs.

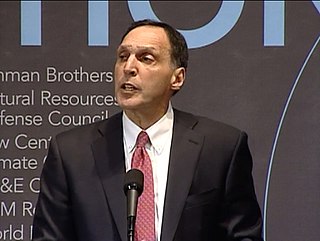

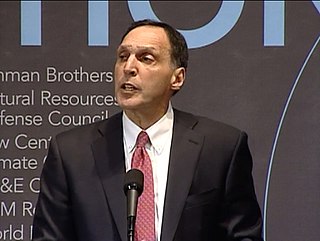

Richard Severin Fuld Jr. is an American banker best known as the final chairman and chief executive officer of investment bank Lehman Brothers. Fuld held this position from April 1, 1994 after the firm's spinoff from American Express until September 15, 2008. Lehman Brothers filed for bankruptcy protection under Chapter 11 on September 15, 2008, and subsequently announced the sale of major operations to parties including Barclays Bank and Nomura Securities.

Lloyd Craig Blankfein is an American investment banker who has served as senior chairman of Goldman Sachs since 2019, and chairman and chief executive officer (CEO) from 2006 until the end of 2018. Before leading Goldman Sachs as CEO, he was the company's president and chief operating officer (COO) from 2004 to 2006, serving under then-CEO Henry Paulson.

Alan David Schwartz is an American businessman and is the executive chairman of Guggenheim Partners, an investment banking firm based in Chicago and New York City. He was previously the last president and chief executive officer of Bear Stearns when the Federal Reserve Bank of New York forced its March 2008 acquisition by JPMorgan Chase & Co.

William David Cohan is an American business writer.

John Francis William Rogers is an American businessman, serving as executive vice president, chief of staff, and secretary to the board of Goldman Sachs.

Terence James O'Neill, Baron O'Neill of Gatley is a British economist best known for coining BRIC, the acronym that stands for Brazil, Russia, India, and China—the four once-rapidly developing countries that he predicted would challenge the global economic power of the developed G7 economies. He is also a former chairman of Goldman Sachs Asset Management and former Conservative government minister.

House of Cards: A Tale of Hubris and Wretched Excess on Wall Street is the second book written by William D. Cohan. It was released on March 10, 2009 by Doubleday.

Paulson & Co., Inc. is a family office based in New York City. Previously, it was a hedge fund established by John Paulson in 1994. Specializing in "global mergers, event arbitrage, and credit strategies", the firm had a relatively low profile on Wall Street until its hugely successful bet against the subprime mortgage market in 2007. At one time the company had offices in London and Dublin.

James Mark Pittman was a financial journalist covering corporate finance and derivative markets. He was awarded several prestigious journalism awards, the Gerald Loeb Award, the George Polk Award, a New York Press Club award, the Hillman Prize and several New York Associated Press awards.

Financial Times Business Book of the Year Award is an annual award given to the best business book of the year as determined by the Financial Times. It aims to find the book that has "the most compelling and enjoyable insight into modern business issues". The award was established in 2005 and is worth £30,000. Beginning in 2010, five short-listed authors each receive £10,000, previously it was £5,000.

Griftopia: Bubble Machines, Vampire Squids, and the Long Con That Is Breaking America is a 2010 book by American political journalist Matt Taibbi about the events that led to the 2007–2008 financial crisis.

Steven George Mandis is an American investor and the founder of Kalamata Capital. He is an adjunct associate professor in finance and economics at Columbia University Business School. Previously, he worked at Goldman Sachs and Citigroup and as a senior advisor to McKinsey. He is the author of three books: What Happened to Goldman Sachs: An Insider's Story of Organizational Drift and its Unintended Consequences, The Real Madrid Way: How Values Created the Most Successful Sports Team on the Planet, and What Happened to Serie A: The Rise, Fall and Signs of Revival.

The 2007–2008 financial crisis, or the global financial crisis (GFC), was the most severe worldwide economic crisis since the 1929 Wall Street crash that began the Great Depression. Causes of the crisis included predatory lending in the form of subprime mortgages to low-income homebuyers and a resulting housing bubble, excessive risk-taking by global financial institutions, and lack of regulatory oversight, which culminated in a "perfect storm" that triggered the Great Recession, which lasted from late 2007 to mid-2009. The financial crisis began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, as well as a vast web of derivatives linked to those MBS, collapsed in value. Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers on September 15, 2008, and a subsequent international banking crisis.

Walter Edward Sachs was an American banker and financier.

The Last Tycoons: The Secret History of Lazard Frères & Co. is the debut book by William D. Cohan. It was released on April 3, 2007 by Doubleday. It focuses on the history of the prominent investment bank Lazard Frères. The book won the 2007 Financial Times and Goldman Sachs Business Book of the Year Award.

The Price of Silence: The Duke Lacrosse Scandal, the Power of the Elite, and the Corruption of Our Great Universities is a nonfiction book about the Duke lacrosse case by William D. Cohan. It was published on April 8, 2014, by Scribner.

Goldman Sachs, an investment bank, has been the subject of controversies. The company has been criticized for lack of ethical standards, working with dictatorial regimes, close relationships with the U.S. federal government via a "revolving door" of former employees, and driving up prices of commodities through futures speculation. It has also been criticized by its employees for 100-hour work weeks, high levels of employee dissatisfaction among first-year analysts, abusive treatment by superiors, a lack of mental health resources, and extremely high levels of stress in the workplace leading to physical discomfort.

Josh Birnbaum is an American businessman. He is the co-founder and Chief Investment Officer of Tilden Park Capital Management and a former managing director at Goldman Sachs.