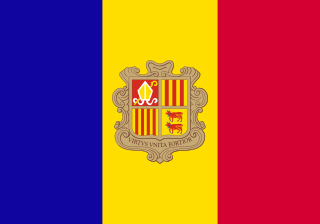

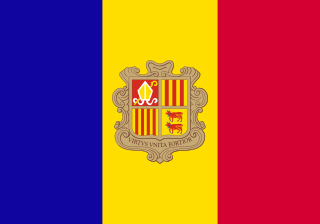

Andorra, officially the Principality of Andorra, is a sovereign landlocked country on the Iberian Peninsula, in the eastern Pyrenees, bordered by France to the north and Spain to the south. Believed to have been created by Charlemagne, Andorra was ruled by the count of Urgell until 988, when it was transferred to the Roman Catholic Diocese of Urgell. The present principality was formed by a charter in 1278. It is currently headed by two co-princes: the bishop of Urgell in Catalonia, Spain and the president of France. Its capital and largest city is Andorra la Vella.

Raiffeisen Bank is a universal bank on the Romanian market, providing a complete range of products and services to private individuals, SMEs and large corporations via multiple distribution channels: banking outlets, ATM and EPOS networks,phone-banking and mobile-banking (myBanking).

Bank One Corporation was an American bank founded in 1968 and at its peak the sixth-largest bank in the United States. It traded on the New York Stock Exchange under the stock symbol ONE. The company merged with JPMorgan Chase & Co. on July 1, 2004, with its CEO Jamie Dimon taking the lead at the combined company. The company had its headquarters in the Bank One Plaza in the Chicago Loop in Chicago, Illinois, now the headquarters of Chase's retail banking division.

Banco de Sabadell, S.A. is a Spanish multinational financial services company headquartered in Alicante and Barcelona, Spain. It is the 4th-largest Spanish banking group. It includes several banks, brands, subsidiaries and associated banks. It is a universal bank and specialises in serving small and medium enterprises (SMEs) and the affluent with a bias towards international trade.

Deposit insurance or deposit protection is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance systems are one component of a financial system safety net that promotes financial stability.

The net international investment position (NIIP) is the difference in the external financial assets and liabilities of a country. External debt of a country includes government debt and private debt. External assets publicly and privately held by a country's legal residents are also taken into account when calculating NIIP. Commodities and currencies tend to follow a cyclical pattern of significant valuation changes, which is also reflected in NIIP.

Futbol Club Andorra is a professional football club based in Andorra la Vella, Andorra, that currently competes in Segunda División, the second tier of the Spanish league system. The club was founded in 1942 and currently plays its home fixtures at Estadi Nacional. In spite of being based in the microstate of Andorra, the club, voluntarily affiliated to the Catalan Football Federation, has been allowed to compete in Spanish leagues since 1948.

UniCredit Bank is a Romanian bank and member of UniCredit Group. It has a network of 8,500 branches in 17 European countries, and a presence in another 50 international markets.

The Philippine Deposit Insurance Corporation is a Philippine government-run deposit insurance fund. It was established on June 22, 1963, by Republic Act 3591. It guarantees deposits up to ₱500,000. The primary function of PDIC is to protect small investors/depositors and build strong confidence in banking. PDIC receives guidance from the International Association of Deposit Insurers.

Canadian public debt, or general government debt, is the liabilities of the government sector. Government gross debt consists of liabilities that are a financial claim that requires payment of interest and/or principal in future. They consist mainly of Treasury bonds, but also include public service employee pension liabilities. Changes in debt arise primarily from new borrowing, due to government expenditures exceeding revenues.

Crédit Agricole Italia S.p.A., formerly Crédit Agricole Cariparma S.p.A., is an Italian banking group, a subsidiary of French banking group Crédit Agricole. Crédit Agricole Italia was ranked as the 11th largest bank in Italy by total assets at 31 December 2015. The group serving Emilia-Romagna, Liguria and Friuli Venezia Giulia, where the predecessors originated, as well as Campania, Lazio, Lombardy, Piedmont, Tuscany, Umbria and Veneto, or half of Italian regions.

Antoni Martí Petit was an Andorran architect and politician who served as the prime minister of Andorra between 2011 and 2019, when he was elected on the ticket of the Democrats for Andorra.

Banca Privada d'Andorra was a bank in Andorra founded in 1957.

Credito Valtellinese was an Italian bank based in Sondrio prior to its acquisition by Crédit Agricole Italia in 2021. The company was a former component of FTSE Italia Mid Cap Index of the Borsa Italiana, but was removed and added as a component of FTSE Italia Small Cap Index in May 2017; the bank was added back to the reserve list of FTSE Italia Mid Cap in August 2017.

Fondo Interbancario di Tutela dei Depositi (FITD) is an Italian deposit guarantee fund founded in 1987. The fund became a mandatory scheme by the EU Deposit Guarantee Schemes Directive (94/19/EEC). However, the cooperative banks (BCC) of Italy had their own fund instead. There was another fund to guarantee asset management firm in Italy: Fondo Nazionale di Garanzia.

Atlante is an Italian banking sector owned bail-out equity fund that is dedicated to recapitalize some Italian banks, as well as purchase the securities of the junior tranches of non-performing loans. It was established in 2015 in response to the Italian bad debt crisis of that year. The fund was under regulation by the EU Alternative Investment Fund Managers Directive.

Banca Apulia S.p.A. marketed as BancApulia is an Italian bank incorporated in San Severo, in the Province of Foggia, Apulia region. The main office of the bank was located in Bari, in the centre of Apulia region instead. The bank was takeover by Intesa Sanpaolo, after the previous owner was under administration and then being liquidated.

Banco BPM S.p.A. is an Italian bank that started to operate on 1 January 2017, by the merger of Banco Popolare and Banca Popolare di Milano (BPM). The bank is the third largest retail and corporate banking conglomerate in Italy, behind Intesa Sanpaolo and UniCredit. The bank had dual headquarters in Verona and Milan respectively.

The nations of Andorra and Mexico established diplomatic relations in 1995. Both nations are members of the Organization of Ibero-American States and the United Nations.