In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodic employee contributions come directly out of their paychecks, and may be matched by the employer. This pre-tax option is what makes 401(k) plans attractive to employees, and many employers offer this option to their (full-time) workers. 401(k) payable is a general ledger account that contains the amount of 401(k) plan pension payments that an employer has an obligation to remit to a pension plan administrator. This account is classified as a payroll liability, since the amount owed should be paid within one year.

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935, and the existing version of the Act, as amended, encompasses several social welfare and social insurance programs.

An individual savings account is a class of retail investment arrangement available to residents of the United Kingdom. First introduced in 1999, the accounts have favourable tax status. Payments into the account are made from after-tax income, then the account is exempt from income tax and capital gains tax on the investment returns, and no tax is payable on money withdrawn from the scheme.

The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this has been increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of the government of the United States, and according to the FDIC, "since its start in 1933 no depositor has ever lost a penny of FDIC-insured funds".

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, Individual Retirement Arrangements (IRAs). Other arrangements include individual retirement annuities and employer-established benefit trusts.

A Roth IRA is an individual retirement account (IRA) under United States law that is generally not taxed upon distribution, provided certain conditions are met. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan, qualified withdrawals from the Roth IRA plan are tax-free, and growth in the account is tax-free.

A registered retirement savings plan (RRSP), or retirement savings plan (RSP), is a Canadian financial account intended to provide retirement income, but accessible at any time. RRSPs reduce taxes compared to normally taxed accounts. They were introduced in 1957 to promote savings by employees and self-employed people.

A 529 plan, also called a Qualified Tuition Program, is a tax-advantaged investment vehicle in the United States designed to encourage saving for the future higher education expenses of a designated beneficiary. In 2017, K–12 public, private, and religious school tuition were included as qualified expenses for 529 plans along with post-secondary education costs after passage of the Tax Cuts and Jobs Act.

A health savings account (HSA) is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan (HDHP). The funds contributed to an account are not subject to federal income tax at the time of deposit. Unlike a flexible spending account (FSA), HSA funds roll over and accumulate year to year if they are not spent. HSAs are owned by the individual, which differentiates them from company-owned Health Reimbursement Arrangements (HRA) that are an alternate tax-deductible source of funds paired with either high-deductible health plans or standard health plans.

The Thrift Savings Plan (TSP) is a defined contribution plan for United States civil service employees and retirees as well as for members of the uniformed services. As of December 31, 2023, TSP has approximately 7 million participants, and more than $845.4 billion in assets under management; it purports to be the largest defined contribution plan in the world. The TSP is administered by the Federal Retirement Thrift Investment Board, an independent agency.

The Social Security debate in the United States encompasses benefits, funding, and other issues. Social Security is a social insurance program officially called "Old-age, Survivors, and Disability Insurance" (OASDI), in reference to its three components. It is primarily funded through a dedicated payroll tax. During 2015, total benefits of $897 billion were paid out versus $920 billion in income, a $23 billion annual surplus. Excluding interest of $93 billion, the program had a cash deficit of $70 billion. Social Security represents approximately 40% of the income of the elderly, with 53% of married couples and 74% of unmarried persons receiving 50% or more of their income from the program. An estimated 169 million people paid into the program and 60 million received benefits in 2015, roughly 2.82 workers per beneficiary. Reform proposals continue to circulate with some urgency, due to a long-term funding challenge faced by the program as the ratio of workers to beneficiaries falls, driven by the aging of the baby-boom generation, expected continuing low birth rate, and increasing life expectancy. Program payouts began exceeding cash program revenues in 2011; this shortfall is expected to continue indefinitely under current law.

A traditional IRA is an individual retirement arrangement (IRA), established in the United States by the Employee Retirement Income Security Act of 1974 (ERISA). Normal IRAs also existed before ERISA.

The Central Provident Fund Board (CPFB), commonly known as the CPF Board or simply the Central Provident Fund (CPF), is a compulsory comprehensive savings and pension plan for working Singaporeans and permanent residents primarily to fund their retirement, healthcare, and housing needs in Singapore.

A paycheck, also spelled paycheque, pay check or pay cheque, is traditionally a paper document issued by an employer to pay an employee for services rendered. In recent times, the physical paycheck has been increasingly replaced by electronic direct deposits to the employee's designated bank account or loaded onto a payroll card. Employees may still receive a pay slip to detail the calculations of the final payment amount.

Pensions in the United States consist of the Social Security system, public employees retirement systems, as well as various private pension plans offered by employers, insurance companies, and unions.

TreasuryDirect is a website run by the Bureau of the Fiscal Service under the United States Department of the Treasury that allows US individual investors to purchase treasury securities, such as savings bonds, directly from the US government. It enables people to manage their investments online, including connecting their TreasuryDirect account to a bank account for deposits and withdrawals.

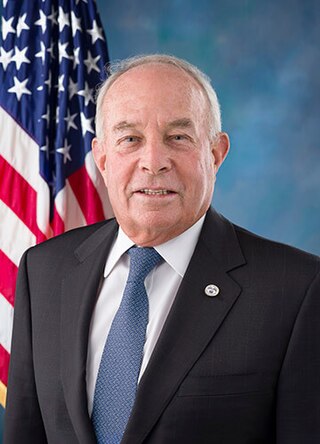

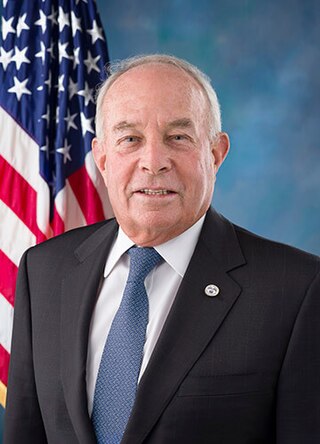

Andrew Marshall Saul is an American businessman and political candidate who served as the 16th commissioner of the United States Social Security Administration from 2019 to 2021. Saul was fired from the position by President Joe Biden on July 9, 2021, after refusing to offer his requested resignation. Saul stated that his discharge was illegal.

In the United States, a medical savings account (MSA) refers to a medical savings account program, generally associated with self-employed individuals, in which tax-deferred deposits can be made for medical expenses. Withdrawals from the MSA are tax-free if used to pay for qualified medical expenses. The MSA must be coupled with a high-deductible health plan (HDHP). Withdrawals from MSA go toward paying the deductible expenses in a given year. MSA account funds can cover expenses related to most forms of health care, disability, dental care, vision care, and long-term care, whether the expenses were billed through the qualifying insurance or otherwise.

A Nippon individual savings account (NISA) is an account that is meant to help residents in Japan save money with tax-exempt benefits. It is modeled after the Individual Savings Account in the United Kingdom. There are two types of NISA accounts: a general NISA and a tsumitate (savings) NISA. The savings NISA is primarily for mutual funds and long-term investments, whereas the general NISA includes domestic and foreign equities, exchange traded funds (ETF) and real-estate investment trusts (REITs).