In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodic employee contributions come directly out of their paychecks, and may be matched by the employer. This pre-tax option is what makes 401(k) plans attractive to employees, and many employers offer this option to their (full-time) workers. 401(k) payable is a general ledger account that contains the amount of 401(k) plan pension payments that an employer has an obligation to remit to a pension plan administrator. This account is classified as a payroll liability, since the amount owed should be paid within one year.

A pension is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be:

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, Individual Retirement Arrangements (IRAs). Other arrangements include individual retirement annuities and employer-established benefit trusts.

A registered retirement savings plan (RRSP), or retirement savings plan (RSP), is a Canadian financial account intended to provide retirement income, but accessible at any time. RRSPs reduce taxes compared to normally taxed accounts. They were introduced in 1957 to promote savings by employees and self-employed people.

A retirement plan is a financial arrangement designed to replace employment income upon retirement. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. Federal tax aspects of retirement plans in the United States are based on provisions of the Internal Revenue Code and the plans are regulated by the Department of Labor under the provisions of the Employee Retirement Income Security Act (ERISA).

A traditional IRA is an individual retirement arrangement (IRA), established in the United States by the Employee Retirement Income Security Act of 1974 (ERISA). Normal IRAs also existed before ERISA.

The Central Provident Fund Board (CPFB), commonly known as the CPF Board or simply the Central Provident Fund (CPF), is a compulsory comprehensive savings and pension plan for working Singaporeans and permanent residents primarily to fund their retirement, healthcare, and housing needs in Singapore.

The Civil Service Retirement System (CSRS) is a public pension fund organized in 1920 that has provided retirement, disability, and survivor benefits for most civilian employees in the United States federal government. Upon the creation of a new Federal Employees Retirement System (FERS) in 1987, those newly hired after that date cannot participate in CSRS. CSRS continues to provide retirement benefits to those eligible to receive them.

The Federal Employees' Retirement System (FERS) is the retirement system for employees within the United States civil service. FERS became effective January 1, 1987, to replace the Civil Service Retirement System (CSRS) and to conform federal retirement plans in line with those in the private sector.

Superannuation in Australia, or "super", is a savings system for workplace pensions in retirement. It involves money earned by an employee being placed into an investment fund to be made legally available to members upon retirement. Employers make compulsory payments to these funds at a proportion of their employee's wages. From July 2024, the mandatory minimum "guarantee" contribution is 11.5%, rising to 12% from 2025. The superannuation guarantee was introduced by the Hawke government to promote self-funded retirement savings, reducing reliance on a publicly funded pension system. Legislation to support the introduction of the superannuation guarantee was passed by the Keating Government in 1992.

A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts plus any investment earnings on the money in the account. In defined contribution plans, future benefits fluctuate on the basis of investment earnings. The most common type of defined contribution plan is a savings and thrift plan. Under this type of plan, the employee contributes a predetermined portion of his or her earnings to an individual account, all or part of which is matched by the employer.

A private pension is a plan into which individuals privately contribute from their earnings, which then will pay them a pension after retirement. It is an alternative to the state pension. Usually, individuals invest funds into saving schemes or mutual funds, run by insurance companies. Often private pensions are also run by the employer and are called occupational pensions. The contributions into private pension schemes are usually tax-deductible.

A Leave and Earnings Statement, generally referred to as an LES, is a document given on a monthly basis to members of the United States military which documents their pay and leave status on a monthly basis.

KiwiSaver is a New Zealand savings scheme which has been operating since 2 July 2007. Participants can normally access their KiwiSaver funds only after the age of 65, but can withdraw them earlier in certain limited circumstances, for example if undergoing significant financial hardship or to use a deposit for a first home.

Congressional pension is a pension made available to members of the United States Congress. As of 2019, members who participated in the congressional pension system are vested after five years of service. A pension is available to members 62 years of age with 5 years of service; 50 years or older with 20 years of service; or 25 years of service at any age. A reduced pension is available depending upon which of several different age/service options is chosen. If Members leave Congress before reaching retirement age, they may leave their contributions behind and receive a deferred pension later. The current pension program, effective January 1987, is under the Federal Employees Retirement System (FERS), which covers members and other federal employees whose federal employment began in 1984 or later. This replaces the older Civil Service Retirement System (CSRS) for most members of congress and federal employees.

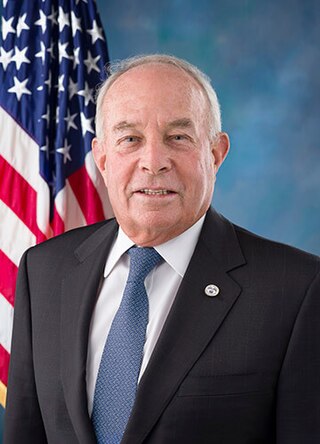

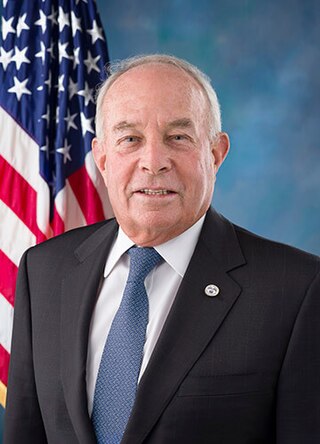

Andrew Marshall Saul is an American businessman and political candidate who served as the 16th commissioner of the United States Social Security Administration from 2019 to 2021. Saul was fired from the position by President Joe Biden on July 9, 2021, after refusing to offer his requested resignation. Saul stated that his discharge was illegal.

The State Universities Retirement System, or SURS, is an agency in the U.S. state of Illinois government that administers retirement, disability, death, and survivor benefits to eligible SURS participants and annuitants. Membership in SURS is attained through employment with 61 employing agencies, including public universities, community colleges, and other qualified state agencies. Eligible employees are automatically enrolled in SURS when employment begins.

In the United States, an employer matching program is an employer's potential payment to their 401(k) plan that depends on participating employees' contribution to the plan.

A Solo 401(k) (also known as a Self Employed 401(k) or Individual 401(k)) is a 401(k) qualified retirement plan for Americans that was designed specifically for employers with no full-time employees other than the business owner(s) and their spouse(s). The general 401(k) plan gives employees an incentive to save for retirement by allowing them to designate funds as 401(k) funds and thus not have to pay taxes on them until the employee reaches retirement age. In this plan, both the employee and his/her employer may make contributions to the plan. The Solo 401(k) is unique because it only covers the business owner(s) and their spouse(s), thus, not subjecting the 401(k) plan to the complex ERISA (Employee Retirement Income Security Act of 1974) rules, which sets minimum standards for employer pension plans with non-owner employees. Self-employed workers who qualify for the Solo 401(k) can receive the same tax benefits as in a general 401(k) plan, but without the employer being subject to the complexities of ERISA.

The Smart Savings Act made the default investment in the Thrift Savings Plan (TSP) an age-appropriate target date asset allocation investment fund instead of the Government Securities Investment Fund.