| Type | Private company |

|---|---|

| Industry | Financial services |

| Predecessors | Consolidated National Bank and Oriental Bank |

| Founded | March 8, 1909 in New York City, New York, United States |

| Defunct | January 27, 1914 |

| Fate | Acquired by Mutual Alliance Trust Company on January 27, 1914 |

| Headquarters | Manhattan, New York City , |

| Services | Banking |

The National Reserve Bank of the City of New York was a New York City bank in that was formed from a merger of Consolidated National Bank and Oriental Bank in 1909 and operated until acquired by the Mutual Alliance Trust Company in 1914. [1]

Deposits of the National Bank Reserve Bank were about $4,352,561 on January 13, 1914 [2] and the bank had "a large number of country bank accounts, chiefly in the West and Southwest," handling a large degree of cotton exchange business. [2]

On January 27, 1914, the National Reserve Bank was taken over by the Mutual Alliance Trust Company, operating for a time as the Reserve Branch of the trust company. [2]

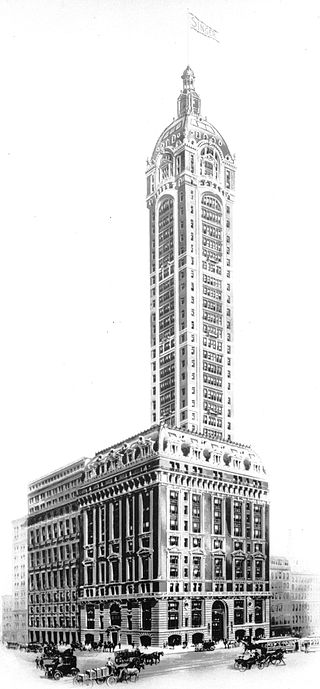

On February 2, 1909, Consolidated National Bank ratified a plan to acquire the Oriental Bank "by allowing its shareholders to subscribe to the shares of a new institution at $150 a share." The Oriental Bank had closed the year prior, but had paid its depositors in full. The new institution, to be named the National Reserve Bank, combined aspects of both banks. A special meeting was called for February 18 for final ratification by stockholders. [3] On February 18, 1909, the bank stockholders voted to enact the merger proposed by the directors, to take over the assets of Oriental Bank and merge them with Consolidated, creating the National Reserve Bank of the City of New York. The plan increased capital of the bank from $1,000,000 to $1,200,000. At the same meeting, 23 directors were elected to the new board, including E. A. Fisher and Mortimer H. Wagar. The bank planned to keep the Consolidated name operative until March 1, 1909. [1] On March 2, 1909, [4] Will-tarn O. Allison [5] (W.O. Allison), president of Consolidated National Bank, was voted president of the new National Reserve Bank entity formed by Consolidated's absorption of Oriental Bank's assets. Thomas J. Lewis and R. W. Jones Jr. were elected vice presidents, [4] and George W. Adams, cashier. [5] With the merger of the reorganized Oriental Bank with the Consolidated National Bank of New York, capital was increased from $1,000,000 to $2,000,000. [5] The National Reserve Bank of the City of New York formally opened its doors for business on March 8, 1909, [5] at "the old banking quarters of the Oriental Bank" [4] at 182 Broadway, corner of John Street in Manhattan, [5] until new facilities at the City Investing Building could be completed at 165 Broadway. [4] In late April 1909, the National Reserve Bank, formerly named Consolidated National Bank, opened for business in the City Investing Building. [6]

Deposits of the National Bank Reserve were about $4,352,561 on January 13, 1914. [2] On January 27, 1914, the National Reserve Bank was taken over by the Mutual Alliance Trust Company, which was based at 35 Wall Street. The two companies had previously been affiliated and had shared directors. At the time of the merge, the New York Times wrote that "both institutions have a large number of country bank accounts, chiefly in the West and Southwest, and handle much cotton exchange business." When the National Reserve was liquidated, its stockholders received the value "of the assets exceeding the amount of the deposits and a substantial payment for the good will of the institution." Deposits of the merged institutions came to about $12,000,000. For a time, the office of the National Bank Reserve at 165 was continued as the Reserve Branch of the trust company. [2]

On February 18, 1909, directors were elected to the board of the newly formed National Reserve Bank of the City of New York, resulting in a board totaling Wagar, Nelson G. Ayres, Charles K. Beekman, Samuel Bettle, Eugene Britton, R. W. Jones Jr., George E. Keeney, Ludwig Nissen, William O. Allison, James G. Newcomb, E. A. Fisher, E.R. Chapman, E. Burton Hart, George V. Hagerty, Thomas J. Lewis, A. M. Probst, Robert E. Dowling, George L. Gillon, Harry J. Schnell, H. Louderbough, J.H. Parker, Thomas N. Jones, and Erskine Hewitt. [1] On March 2, 1909, Hewitt was elected chairman. [4]

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons in 1997 before being acquired by Deutsche Bank in 1999. Deutsche Bank sold the Trust and Custody division of Bankers Trust to State Street Corporation in 2003.

Standard Federal Bank was a Troy, Michigan-based bank serving Michigan and Northern Indiana in the United States which was acquired by Bank of America on 5 May 2008.

Manufacturers Hanover Corporation was the bank holding company formed as parent of Manufacturers Hanover Trust Company, a large New York bank formed by a merger in 1961. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufacturers Hanover Corporation. Charles J. Stewart was the company's first president and chairman.

The Knickerbocker Trust was a bank based in New York City that was, at one time, among the largest banks in the United States. It was a central player in the Panic of 1907.

The Brooklyn Trust Company was a bank in New York City. Chartered in 1866, the Brooklyn Trust Company originally offered trust management and estate management services but also functioned as a commercial bank. The Brooklyn Trust Company acquired over a dozen smaller banks throughout its existence, merging with the Manufacturers Trust Company in 1950.

The Mechanics and Metals National Bank (MMNB) was a bank in New York City, founded in 1810 as the Mechanics National Bank. In 1910, it merged with National Copper Bank and took the Mechanics and Metals National Bank name. After a number of mergers and acquisitions, in 1926 MMNB consolidated with the Chase National Bank.

Bank United Corporation, headquartered in Houston, Texas, was a broad-based financial services provider and the largest publicly traded depository institution headquartered in Texas before its merger with Washington Mutual in 2001. Bank United Corp. conducted its business through its wholly owned subsidiary, Bank United, a federally chartered savings bank. The company operated a 155-branch community banking network in Texas, including 77 in the Dallas/Fort Worth Metroplex, 66 in the greater Houston area, five in Midland, four in Austin, and three in San Antonio; operated 19 SBA lending offices in 14 states; was a national middle market commercial bank with 23 regional offices in 16 states; originated mortgage loans through 11 wholesale offices in 10 states; operated a national mortgage servicing business serving approximately 324,000 customers, and managed an investment portfolio. As of June 30, 2000, Bank United Corp. had assets of $18.2 billion, deposits of $8.8 billion, and stockholder's equity of $823 million.

Valley National Bank of Arizona was a bank based in Phoenix, Arizona, founded in 1900 and acquired by Bank One in 1992. The bank was one of Arizona's leading financial institutions during the 20th century and the last major independent bank in Arizona at the time of its acquisition.

Consolidated National Bank of New York was a bank operating in New York City. Also referred to in the press as Consolidated National Bank, the institution was organized on July 1, 1902, with capital of $1 million. Wrote The New York Times, the bank was "founded with the idea of cornering the business of the Consolidated Exchange and its brokers." The bank opened for business at 57 Broadway on September 22, 1902, and a year later the bank took out a five-year lease at the Exchange Court Building. In 1906, the Consolidated Stock Exchange withdrew its deposits with the Consolidated National Bank. In 1909, the bank voted to acquire the assets of Oriental Bank and merge them with Consolidated, creating the National Reserve Bank. The Consolidated name was operative for a short time afterwards.

The Mutual Alliance Trust Company was a trust company formed in New York City in 1902, with founders such as Cornelius Vanderbilt III and William Rockefeller.

Mortimer Hartwell Wagar was an American banker and businessperson. Wagar was a member of the Consolidated Exchange for 33 years. He was president from 1900 until 1903. He retired from the exchange in June 1923, at which point he was vice president. He also helped organize the Clearing House of the Consolidated Exchange, where he was president.

The Chatham Phenix National Bank and Trust Company was a bank in New York City connected with the Chatham Phenix Corporation. Its predecessor Chatham and Phenix National Bank was formed in 1911 when Chatham National Bank paid $1,880,000 to absorb the asset of the Phenix National Bank. The bank grew significantly as it absorbed smaller banking institutions, such as Mutual Alliance Trust Company and Century Bank in 1915, at which point Chatham and Phenix National Bank became the "first national bank to operate branches in the same city with the main bank."

The Trust Company of America was a large company in New York City. Founded on May 23, 1899 in Albany, New York, its founding president was Ashbel P. Fitch and it was initially located in the Singer Building in Manhattan's Financial District. In 1907 the company absorbed the Colonial Trust Company, a commercial bank. During the Panic of 1907 it was the target of a bank run starting on October 23, 1907, which it survived with the backing of J. Pierpont Morgan and an infusion of gold from the Bank of England and other European sources. The company ultimately represented a consolidation of the North American Trust Company, the former Trust Company of America, the City Trust Company and the Colonial Trust Company. The Trust Company of America was absorbed by the Equitable Trust Company in the spring of 1912.

The North American Trust Company was a trust company based in New York City. It was organized in early 1896. At the start of 1898, the company was located in the American Surety Building at 100 Broadway. On April 3, 1900, the directors of the International Banking and Trust Company and the North American Trust Company unanimously voted to merge the two organizations under the new name the North American Trust Company. Other organizations were acquired in 1901, and in 1905 the City Trust, the North American Trust, and the Trust Company of America merged in what the Times called "the most important trust company consolidation of recent years." The new company was named the Trust Company of America.

The Continental Bank and Trust Company of New York was a financial institution based in New York City, New York, United States. It was established in 1870 as the German-American Bank, which became the Continental Bank of New York. Originally in the Equitable Building at 120 Broadway, the bank was later headquartered at 50 Wall Street, 25 Broad Street, and starting in 1932 the Continental Bank Building It became known as the "brokers bank" for its collaboration with Wall Street brokers and investment banking interests. The institution was renamed the Continental Bank and Trust Company of New York around 1929, at which point it was involved in extending its business with acquisitions of commercial banking and fiduciary operations. Acquired banks included the Fidelity Trust Company in 1929, International Trust Company and Straus National Bank and Trust Company in 1931, and Industrial National Bank later that year. In 1947, the bank earned $804,000 in net profits. As of December 31, 1947, Continental had total resources of $202,000,000, and deposits of $188,000,000. It merged with the Chemical Bank and Trust Company in 1948.

The Straus National Bank and Trust Company was a financial institution based in New York City. Founded in In 1928, in 1931 it merged with the Continental Bank and Trust Company in New York.

The Astor Trust Company was a historic American banking organization. The firm merged with Bankers Trust in 1917.

The National Bank of Commerce in New York was a national bank headquartered in New York City that merged into the Guaranty Trust Company of New York.

The Metropolitan Trust Company of the City of New York was a trust company located in New York City that was founded in 1881. The trust company merged with the Chatham and Phenix National Bank in 1925 under the name of the Chatham Phenix National Bank and Trust Company of New York.