Related Research Articles

Manufacturers Hanover Corporation was the bank holding company formed as parent of Manufacturers Hanover Trust Company, a large New York bank formed by a merger in 1961. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufacturers Hanover Corporation. Charles J. Stewart was the company's first president and chairman.

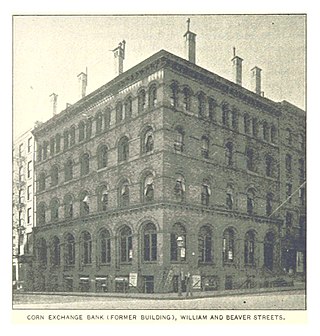

The Corn Exchange Bank was a retail bank founded in 1853 in New York state. Over the years, the company acquired many community banks.

The Knickerbocker Trust was a bank based in New York City that was, at one time, among the largest banks in the United States. It was a central player in the Panic of 1907.

PaineWebber & Co. was an American investment bank and stock brokerage firm that was acquired by the Swiss bank UBS in 2000. The company was founded in 1880 in Boston, Massachusetts, by William Alfred Paine and Wallace G. Webber. Operating with two employees, they leased premises at 48 Congress Street in May 1881. The company was renamed Paine, Webber & Co. when Charles Hamilton Paine became a partner. Members of the Boston Stock Exchange, in 1890 the company acquired a seat on the New York Stock Exchange. Wallace G. Webber retired after the business weathered a major financial crisis that hit the market in 1893.

The Mechanics and Metals National Bank (MMNB) was a bank in New York City, founded in 1810 as the Mechanics National Bank. In 1910 it merged with National Copper Bank and took the Mechanics and Metals National Bank name. After a number of mergers and acquisitions, in 1926 MMNB consolidated with the Chase National Bank.

The New York Trust Company was a large trust and wholesale-banking business that specialized in servicing large industrial accounts. It merged with the Chemical Corn Exchange Bank and eventually the merged entity became Chemical Bank.

Edward Russell Thomas was an American businessman and sportsman.

The Consolidated Stock Exchange of New York, also known as the New York Consolidated Stock Exchange or Consolidated, was a stock exchange in New York City, New York in direct competition to the New York Stock Exchange (NYSE) from 1885–1926. It was formed from the merger of other smaller exchanges, and was referred to in the industry and press as the "Little Board." By its official formation in 1885, its membership of 2403 was considered the second largest membership of any exchange in the United States.

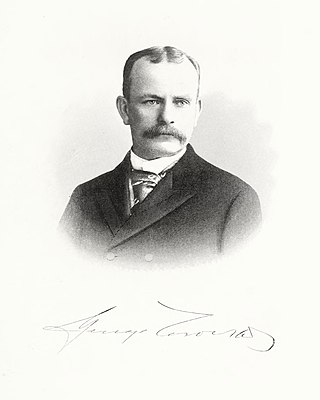

George Crocker was an American businessman. A member of Tuller & Co., he was also a director of several corporations, including Trust Company of America. He was second vice president of the Southern Pacific Railroad. In 1909, Crocker was valued between $10 million to $20 million. The 75-room, three-story Crocker Mansion was built in 1907 for Crocker in Mahwah, New Jersey, and is one of New Jersey's historical landmarks.

The National Reserve Bank of the City of New York was a bank in New York City that was formed from a merger of Consolidated National Bank and Oriental Bank in 1909. Deposits of the National Bank Reserve Bank were about $4,352,561 on January 13, 1914 and the bank had "a large number of country bank accounts, chiefly in the West and Southwest," handling a large degree of cotton exchange business. On January 27, 1914, the National Reserve Bank was taken over by the Mutual Alliance Trust Company, operating for a time as the Reserve Branch of the trust company.

The Mutual Alliance Trust Company was a trust company formed in New York City in 1902, with founders such as Cornelius Vanderbilt and William Rockefeller.

Mortimer Hartwell Wagar was an American banker and businessperson. Wagar was a member of the Consolidated Exchange for 33 years. He was president from 1900 until 1903. He retired from the exchange in June 1923, at which point he was vice president. He also helped organize the Clearing House of the Consolidated Exchange, where he was president.

Charles G. Wilson was an American financier and businessman. Wilson was president of the Consolidated Stock and Petroleum Exchange of New York from 1883 until 1900. As of December 1894, he was serving as President of the New York City Board of Health as well.

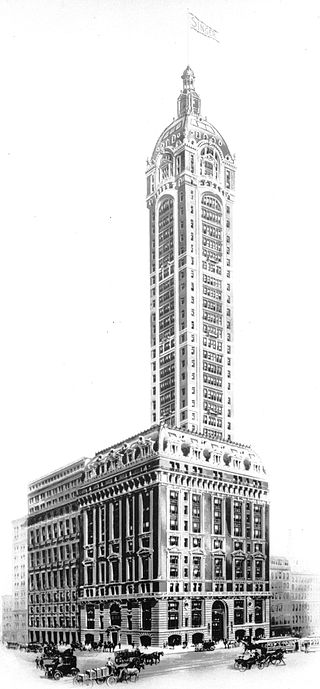

The Trust Company of America was a large company in New York City. Founded on May 23, 1899 in Albany, New York, its founding president was Ashbel P. Fitch and it was initially located in the Singer Building in Manhattan's Financial District. In 1907 the company absorbed the Colonial Trust Company, a commercial bank. During the Panic of 1907 it was the target of a bank run starting on October 23, 1907, which it survived with the backing of J. Pierpont Morgan and an infusion of gold from the Bank of England and other European sources. The company ultimately represented a consolidation of the North American Trust Company, the former Trust Company of America, the City Trust Company and the Colonial Trust Company. The Trust Company of America was absorbed by the Equitable Trust Company in the spring of 1912.

The North American Trust Company was a trust company based in New York City. It was organized in early 1896. At the start of 1898, the company was located in the American Surety Building at 100 Broadway. On April 3, 1900, the directors of the International Banking and Trust Company and the North American Trust Company unanimously voted to merge the two organizations under the new name the North American Trust Company. Other organizations were acquired in 1901, and in 1905 the City Trust, the North American Trust, and the Trust Company of America merged in what the Times called "the most important trust company consolidation of recent years." The new company was named the Trust Company of America.

The St. Louis Stock Exchange was a regional stock exchange located in St. Louis, Missouri. Opened in 1899, in September 1949, the St. Louis Stock Exchange was acquired by the Chicago Stock Exchange, and renamed the Midwest Stock Exchange.

The Continental Bank and Trust Company of New York was a financial institution based in New York City, New York, United States. It was established in 1870 as the German-American Bank, which became the Continental Bank of New York. Originally in the Equitable Building at 120 Broadway, the bank was later headquartered at 50 Wall Street, 25 Broad Street, and starting in 1932 the Continental Bank Building It became known as the "brokers bank" for its collaboration with Wall Street brokers and investment banking interests. The institution was renamed the Continental Bank and Trust Company of New York around 1929, at which point it was involved in extending its business with acquisitions of commercial banking and fiduciary operations. Acquired banks included the Fidelity Trust Company in 1929, International Trust Company and Straus National Bank and Trust Company in 1931, and Industrial National Bank later that year. In 1947, the bank earned $804,000 in net profits. As of December 31, 1947, Continental had total resources of $202,000,000, and deposits of $188,000,000. It merged with the Chemical Bank and Trust Company in 1948.

The Fourth National Bank of New York was an American bank based in New York City.

The National Bank of Commerce in New York was a national bank headquartered in New York City that merged into the Guaranty Trust Company of New York.

The Metropolitan Trust Company of the City of New York was a trust company located in New York City that was founded in 1881. The trust company merged with the Chatham and Phenix National Bank in 1925 under the name of the Chatham Phenix National Bank and Trust Company of New York.

References

- 1 2 3 Among the banks The Banking Law Journal, volume 19, p. 664

- 1 2 3 "Wall Street Topics", The New York Times , New York City, p. 12, July 2, 1902, retrieved January 19, 2017

- 1 2 3 "Drops out of Thomas Bank", The New York Times , New York City, p. 3, February 10, 1906, retrieved January 20, 2017

- 1 2 "Consolidated National's New Quarters.", The New York Times , New York, p. 11, September 2, 1903, retrieved January 21, 2017

- 1 2 "Oriental Bank Merged", The New York Times , New York City, p. 6, February 19, 1909, retrieved January 19, 2017

- ↑ "Mutual Alliance Takes Over Bank; National Reserve Office Will Continue as Branch of Trust Company.", The New York Times , New York City, p. 12, January 28, 1914, retrieved January 19, 2017

- 1 2 "No Express Company Merger; Presidents of Three Concerns Deny Wall Street Reports.", The New York Times , New York City, p. 13, February 11, 1902, retrieved January 19, 2017

- ↑ "Consolidated Exchange - Closely Fought Election - Mr. Wagar Displaces President Wilson". The New York Times . 2012-06-10. Retrieved 2017-01-15.

- ↑ Nelson, Samuel Armstrong (1907). The Consolidated Stock Exchange of New York: Its History, Organization, Machinery and Methods. p. 19. Retrieved 2017-01-15.

- 1 2 "Consolidated Bank Directors", The New York Times , New York City, p. 10, August 26, 1902, retrieved January 19, 2017

- 1 2 "Consolidated National Bank", The New York Times , New York City, p. 12, September 12, 1902, retrieved January 19, 2017

- 1 2 3 "Full text of "The Shield; a magazine pub. quarterly by and in the interests of the Theta delta chi fraternity"". Archive.org. Retrieved 2017-01-15.

- ↑ "New National Banknote", The New York Times , New York, p. 16, October 24, 1902, retrieved January 21, 2017

- ↑ "Changes in New York Bank Conditions; The Exhibit Just Made to the Treasury Department.", The New York Times , New York City, p. 29, December 7, 1902, retrieved January 19, 2017

- 1 2 3 "Topics in Wall Street; Erie Strong on Reported Buying by Harriman Interests. Some Unfavorable Aspects of Further Issues of Notes -- Wabash Strong -Market Very Quiet and Price Changes Small.", The New York Times , New York City, p. 12, April 16, 1904, retrieved January 19, 2017

- 1 2 Greeley, Horace; Cleveland, John Fitch; Ottarson, F. J.; Schem, Alexander Jacob; McPherson, Edward; Rhoades, Henry Eckford (1905). The Tribune Almanac and Political Register. p. 395. Retrieved 2017-01-15.

- ↑ S. Paine, Willis (January 8, 1905), "Frequent Examinations a Necessity for the Banks; Willis S. Paine Writes of the Vigilance Needed to Guarantee Safety to Depositors and Stockholders.", The New York Times , New York, p. 36, retrieved January 21, 2017

- ↑ "Seeking to Control Consolidated National; Broker Carney Is Requesting Proxies for the Bank's Stock.", The New York Times , New York, p. 11, September 20, 1905, retrieved January 21, 2017

- 1 2 3 "LO.F. Thomas Now Heads Consolidated National; Is Elected President to Succeed Willis S. Paine.", The New York Times , New York, p. 13, November 1, 1905, retrieved January 21, 2017

- ↑ "Brokers Sue Joe Weber", The New York Times , New York, p. 16, February 24, 1909, retrieved January 21, 2017

- ↑ "Undesired Controls End", The New York Times , New York, p. 2, October 21, 1907, retrieved January 21, 2017

- ↑ "Bank Merger Assured; The Consolidated All Ready to Absorb the National of North America.", The New York Times , New York City, p. 13, December 14, 1907, retrieved January 20, 2017

- ↑ "Bank Merger Vetoed; Consolidated National Not to Acquire the National of North America.", The New York Times , New York City, December 18, 1907, retrieved January 20, 2017

- ↑ "Oriental Bank Merger Ratified", The New York Times , New York, p. 11, February 3, 1909, retrieved January 21, 2017

- 1 2 3 4 "Allison Heads Bank Merger", The New York Times , New York City, p. 16, March 3, 1909, retrieved January 19, 2017

- 1 2 3 4 5 "The Brooklyn Daily Eagle from Brooklyn, New York on March 7, 1909 · Page 12". Newspapers.com. 1909-03-07. Retrieved 2017-01-15.

- ↑ "Financial Notes", The New York Times , New York City, p. 27, April 25, 1909, retrieved January 19, 2017