In complex analysis, a branch of mathematics, analytic continuation is a technique to extend the domain of definition of a given analytic function. Analytic continuation often succeeds in defining further values of a function, for example in a new region where the infinite series representation which initially defined the function becomes divergent.

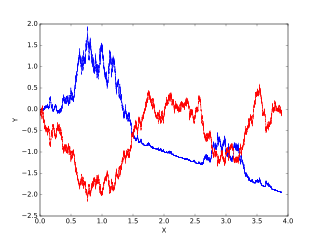

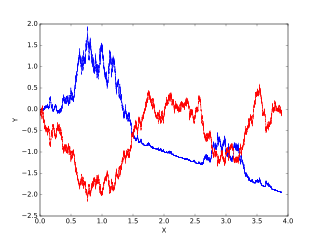

In mathematics, the Wiener process is a real-valued continuous-time stochastic process named in honor of American mathematician Norbert Wiener for his investigations on the mathematical properties of the one-dimensional Brownian motion. It is often also called Brownian motion due to its historical connection with the physical process of the same name originally observed by Scottish botanist Robert Brown. It is one of the best known Lévy processes and occurs frequently in pure and applied mathematics, economics, quantitative finance, evolutionary biology, and physics.

In mathematical analysis, Hölder's inequality, named after Otto Hölder, is a fundamental inequality between integrals and an indispensable tool for the study of Lp spaces.

In mathematics, the limit of a function is a fundamental concept in calculus and analysis concerning the behavior of that function near a particular input.

In complex analysis, the Hardy spacesHp are certain spaces of holomorphic functions on the unit disk or upper half plane. They were introduced by Frigyes Riesz, who named them after G. H. Hardy, because of the paper. In real analysis Hardy spaces are certain spaces of distributions on the real line, which are boundary values of the holomorphic functions of the complex Hardy spaces, and are related to the Lp spaces of functional analysis. For 1 ≤ p < ∞ these real Hardy spaces Hp are certain subsets of Lp, while for p < 1 the Lp spaces have some undesirable properties, and the Hardy spaces are much better behaved.

The fundamental theorems of asset pricing, in both financial economics and mathematical finance, provide necessary and sufficient conditions for a market to be arbitrage-free, and for a market to be complete. An arbitrage opportunity is a way of making money with no initial investment without any possibility of loss. Though arbitrage opportunities do exist briefly in real life, it has been said that any sensible market model must avoid this type of profit. The first theorem is important in that it ensures a fundamental property of market models. Completeness is a common property of market models. A complete market is one in which every contingent claim can be replicated. Though this property is common in models, it is not always considered desirable or realistic.

Itô calculus, named after Kiyosi Itô, extends the methods of calculus to stochastic processes such as Brownian motion. It has important applications in mathematical finance and stochastic differential equations.

In the mathematical field of analysis, the Nash–Moser theorem, discovered by mathematician John Forbes Nash and named for him and Jürgen Moser, is a generalization of the inverse function theorem on Banach spaces to settings when the required solution mapping for the linearized problem is not bounded.

In probability theory, a real valued stochastic process X is called a semimartingale if it can be decomposed as the sum of a local martingale and a càdlàg adapted finite-variation process. Semimartingales are "good integrators", forming the largest class of processes with respect to which the Itô integral and the Stratonovich integral can be defined.

In probability theory, the optional stopping theorem says that, under certain conditions, the expected value of a martingale at a stopping time is equal to its initial expected value. Since martingales can be used to model the wealth of a gambler participating in a fair game, the optional stopping theorem says that, on average, nothing can be gained by stopping play based on the information obtainable so far. Certain conditions are necessary for this result to hold true. In particular, the theorem applies to doubling strategies.

In mathematics and information theory of probability, a sigma-martingale is a semimartingale with an integral representation. Sigma-martingales were introduced by C.S. Chou and M. Emery in 1977 and 1978. In financial mathematics, sigma-martingales appear in the fundamental theorem of asset pricing as an equivalent condition to no free lunch with vanishing risk.

In finance, an admissible trading strategy or admissible strategy is any trading strategy with wealth almost surely bounded from below. In particular, an admissible trading strategy precludes unhedged short sales of any unbounded assets. A typical example of a trading strategy which is not admissible is the doubling strategy.

Input-to-state stability (ISS) is a stability notion widely used to study stability of nonlinear control systems with external inputs. Roughly speaking, a control system is ISS if it is globally asymptotically stable in the absence of external inputs and if its trajectories are bounded by a function of the size of the input for all sufficiently large times. The importance of ISS is due to the fact that the concept has bridged the gap between input–output and state-space methods, widely used within the control systems community.

Stochastic portfolio theory (SPT) is a mathematical theory for analyzing stock market structure and portfolio behavior introduced by E. Robert Fernholz in 2002. It is descriptive as opposed to normative, and is consistent with the observed behavior of actual markets. Normative assumptions, which serve as a basis for earlier theories like modern portfolio theory (MPT) and the capital asset pricing model (CAPM), are absent from SPT.

Exponential Tilting (ET), Exponential Twisting, or Exponential Change of Measure (ECM) is a distribution shifting technique used in many parts of mathematics. The different exponential tiltings of a random variable is known as the natural exponential family of .

Freddy Delbaen is a Belgian-Swiss mathematician. He is professor emeritus of financial mathematics at ETH Zurich.

In probability theory, Yan's theorem is a separation and existence result. It is of particular interest in financial mathematics where one uses it to prove the Kreps-Yan theorem.

In mathematics, stochastic analysis on manifolds or stochastic differential geometry is the study of stochastic analysis over smooth manifolds. It is therefore a synthesis of stochastic analysis and differential geometry.

In probability theory, Kramkov's optional decomposition theorem is a mathematical theorem on the decomposition of a positive supermartingale with respect to a family of equivalent martingale measures into the form