Related Research Articles

A pension is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be:

A pay-as-you-earn tax (PAYE), or pay-as-you-go (PAYG) in Australia, is a withholding of taxes on income payments to employees. Amounts withheld are treated as advance payments of income tax due. They are refundable to the extent they exceed tax as determined on tax returns. PAYE may include withholding the employee portion of insurance contributions or similar social benefit taxes. In most countries, they are determined by employers but subject to government review. PAYE is deducted from each paycheck by the employer and must be remitted promptly to the government. Most countries refer to income tax withholding by other terms, including pay-as-you-go tax.

A retirement plan is a financial arrangement designed to replace employment income upon retirement. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. Federal tax aspects of retirement plans in the United States are based on provisions of the Internal Revenue Code and the plans are regulated by the Department of Labor under the provisions of the Employee Retirement Income Security Act (ERISA).

Pensions in the United Kingdom, whereby United Kingdom tax payers have some of their wages deducted to save for retirement, can be categorised into three major divisions - state, occupational and personal pensions.

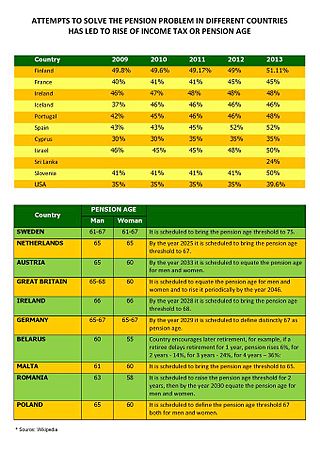

The pensions crisis or pensions timebomb is the predicted difficulty in paying for corporate or government employment retirement pensions in various countries, due to a difference between pension obligations and the resources set aside to fund them. The basic difficulty of the pension problem is that institutions must be sustained over far longer than the political planning horizon. Shifting demographics are causing a lower ratio of workers per retiree; contributing factors include retirees living longer, and lower birth rates. An international comparison of pension institution by countries is important to solve the pension crisis problem. There is significant debate regarding the magnitude and importance of the problem, as well as the solutions. One aspect and challenge of the "Pension timebomb" is that several countries' governments have a constitutional obligation to provide public services to its citizens, but the funding of these programs, such as healthcare are at a lack of funding, especially after the 2008 recession and the strain caused on the dependency ratio by an ageing population and a shrinking workforce, which increases costs of elderly care.

A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts plus any investment earnings on the money in the account. In defined contribution plans, future benefits fluctuate on the basis of investment earnings. The most common type of defined contribution plan is a savings and thrift plan. Under this type of plan, the employee contributes a predetermined portion of his or her earnings to an individual account, all or part of which is matched by the employer.

A life annuity is an annuity, or series of payments at fixed intervals, paid while the purchaser is alive. The majority of life annuities are insurance products sold or issued by life insurance companies however substantial case law indicates that annuity products are not necessarily insurance products.

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. Traditionally, many governmental and public entities, as well as a large number of corporations, provide defined benefit plans, sometimes as a means of compensating workers in lieu of increased pay.

Mexico reformed its pension system in 1997, transforming it from a pay as you go (PAYG), defined benefit (DB) scheme to a fully funded, private and mandatory defined contribution (DC) scheme. The reform was modeled after the pension reforms in Chile in the early 1980s, and was a result of recommendations from the World Bank. On December 10, 2020, the Mexican pension system would again undergo a major reform.

Pensions in Norway fall into three major divisions; State Pensions, Occupational Pensions and Individual or personal Pensions.

According to the International Labour Organization, social security is a human right that aims at reducing and preventing poverty and vulnerability throughout the life cycle of individuals. Social security includes different kinds of benefits A social pension is a stream of payments from the state to an individual that starts when someone retires and continues to be paid until death. This type of pension represents the non-contributory part of the pension system, the other being the contributory pension, as per the most common form of composition of these systems in most developed countries.

In France, pensions fall into five major divisions;

Pensions in Spain consist of a mandatory state pension scheme, and voluntary company and individual pension provision.

Income drawdown is a method withdrawing benefits from a UK Registered Pension Scheme. In theory, it is available under any money purchase pension scheme. However, it is, in practice, rarely offered by occupational pensions and is therefore generally only available to those who own, or transfer to, a personal pension.

The Swiss pension system rests on three pillars:

- the state-run pension scheme for the aged, orphans, and surviving spouses ;

- the pension funds run by investment foundations, which are tied to employers ;

- voluntary, private investments.

There are various types of Pensions in Armenia, including social pensions, mandatory funded pensions, or voluntary funded pensions. Currently, Amundi-ACBA and Ampega act as the mandatory pension fund managers within Armenia.

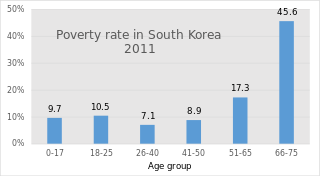

South Korea's pension scheme was introduced relatively recently, compared to other democratic nations. Half of the country's population aged 65 and over lives in relative poverty, or nearly four times the 13% average for member countries of the Organisation for Economic Co-operation and Development (OECD). This makes old age poverty an urgent social problem. Public social spending by general government is half the OECD average, and is the lowest as a percentage of GDP among OECD member countries.

Pensions in Denmark consist of both private and public programs, all managed by the Agency for the Modernisation of Public Administration under the Ministry of Finance. Denmark created a multipillar system, consisting of an unfunded social pension scheme, occupational pensions, and voluntary personal pension plans. Denmark's system is a close resemblance to that encouraged by the World Bank in 1994, emphasizing the international importance of establishing multifaceted pension systems based on public old-age benefit plans to cover the basic needs of the elderly. The Danish system employed a flat-rate benefit funded by the government budget and available to all Danish residents. The employment-based contribution plans are negotiated between employers and employees at the individual firm or profession level, and cover individuals by labor market systems. These plans have emerged as a result of the centralized wage agreements and company policies guaranteeing minimum rates of interest. The last pillar of the Danish pension system is income derived from tax-subsidized personal pension plans, established with life insurance companies and banks. Personal pensions are inspired by tax considerations, desirable to people not covered by the occupational scheme.

An occupational pension fund, also referred to as an employer funded or employer administered scheme, is a pension offered by an employer to an employee's retirement scheme. Within the European Union (EU), these pension funds can vary throughout certain Member States due to differences in retirement ages in Europe, salaries and length of careers, labour and tax laws, and phases of reform.

Old Pension Scheme (OPS) in India was abolished as a part of pension reforms by Union Government. Repealed from 1 January 2004, it had a defined-benefit (DB) pension of half the Last Pay Drawn (LPD) at the time of retirement along with components like Dearness Allowances (DA) etc. OPS was an unfunded pension scheme financed on a pay-as-you-go (PAYG) basis in which current revenues of the government funded the pension benefit for its retired employees. Old Pension Scheme was replaced by a restructured defined-contribution (DC) pension scheme called the National Pension System.

References

- 1 2 3 4 5 6 7 8 Holzmann, Robert., Palmer, Edward. & Robalino, David. Nonfinancial Defined Contribution Pension Schemes in a Changing Pension World. The World Bank, 2012. p. 31-85.

- 1 2 3 Börsch-Supan, Axel. What are NDC Pension Systems? What Do They Bring to Reform Strategies. National Bureau of Economic Research (NBER), 2004.

- ↑ Disney, Richard. Notional accounts as a pension reform strategy: An evaluation. World Bank Pension Reform Primer, 1998.