In physics and thermodynamics, an equation of state is a thermodynamic equation relating state variables which describe the state of matter under a given set of physical conditions, such as pressure, volume, temperature (PVT), or internal energy. Equations of state are useful in describing the properties of fluids, mixtures of fluids, solids, and the interior of stars.

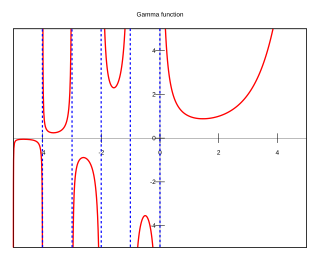

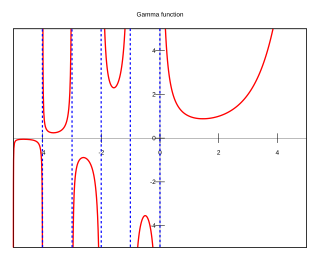

In mathematics, the gamma function is one commonly used extension of the factorial function to complex numbers. The gamma function is defined for all complex numbers except the non-positive integers. For any positive integer ,

In probability theory, the normaldistribution is a very common continuous probability distribution. Normal distributions are important in statistics and are often used in the natural and social sciences to represent real-valued random variables whose distributions are not known. A random variable with a Gaussian distribution is said to be normally distributed and is called a normal deviate.

In physics, redshift is a phenomenon where electromagnetic radiation from an object undergoes an increase in wavelength. Whether or not the radiation is visible, "redshift" means an increase in wavelength, equivalent to a decrease in wave frequency and photon energy, in accordance with, respectively, the wave and quantum theories of light.

In physical chemistry, the Arrhenius equation is a formula for the temperature dependence of reaction rates. The equation was proposed by Svante Arrhenius in 1889, based on the work of Dutch chemist Jacobus Henricus van 't Hoff who had noted in 1884 that van 't Hoff equation for the temperature dependence of equilibrium constants suggests such a formula for the rates of both forward and reverse reactions. This equation has a vast and important application in determining rate of chemical reactions and for calculation of energy of activation. Arrhenius provided a physical justification and interpretation for the formula. Currently, it is best seen as an empirical relationship. It can be used to model the temperature variation of diffusion coefficients, population of crystal vacancies, creep rates, and many other thermally-induced processes/reactions. The Eyring equation, developed in 1935, also expresses the relationship between rate and energy.

In electrochemistry, the Nernst equation is an equation that relates the reduction potential of an electrochemical reaction to the standard electrode potential, temperature, and activities of the chemical species undergoing reduction and oxidation. It was named after Walther Nernst, a German physical chemist who formulated the equation.

The Black–Scholes or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing derivative investment instruments. From the partial differential equation in the model, known as the Black–Scholes equation, one can deduce the Black–Scholes formula, which gives a theoretical estimate of the price of European-style options and shows that the option has a unique price regardless of the risk of the security and its expected return. The formula led to a boom in options trading and provided mathematical legitimacy to the activities of the Chicago Board Options Exchange and other options markets around the world. It is widely used, although often with some adjustments, by options market participants.

In mathematics, Stirling's approximation is an approximation for factorials. It is a good approximation, leading to accurate results even for small values of n. It is named after James Stirling, though it was first stated by Abraham de Moivre.

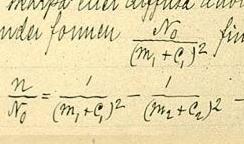

In atomic physics, the Rydberg formula calculates the wavelengths of a spectral line in many chemical elements. The formula was primarily presented as a generalization of the Balmer series for all atomic electron transitions of hydrogen. It was first empirically stated in 1888 by the Swedish physicist Johannes Rydberg, then theoretically by Niels Bohr in 1913, who used a primitive form of quantum mechanics. The formula directly generalizes the equations used to calculate the wavelengths of the hydrogen spectral series.

Runs created (RC) is a baseball statistic invented by Bill James to estimate the number of runs a hitter contributes to his team.

Pythagorean expectation is a sports analytics formula devised by Bill James to estimate the percentage of games a baseball team "should" have won based on the number of runs they scored and allowed. Comparing a team's actual and Pythagorean winning percentage can be used to make predictions and evaluate which teams are over-performing and under-performing. The name comes from the formula's resemblance to the Pythagorean theorem.

In classical statistical mechanics, the equipartition theorem relates the temperature of a system to its average energies. The equipartition theorem is also known as the law of equipartition, equipartition of energy, or simply equipartition. The original idea of equipartition was that, in thermal equilibrium, energy is shared equally among all of its various forms; for example, the average kinetic energy per degree of freedom in translational motion of a molecule should equal that in rotational motion.

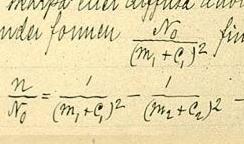

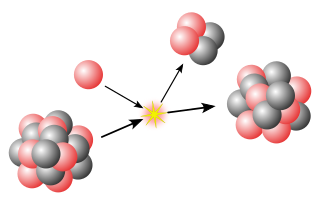

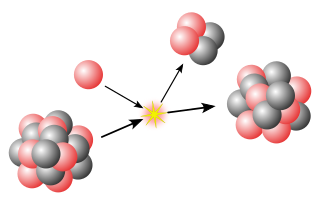

In nuclear physics, the semi-empirical mass formula (SEMF) is used to approximate the mass and various other properties of an atomic nucleus from its number of protons and neutrons. As the name suggests, it is based partly on theory and partly on empirical measurements. The theory is based on the liquid drop model proposed by George Gamow, which can account for most of the terms in the formula and gives rough estimates for the values of the coefficients. It was first formulated in 1935 by German physicist Carl Friedrich von Weizsäcker, and although refinements have been made to the coefficients over the years, the structure of the formula remains the same today.

Distressed securities are securities over companies or government entities that are experiencing financial or operational distress, default, or are under bankruptcy. As far as debt securities, this is called distressed debt. Purchasing or holding such distressed-debt creates significant risk due to the possibility that bankruptcy may render such securities worthless.

Financial distress is a term in corporate finance used to indicate a condition when promises to creditors of a company are broken or honored with difficulty. If financial distress cannot be relieved, it can lead to bankruptcy. Financial distress is usually associated with some costs to the company; these are known as costs of financial distress.

Edward I. Altman is a Professor of Finance, Emeritus, at New York University's Stern School of Business. He is best known for the development of the Altman Z-score for predicting bankruptcy which he published in 1968. Professor Altman is a leading academic on the High-Yield and Distressed Debt markets and is the pioneer in the building of models for credit risk management and bankruptcy prediction. He is the brother of Stuart Altman, a noted health care economist.

A period of financial distress occurs when the price of a company or an asset or an index of a set of assets in a market is declining with the danger of a sudden crash of value occurring, either because the company is experiencing increasing problems of cash flow or a deteriorating credit balance or because the price had become too high as a result of a speculative bubble that has now peaked.

In statistics, the Jonckheere trend test is a test for an ordered alternative hypothesis within an independent samples (between-participants) design. It is similar to the Kruskal–Wallis test in that the null hypothesis is that several independent samples are from the same population. However, with the Kruskal–Wallis test there is no a priori ordering of the populations from which the samples are drawn. When there is an a priori ordering, the Jonckheere test has more statistical power than the Kruskal–Wallis test. The test was developed by A. R. Jonckheere, who was a psychologist and statistician at University College London.