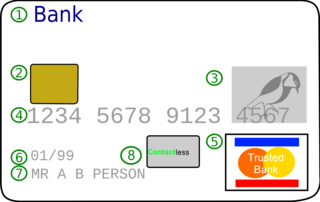

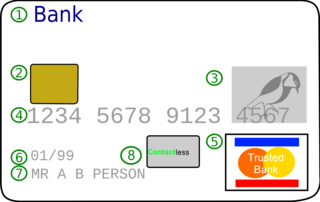

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many of the new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. These are similar to a credit card, but unlike a credit card, the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

Electronic funds transfer at point of sale is an electronic payment system involving electronic funds transfers based on the use of payment cards, such as debit or credit cards, at payment terminals located at points of sale. EFTPOS technology was developed during the 1980s.

Electronic cash was, until 2007, the debit card system of the German Banking Industry Committee, the association that represents the top German financial interest groups. Usually paired with a transaction account or current account, cards with an Electronic Cash logo were only handed out by proper credit institutions. An electronic card payment was generally made by the card owner entering their PIN at a so-called EFT-POS-terminal (Electronic-Funds-Transfer-Terminal). The name "EC" originally comes from the unified European checking system Eurocheque. Comparable debit card systems are Maestro and Visa Electron. Banks and credit institutions who issued these cards often paired EC debit cards with Maestro functionality. These combined cards, recognizable by an additional Maestro logo, were referred to as "EC/Maestro cards".

EMV is a payment method based on a technical standard for smart payment cards and for payment terminals and automated teller machines which can accept them. EMV stands for "Europay, Mastercard, and Visa", the three companies that created the standard.

Mastercard Maestro is a brand of debit cards and prepaid cards owned by Mastercard that was introduced in 1991. Maestro is accepted at around fifteen million point of sale outlets in 93 countries.

Carte Bleue was a major debit card payment system operating in France. Unlike Visa Electron or Maestro debit cards, Carte Bleue transactions worked without requiring authorization from the cardholder's bank. In many situations, the card worked like a credit card but without fees for the cardholder. The system has now been integrated into a wider scheme called CB or carte bancaire. All Carte Bleue cards were part of CB, but not all CB cards were Carte Bleue.

A payment gateway is a merchant service provided by an e-commerce application service provider that authorizes credit card or direct payments processing for e-businesses, online retailers, bricks and clicks, or traditional brick and mortar. The payment gateway may be provided by a bank to its customers, but can be provided by a specialised financial service provider as a separate service, such as a payment service provider.

A merchant account is a type of bank account that allows businesses to accept payments in multiple ways, typically debit or credit cards. A merchant account is established under an agreement between an acceptor and a merchant acquiring bank for the settlement of payment card transactions. In some cases a payment processor, independent sales organization (ISO), or member service provider (MSP) is also a party to the merchant agreement. Whether a merchant enters into a merchant agreement directly with an acquiring bank or through an aggregator, the agreement contractually binds the merchant to obey the operating regulations established by the card associations. A high-risk merchant account is a business account or merchant account that allows the business to accept online payments though they are considered to be of high-risk nature by the banks and credit card processors. The industries that possess this account are adult industry, travel, Forex trading business, multilevel marketing business. "High-Risk" is the term that is used by the acquiring banks to signify industries or merchants that are involved with the higher financial risk.

A hardware security module (HSM) is a physical computing device that safeguards and manages secrets, performs encryption and decryption functions for digital signatures, strong authentication and other cryptographic functions. These modules traditionally come in the form of a plug-in card or an external device that attaches directly to a computer or network server. A hardware security module contains one or more secure cryptoprocessor chips.

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer with a payment terminal and access automated teller machines (ATMs). Such cards are known by a variety of names including bank cards, ATM cards, client cards, key cards or cash cards.

A contactless smart card is a contactless credential whose dimensions are credit-card size. Its embedded integrated circuits can store data and communicate with a terminal via NFC. Commonplace uses include transit tickets, bank cards and passports.

Authorization hold is a service offered by credit and debit card providers whereby the provider puts a hold of the amount approved by the cardholder, reducing the balance of available funds until the merchant clears the transaction, after the transaction is completed or aborted, or because the hold expires.

Contactless payment systems are credit cards and debit cards, key fobs, smart cards, or other devices, including smartphones and other mobile devices, that use radio-frequency identification (RFID) or near-field communication for making secure payments. The embedded integrated circuit chip and antenna enable consumers to wave their card, fob, or handheld device over a reader at the Point-of-sale terminal. Contactless payments are made in close physical proximity, unlike other types of mobile payments which use broad-area cellular or WiFi networks and do not involve close physical proximity.

A payment terminal, also known as a point of sale (POS) terminal, credit card machine, PIN pad, EFTPOS terminal, is a device which interfaces with payment cards to make electronic funds transfers. The terminal typically consists of a secure keypad for entering PIN, a screen, a means of capturing information from payments cards and a network connection to access the payment network for authorization.

The Chip Authentication Program (CAP) is a MasterCard initiative and technical specification for using EMV banking smartcards for authenticating users and transactions in online and telephone banking. It was also adopted by Visa as Dynamic Passcode Authentication (DPA). The CAP specification defines a handheld device with a smartcard slot, a numeric keypad, and a display capable of displaying at least 12 characters. Banking customers who have been issued a CAP reader by their bank can insert their Chip and PIN (EMV) card into the CAP reader in order to participate in one of several supported authentication protocols. CAP is a form of two-factor authentication as both a smartcard and a valid PIN must be present for a transaction to succeed. Banks hope that the system will reduce the risk of unsuspecting customers entering their details into fraudulent websites after reading so-called phishing emails.

Credit card fraud is an inclusive term for fraud committed using a payment card, such as a credit card or debit card. The purpose may be to obtain goods or services or to make payment to another account, which is controlled by a criminal. The Payment Card Industry Data Security Standard is the data security standard created to help financial institutions process card payments securely and reduce card fraud.

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt. The card issuer creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards, and a few gemstone-encrusted metal cards.

A card security code is a series of numbers that, in addition to the bank card number, is printed on a credit or debit card. The CSC is used as a security feature for card not present transactions, where a personal identification number (PIN) cannot be manually entered by the cardholder. It was instituted to reduce the incidence of credit card fraud.

Apple Pay is a mobile payment service by Apple Inc. that allows users to make payments in person, in iOS apps, and on the web. It is supported on iPhone, Apple Watch, iPad, and Mac. It digitizes and can replace a credit or debit card chip and PIN transaction at a contactless-capable point-of-sale terminal. It does not require Apple Pay-specific contactless payment terminals; it can work with any merchant that accepts contactless payments. It adds two-factor authentication via Touch ID, Face ID, PIN, or passcode. Devices wirelessly communicate with point of sale systems using near field communication (NFC), with an embedded secure element (eSE) to securely store payment data and perform cryptographic functions, and Apple's Touch ID and Face ID for biometric authentication.

Google Pay is a mobile payment service developed by Google to power in-app, online, and in-person contactless purchases on mobile devices, enabling users to make payments with Android phones, tablets, or watches. Users can authenticate via a PIN, passcode, or biometrics such as 3D face scanning or fingerprint recognition.