| Company type | Agency House |

|---|---|

| Founded | 18th century in British India |

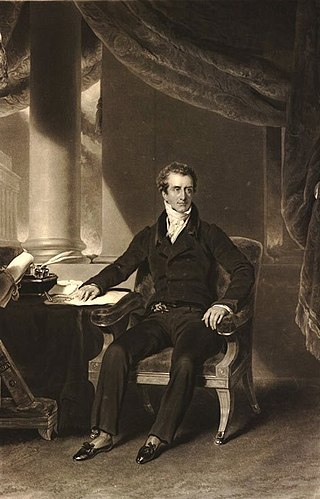

| Founders | John Palmer (1767 - 1836) |

| Headquarters | Hyderabad, , |

Area served | British India |

| Services | Trading and Banking |

The Palmer and Company, Limited, often simply called Palmer and Co. was an Agency House in British India founded by John Palmer (1767-1836), son of General William Palmer (1740-1816) and his first wife Sarah Hazell. Palmer and Co. was the largest Agency House in British India. [1] [2]

Another banking company William Palmer and Company was started in 1810 in Hyderabad by William Palmer (1780-1867), also known as "King Palmer", son of General William Palmer (1740-1816) and his second wife Bibi Faiz Bakhsh ‘Faiz-un-Nisa’ Begum (died 1828) who came from the Oudh ruling family along with the Gujarati moneylender Benkati Das. A partner in this company would later be Sir William Rumbold, 3rd Baronet (1787–1833). [3]

Before the advent of joint-stock banking companies in India, the role of banks was played by agency houses. The agency houses performed various quasi-banking functions which included but were not limited to: [4]

The Palmer and Co. was founded with the name Paxton, Cockerell and Trail. Their name was later changed to Palmer and Co. [5]

In 1829, Palmer and Co. financed and exported more than 16% of all the Indigo produced in British India. [6] As a result, Palmer and Co. came to be known as the Indigo King of Bengal. [7]

The Palmer and Co. agency house failed in the year 1830 due to major economic downturn affecting the British India. The main cause of the economic crisis was the unexpected fall in the prices of commodities such as Indigo. [8]

Charles Russell (1786–1856) was implicated in a corruption scandal where Lord Hastings, a Governor-General of India, was alleged to have acted partially on behalf of Palmer and Company, a Hyderabad banking house. The Russells were found to have to have been involved in and profited from the firm's dealings with the Nizam of Hyderabad, Mir Akbar Ali Khan, directly from Hastings' 1816 decision to exempt the house from a ban on lending money to native princes. Henry Russell's successor, Sir Charles Metcalfe, discovered a loan in 1820 that was both fictitious and fraudulent. [9] [10] [11] [1]

Hyderabad State was a princely state in the Deccan region of south-central India with its capital at the city of Hyderabad. It is now divided into the present-day state of Telangana, the Kalyana-Karnataka region of Karnataka, and the Marathwada region of Maharashtra in India.

Mir Qamar-ud-din Khan Siddiqi also known as Chin Qilich Qamaruddin Khan, Nizam-ul-Mulk, Asaf Jah and Nizam I, was the first Nizam of Hyderabad.

Colonel Philip Meadows Taylor, an administrator in British India and a novelist, made notable contributions to public knowledge of South India. Though largely self-taught, he was a polymath, working alternately as a judge, engineer, artist, and man of letters.

Nizam of Hyderabad was the title of the ruler of Hyderabad State. Nizam is a shortened form of Niẓām ul-Mulk, and was the title bestowed upon Asaf Jah I when he was appointed Viceroy of the Deccan by the Mughal Emperor Farrukhsiyar. In addition to being the Mughal Viceroy (Naib) of the Deccan, Asaf Jah I was also the premier courtier of the Mughal Empire until 1724, when he established an independent realm based in Hyderabad, but in practice, continued to recognise the nominal authority of emperor.

The Anglo-Mysore Wars were a series of four wars fought during the last three decades of the 18th century between the Sultanate of Mysore on the one hand, and the British East India Company, Maratha Empire, Kingdom of Travancore, and the Kingdom of Hyderabad on the other. Hyder Ali and his succeeding son Tipu fought the wars on four fronts: with the British attacking from the west, south and east and the Nizam's forces attacking from the north. The fourth war resulted in the overthrow of the house of Hyder Ali and Tipu, and the dismantlement of Mysore to the benefit of the East India Company, which took control of much of the Indian subcontinent.

State Bank of Hyderabad (SBH) was a regional bank India, with its headquarters at Gunfoundry, Abids, Hyderabad, Telangana. Founded by the 7th Nizam of Hyderabad State, Mir Osman Ali Khan, it is now one of the five associate banks of State Bank of India (SBI) and was one of the nationalised banks in India. It was established on 8 February 1941, as the Hyderabad State Bank. From 1956 until 31 March 2017, it had been the largest associate bank of the SBI. After formation of Telangana in 2014, SBH was the lead bank of the newly created state. The State Bank of Hyderabad was merged with State Bank of India on 1 April 2017.

Mir Osman Ali Khan, Asaf Jah VII was the last Nizam (ruler) of Hyderabad State, the largest state in the erstwhile Indian Empire. He ascended the throne on 29 August 1911, at the age of 25 and ruled the State of Hyderabad between 1911 and 1948, until the Indian Union annexed it. He was styled as His Exalted Highness (H.E.H) the Nizam of Hyderabad, and was widely considered one of the world's wealthiest people of all time. With some estimates placing his wealth at 2% of U.S. GDP, his portrait was on the cover of Time magazine in 1937. As a semi-autonomous monarch, he had his mint, printing his currency, the Hyderabadi rupee, and had a private treasury that was said to contain £100 million in gold and silver bullion, and a further £400 million of jewels. The major source of his wealth was the Golconda mines, the only supplier of diamonds in the world at that time. Among them was the Jacob Diamond, valued at some £50 million, and used by the Nizam as a paperweight.

The Carnatic wars were a series of military conflicts in the middle of the 18th century in India's coastal Carnatic region, a dependency of Hyderabad State, India. The first Carnatic wars were fought between 1740 and 1748.

John Adam was a British administrator in India, serving as the acting Governor-General of the British East India Company in 1823.

Lieutenant-Colonel James Achilles Kirkpatrick was an East India Company officer and diplomat who served as the Resident at Hyderabad Deccan from 1798 until 1805. Kirkpatrick also ordered the construction of the Koti Residency in Hyderabad, which has since come to serve as a major tourist attraction.

Nizam's Guaranteed State Railway (NGSR) was a railway company operating in India from 1883 to 1950. The company began with a line built privately by the HEH, the Nizam, which was owned and operated by the company under a guarantee from the Hyderabad State. Capital for the line was raised by issuing redeemable mortgage debentures. The Nizam's railway was eventually consolidated with the Hyderabad-Godavari Valley Railway (HGVR). In 1951, both the NGSR and the HGVR were nationalised and merged into Indian Railways.

The British credit crisis of 1772–1773, also known as the crisis of 1772, or the panic of 1772, was a peacetime financial crisis which originated in London and then spread to Scotland and the Dutch Republic. It has been described as the first modern banking crisis faced by the Bank of England. New colonies, as Adam Smith observed, had an insatiable demand for capital. Accompanying the more tangible evidence of wealth creation was a rapid expansion of credit and banking, leading to a rash of speculation and dubious financial innovation. In today's language, they bought shares on margin.

The siege of Trichinopoly was part of an extended series of conflicts between the Nizam of Hyderabad and the Maratha Empire for control of the Carnatic region. On 29 August 1743, after a six-month siege, Murari Rao surrendered, giving Nizam ul Mulk (Nizam) the suzerainty of Trichinopoly. By the end of 1743, the Nizam had regained full control of Deccan. This stopped the Maratha interference in the region and ended their hegemony over the Carnatic. The Nizam resolved the internal conflicts among the regional hereditary nobles (Nawabs) for the seat of governor (Subedar) of Arcot State, and monitored the activities of the British East India company and French East India Company by limiting their access to ports and trading.

Gosains (गोसाईं), who are also known as Gossain, Gosine, Gossai, Gosavi, and as Goswamis, are Brahmins, Hindu ascetics and religious functionaries of India. Found chiefly in northern, central and western India, they have different histories by place and time. Even the name Goswami has been variously interpreted as 'master of cows', 'master of mind or intellect', 'master of senses or emotions' and 'master of passion'.

Events in the year 1795 in India.

Hyderabad is the capital of the Indian state of Telangana. It is a historic city noted for its many monuments, temples, mosques and bazaars. A multitude of influences have shaped the character of the city in the last 400 years.

Zubaida Yazdani was an Indian historian specialized in the history of the Deccan Plateau and the Nizam State of Hyderabad, in India. She studied history at Oxford.

Charles Russell was a British Conservative and Tory politician.

Alexander and Company, Limited, often simply called Alexander and Co., was an Agency House in British India founded by traders and merchants from Scotland. Alexander and Co. has made several pioneering contributions to the economy of India. Alexander and Co. was the promoter and founder of India's very first bank, the Bank of Hindostan.

Agency houses in British India were trading companies that arose in 17th and 18th century India during the rule of the British East India Company.