In finance, a high-yield bond is a bond that is rated below investment grade. These bonds have a higher risk of default or other adverse credit events, but typically pay higher yields than better quality bonds in order to make them attractive to investors.

Axel Alfred Weber is a German economist, professor, and banker. He is currently a board member and chairman of Swiss investment bank and financial services company, UBS Group AG.

Solidity is an object-oriented programming language for writing smart contracts. It is used for implementing smart contracts on various blockchain platforms, most notably, Ethereum. It was developed by Gavin Wood, Christian Reitwiessner, Alex Beregszaszi, Liana Husikyan, Yoichi Hirai and several former Ethereum core contributors to enable writing smart contracts on blockchain platforms such as Ethereum.

Markus Konrad Brunnermeier is an economist, who is the Edwards S. Sanford Professor of Economics at Princeton University. He is a faculty member of Princeton's Department of Economics and director of the Bendheim Center for Finance. His research focuses on international financial markets and the macro economy with special emphasis on bubbles, liquidity, financial crises and monetary policy. He promoted the concepts of liquidity spirals, CoVaR as co-risk measure, the paradox of prudence, and the I Theory of Money. He is or was a member of several advisory groups, including to the IMF, the Federal Reserve Bank of New York, the European Systemic Risk Board, the German Bundesbank and the U.S. Congressional Budget Office.

Carlo Carraro is the Chancellor of the University of Venice for the three-year period 2009-2012, with a two-year extension of his mandate in accordance to the Gelmini University Law bringing it up to summer 2014. He is also professor of Environmental Economics at the same University. He is Director of the Sustainable Development Programme of the Fondazione Eni Enrico Mattei and Director of the Climate Impacts and Policy Division of the Euro-Mediterranean Center for Climate Change (CMCC). In 2008, Carlo Carraro was elected Vice-Chair of the Working Group III and Member of the Bureau of the Nobel Laureate Intergovernmental Panel on Climate Change (IPCC).

Jens Weidmann is a German economist, president of the Deutsche Bundesbank, and Chairman of the Board of the Bank for International Settlements.

Claudia Maria Buch is a German economist who currently serves as Vice President of the Bundesbank. She previously worked as professor at the University of Tübingen and served as a member of the German Council of Economic Experts. Buch worked as scientific director at the Institut für Angewandte Wirtschaftsforschung in Tübingen and as chairperson of the economic council at the Federal Ministry of Economics and Technology. Her research focuses on regulation and supervision of banking.

A cryptocurrency is a digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets. Cryptocurrencies use decentralized control as opposed to centralized digital currency and central banking systems.

Proof of stake (PoS) is a type of consensus algorithm by which a cryptocurrency blockchain network aims to achieve distributed consensus. In PoS-based cryptocurrencies the creator of the next block is chosen via various combinations of random selection and wealth or age. In contrast, the algorithm of proof-of-work-based cryptocurrencies such as bitcoin uses mining; that is, the solving of computationally intensive puzzles to validate transactions and create new blocks.

Ethereum is an open source, public, blockchain-based distributed computing platform and operating system featuring smart contract (scripting) functionality. It supports a modified version of Nakamoto consensus via transaction-based state transitions.

Isabel Schnabel is a German economist. She became professor of financial economics at the University of Bonn in 2015 and a member of the German Council of Economic Experts in 2014. She worked previously at the University of Mainz from 2007 to 2015.

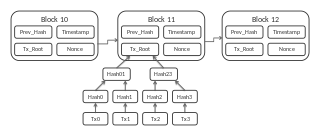

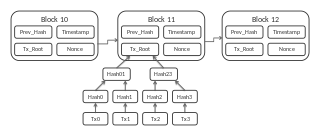

A blockchain, originally block chain, is a growing list of records, called blocks, which are linked using cryptography. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data.

The "too connected to fail" (TCTF) concept refers to a financial institution which is so connected to other institutions that its failure would probably lead to a huge turnover in the whole system. Contrary to the "too big to fail" theory, this approach takes into consideration the highly connected network feature of the financial system rather than the absolute size of one particular institution.

Blockchain Global Ltd. is a multinational bitcoin mining and management consulting company headquartered in Melbourne, Australia. Founded as Bitcoin Group, after attempting to become the first digital currency company to IPO without a so-called 'backdoor listing', the company expanded its focus into management consulting and corporate incubation.

R3 is an enterprise blockchain technology company. It leads an ecosystem of more than 300 firms working together to build distributed applications on top of Corda for usage across industries such as financial services, insurance, healthcare, trade finance, and digital assets. It is headquartered in New York City. It was founded in 2014 by David E Rutter. The current CTO is Richard G Brown.

CryptoKitties is a blockchain game on Ethereum developed by Axiom Zen that allows players to purchase, collect, breed and sell virtual cats. It is one of the earliest attempts to deploy blockchain technology for recreation and leisure. The game's popularity in December 2017 congested the Ethereum network, causing it to reach an all-time high in number of transactions and slowing it down significantly.

Libra is a proposed permissioned blockchain virtual currency, put forward by the American social media conglomerate Facebook. The project, currency and transactions are to be managed and entrusted to the Libra Association, a membership organization founded by Facebook's subsidiary Calibra and 27 others across payment, technology, telecommunication, online marketplace, venture capital and nonprofits.