Related Research Articles

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money (leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The use of debt, which normally has a lower cost of capital than equity, serves to reduce the overall cost of financing the acquisition. This is done at the risk of magnified cash flow losses should the acquisition perform poorly after the buyout.

EF Hutton was an American stock brokerage firm founded in 1904 by Edward Francis Hutton and his brother, Franklyn Laws Hutton. Later, it was led by well known Wall Street trader Gerald M. Loeb. Under their leadership, EF Hutton became one of the most respected financial firms in the United States and for several decades was the second largest brokerage firm in the country.

R. J. Reynolds Nabisco, Inc., doing business as RJR Nabisco, was an American conglomerate, selling tobacco and food products, headquartered in the Calyon Building in Midtown Manhattan, New York City. R. J. Reynolds Nabisco stopped operating as a single entity in 1999. Both RJR and Nabisco still exist.

KKR & Co. Inc., also known as Kohlberg Kravis Roberts & Co., is an American global investment company. As of December 31, 2023, the firm had completed private equity investments in portfolio companies with approximately $710 billion of total enterprise value. Its assets under management (AUM) and fee paying assets under management (FPAUM) were $553 billion and $446 billion, respectively.

Lehman Brothers Inc. was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States, with about 25,000 employees worldwide. It was doing business in investment banking, equity, fixed-income and derivatives sales and trading, research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008.

Forstmann, Little & Company was an American private equity firm, specializing in leveraged buyouts (LBOs). At its peak in the late 1990s, Forstmann Little was among the largest private equity firms globally. Ultimately, the firm would suffer from the bursting of the internet and telecom bubbles, having invested heavily in technology and telecommunications companies. Following the death of the last surviving founder, Theodore Forstmann, in 2011, the firm was dissolved and its assets sold off. It closed in May 2014.

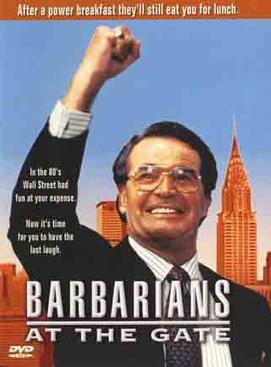

Barbarians at the Gate is a 1993 American biographical comedy-drama television film directed by Glenn Jordan and written by Larry Gelbart, based on the 1989 book of the same name by Bryan Burrough and John Helyar. The film stars James Garner, Jonathan Pryce, and Peter Riegert. It tells the true story of F. Ross Johnson, who was the president and CEO of RJR Nabisco.

Salomon Brothers, Inc., was an American multinational bulge bracket investment bank headquartered in New York City. It was one of the five largest investment banking enterprises in the United States and a very profitable firm on Wall Street during the 1980s and 1990s. Its CEO and chairman at that time, John Gutfreund, was nicknamed "the King of Wall Street".

Frederick Ross Johnson, OC was a Canadian businessman, best known as the chief executive officer of RJR Nabisco in the 1980s.

Donaldson, Lufkin & Jenrette (DLJ) was a U.S. investment bank founded by William H. Donaldson, Richard Jenrette, and Dan Lufkin in 1959. Its businesses included securities underwriting; sales and trading; investment and merchant banking; financial advisory services; investment research; venture capital; correspondent brokerage services; online, interactive brokerage services; and asset management.

TD Cowen, is an American multinational investment bank and financial services division of TD Securities that operates through two business segments: a broker-dealer and an investment management division.

Hayden, Stone & Co. was a major American securities firm founded in 1892 by Charles Hayden and Galen L. Stone. The firm was acquired by Cogan, Berlind, Weill & Levitt in 1972 and, after its name disappeared in 1979, was part of what would become Shearson/American Express in 1981.

The history of private equity, venture capital, and the development of these asset classes has occurred through a series of boom-and-bust cycles since the middle of the 20th century. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel, although interrelated tracks.

Private equity in the 1980s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.

Shearson was the name of a series of investment banking and retail brokerage firms from 1902 until 1994, named for Edward Shearson and the firm he founded, Shearson Hammill & Co. Among Shearson's most notable incarnations were Shearson / American Express, Shearson Lehman / American Express, Shearson Lehman Brothers, Shearson Lehman Hutton and finally Smith Barney Shearson.

Shearson, Hammill & Co. was a Wall Street brokerage and investment banking firm founded in 1902 by Edward Shearson and Caleb Wild Hammill. The firm originally built its business as a stock broker as well as a broker of various commodities, particularly grain and cotton. The firm was a member of the New York Stock Exchange, the Chicago Stock Exchange and the Chicago Mercantile Exchange.

Loeb, Rhoades & Co. was a Wall Street brokerage firm founded in 1931 and acquired in 1979 by Sanford I. Weill's Shearson Hayden Stone. Although the firm would operate as Shearson Loeb Rhoades for two years, the firm would ultimately be acquired in 1981 by American Express to form Shearson/American Express and three years later Shearson Lehman/American Express.

Cogan, Berlind, Weill & Levitt, originally Carter, Berlind, Potoma & Weill, was an American investment banking and brokerage firm founded in 1960 and acquired by American Express in 1981. In its two decades as an independent firm, Cogan, Berlind, Weill & Levitt served as a vehicle for the rollup of more than a dozen brokerage and securities firms led by Sanford I. Weill that culminated in the formation of Shearson Loeb Rhoades.

Barbarians at the Gate: The Fall of RJR Nabisco is a 1989 book about the leveraged buyout (LBO) of RJR Nabisco, written by investigative journalists Bryan Burrough and John Helyar. The book is based upon a series of articles written by the authors for The Wall Street Journal. The book was made into a 1993 made-for-TV movie by HBO, also called Barbarians at the Gate. The book centers on F. Ross Johnson, the CEO of RJR Nabisco, who planned to buy out the rest of the Nabisco shareholders.

Eric Gleacher is an American investor and financier, and the founder and former chairman of the now defunct, Gleacher & Company, an independent investment banking firm based in New York City.

References

- 1 2 Williams, Monci Jo (May 23, 1988). "Brash New Mogul on Wall Street". Fortune (magazine) .

Then you can appreciate the yearnings of Peter Cohen, 41, chairman of the Shearson Lehman Hutton brokerage firm

- ↑ "Cohen's Back, on a Smaller Stage". The Wall Street Journal . November 28, 2009.

- 1 2 Vanities on The Bonfire: Peter Cohen. Time, February 12, 1990

- 1 2 3 4 John Rossant (Mar 29, 1999). "The Reincarnation Of Peter Cohen". Bloomberg.

But they were also fast friends who were linked by their shared Jewish background: DeBenedetti would talk to Cohen about how he had narrowly escaped the Nazis in World War II.

- ↑ Inside Philanthropy: "Peter A. Cohen" retrieved September 21, 2017

- ↑ "Cowen Group - Leadership". Cowen Group . Retrieved June 10, 2014.

- ↑ Nabisco Executives Offer $17 Billion for Company. New York Times, October 21, 1988

- ↑ Shearson Risks, Rewards on RJR Nabisco. New York Times, October 22, 1988

- ↑ RJR Nabisco Bidders Said to Talk. New York Times, October 26, 1988

- ↑ The Nabisco Battle's Key Moment. New York Times, December 2, 1988

- ↑ "Barbarians at the Gate". Internet Movie Database . Retrieved August 21, 2014.

- ↑ "Peter Cohen". Forbes . Archived from the original on October 2, 2012. Retrieved August 21, 2014.

- ↑ "Hale, Hearty, and Virile". New York Magazine . December 22, 1997. p. 26.