HSBC Holdings plc is a British universal bank and financial services group headquartered in London, England, with historical and business links to East Asia and a multinational footprint. It is the largest Europe-based bank by total assets, ahead of BNP Paribas, with US$2.919 trillion as of December 2023.

Citizens Financial Group, Inc. is an American bank holding company, headquartered in Providence, Rhode Island. The company owns the bank Citizens Bank, N.A., which operates in the U.S. states of Connecticut, Delaware, Florida, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, Vermont, and Virginia, as well as Washington, DC.

Chiquita Brands International S.à.r.l., formerly known as United Fruit Co., is a Swiss-domiciled American producer and distributor of bananas and other produce. The company operates under subsidiary brand names, including the flagship Chiquita brand and Fresh Express salads. Chiquita is the leading distributor of bananas in the United States.

HSBC Bank Canada, formerly the Hongkong Bank of Canada (HBC), was a British-Canadian chartered bank and the former Canadian subsidiary of British multinational banking and financial services company HSBC.

Joseph Safra was a Swiss-based Lebanese Brazilian banker and billionaire businessman of Syrian descent. He was Brazil's richest man and the richest banker in the world, running the Brazilian banking and investment empire, Safra Group.

Marine Midland Bank was an American bank formerly headquartered in Buffalo, New York, with several hundred branches throughout the state of New York. In 1998, branches extended to Pennsylvania. It was acquired by HSBC in 1980 and changed its name to HSBC Bank USA in 1999. As a result of several transactions since the turn of the millennium, much of what was once Marine Midland is now part of KeyBank with the exception of Downstate New York and Pennsylvania, that is now part of Citizens Bank. Branches in Seattle are part of Cathay Bank.

Edmond J. Safra was a Lebanese-Brazilian billionaire banker and philanthropist of Syrian descent. He continued his family tradition of banking in Brazil and Switzerland, and was married to Lily Watkins from 1976 until his death. He died in a fire that attracted wide media interest, and was judicially determined to be due to arson.

Lily Safra was a Brazilian-Monegasque billionaire and socialite who amassed considerable wealth through her four marriages. She had a significant art collection and owned the historic Villa Leopolda on the French Riviera. Her net worth was estimated at $1.3 billion. She became strongly engaged with philanthropy when she married the banker Edmond Safra, and this continued through their foundation after his death in 1999.

HSBC Bank USA, National Association, an American subsidiary of the British banking group HSBC, is a bank with its operational head office in New York City and its nominal head office in Tysons, Virginia. HSBC Bank USA, N.A. is a national bank chartered under the National Bank Act, and thus is regulated by the Office of the Comptroller of the Currency (OCC), a part of the U.S. Department of the Treasury. The company has 22 branch locations.

Beal Financial Corporation is a bank holding company based in Plano, Texas that operates two federally chartered banks: Beal Bank, with 6 branches, and Beal Bank USA, headquartered in Las Vegas, Nevada, with 10 branches and a direct bank. It is on the list of largest banks in the United States. It was founded by and is entirely owned by billionaire Andrew Beal and specializes in acquiring distressed securities at discounted values. It acquires risky loans, but keeps a much higher equity buffer than other banks.

Safra Ada Catz is an Israeli-American billionaire banker and technology executive. She is the CEO of Oracle Corporation. She has been an executive at Oracle since April 1999, and a board member since 2001. In April 2011, she was named co-president and chief financial officer (CFO), reporting to founder Larry Ellison. In September 2014, Oracle announced that Ellison would step down as CEO and that Mark Hurd and Catz had been named as joint CEOs. In September 2019, Catz became the sole CEO after Hurd resigned due to health issues.

Safra National Bank of New York is an American privately held bank based in New York City, which provides services in investment banking, private banking, and asset management, to high-net-worth individuals, businesses, family offices and sophisticated investors in the U.S. and internationally.

The J.Safra Group is an international network of companies controlled by the Vicky Safra family, comprising banking and financial institutions and industrial operations. It is present in the United States, Europe, the Middle East, Latin America, Asia and the Caribbean.

First Niagara Bank was a Federal Deposit Insurance Corporation-insured regional banking corporation headquartered in Buffalo, New York. Its parent company, First Niagara Financial Group, Inc. was the 44th-largest bank in the United States with assets of over $37.1 billion as of June 30, 2013.

Theodore "Ted" Maher is a former Green Beret turned registered nurse who was convicted of arson in a 1999 fire that killed Edmond Safra and another nurse, Vivian Torrente, at Safra's Monaco penthouse apartment. In October 2007, Maher was released after serving eight years in jail.

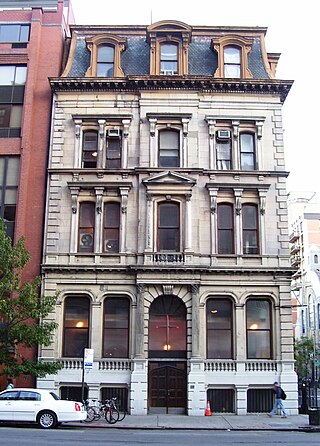

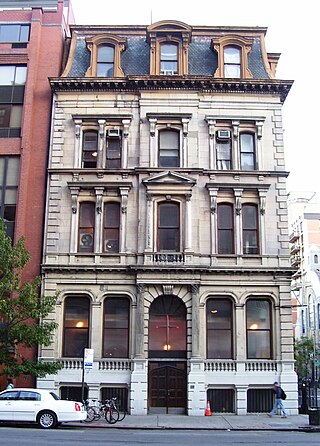

The Metropolitan Savings Bank Building opened on May 30, 1867, at the northeast corner of Third Avenue and East 7th Street, in Manhattan, New York City. Its original address was 10 Cooper Institute. The building, which was designed by architect Carl Pfeiffer in Second Empire style, is four stories high, 45 feet (14 m) wide and 75 feet (23 m) deep, and was considered at the time it opened to be one of the most finely constructed edifices, "from garret to basement." Its facades were composed of white marble, with the upper floor being enclosed by a mansard roof. The building was fireproof, as no combustible materials were used during construction, either internally or externally. The entire cost of the structure was $150,000.

HSBC Guyerzeller Bank AG, a member of the HSBC Group, was a Swiss private bank advising individuals and families in all matters of wealth management, investment advice and trust services. Its head office was in Zürich, and it had two branches in Geneva, as well as representative offices in Hong Kong and Istanbul. It had 360 employees and about CHF 29 billion in assets under management. It is now subsumed under HSBC Private Bank.

Peter A. Cohen is the chairman and CEO of Andover National Corporation, a public holding company. He was formerly the chairman and CEO of Cowen Inc., also known as Cowen & Company now TD Cowen. Prior to his current role, Cohen founded Ramius Capital Management in 1994, a $13 billion investment firm, which he merged with Cowen Inc. in 2009. Prior to this, Cohen was the chairman and chief executive officer of Shearson Lehman American Express from 1983 through 1991.

J. Safra Sarasin is a Swiss private bank, founded in 1841 and headquartered in Basel, Switzerland. It is currently owned by the Brazilian J. Safra Group, and was formed in its present state in 2013, when Safra Group acquired Bank Sarasin & Co. Ltd, merging it with its Bank Jacob Safra Switzerland subsidiary.

Gérard Cohen is a Swiss private banker and patron of the arts. Between 1991 and 2016 he was managing director of HSBC Private Bank in Monaco.