Related Research Articles

HSBC Holdings plc is a British universal bank and financial services group headquartered in London, England, with unique historical and business links to East Asia and a highly multinational footprint. It is the largest Europe-based bank by total assets, ahead of BNP Paribas, with US$2.953 trillion as of December 2021. In 2021, HSBC had $10.8 trillion in assets under custody (AUC) and $4.9 trillion in assets under administration (AUA).

Lloyds Bank plc is a British retail and commercial bank with branches across England and Wales. It has traditionally been considered one of the "Big Four" clearing banks. Lloyds Bank is the largest retail bank in Britain, and has an extensive network of branches and ATMs in England and Wales and offers 24-hour telephone and online banking services.

The Trustee Savings Bank (TSB) was a British financial institution. Trustee savings banks originated to accept savings deposits from those with moderate means. Their shares were not traded on the stock market but, unlike mutually held building societies, depositors had no voting rights; nor did they have the power to direct the financial and managerial goals of the organisation. Directors were appointed as trustees on a voluntary basis. The first trustee savings bank was established by Rev. Henry Duncan of Ruthwell in Dumfriesshire for his poorest parishioners in 1810, with its sole purpose being to serve the local people in the community. Between 1970 and 1985, the various trustee savings banks in the United Kingdom were amalgamated into a single institution named TSB Group plc, which was floated on the London Stock Exchange. In 1995, the TSB merged with Lloyds Bank to form Lloyds TSB, at that point the largest bank in the UK by market share and the second-largest by market capitalisation.

The Continental Bank of Canada is a chartered bank in Canada founded in 2013. A different bank operated under that name in the early 1980s.

HSBC Bank Canada, formerly the Hongkong Bank of Canada (HBC), is a Canadian chartered bank and the Canadian subsidiary of British multinational banking and financial services company HSBC. HSBC Canada is the seventh largest bank in Canada, with offices in every province except Prince Edward Island, and is the largest foreign-owned bank in the country. The corporate headquarters are located at the HSBC Canada Building in the downtown core's financial district of Vancouver, British Columbia. HSBC Bank Canada's Institution Number is 016.

HSBC Bank Malta plc is the Maltese subsidiary of the British multinational banking and financial services company HSBC. The company is headquartered in Qormi and operates over 12 branches and offices throughout the islands of Malta and Gozo. HSBC Bank Malta is part of the European region within HSBC and therefore reports to HSBC Bank plc.

The Hongkong and Shanghai Banking Corporation Limited, commonly known as HSBC, is the Hong Kong-based Asia-Pacific subsidiary of the HSBC banking group, for which it was the parent entity until 1991. The largest bank in Hong Kong, HSBC operates branches and offices throughout the Indo-Pacific region and in other countries around the world. It is also one of the three commercial banks licensed by the Hong Kong Monetary Authority to issue banknotes for the Hong Kong dollar.

Barclays Bank has operated as a retail and commercial bank in Canada from 1929 to 1956, from 1979 to 1996, and most recently from 2010.

HSBC Continental Europe, known until December 2020 as HSBC France SA, is a subsidiary of HSBC, headquartered in Paris.

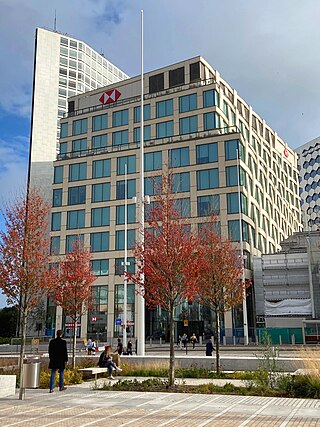

HSBC UK Bank plc is a British multinational banking and financial services organisation based in Birmingham, England. It is a wholly owned subsidiary of the global HSBC banking and financial group, which has been headquartered in London since 1993. The UK headquarters of HSBC is located at One Centenary Square in Birmingham.

HSBC Finance Corporation is a financial services company and a subsidiary of HSBC Holdings. It is the sixth-largest issuer of MasterCard and Visa credit cards in the United States. HSBC Finance Corporation was formed from the legal entity that had been known as Household International—shortly after Household International settled for US$486 million in charges pertaining to predatory lending, after burning through $389 million in legal fees and expenses—and is now expanding its consumer finance model via the HSBC Group to Brazil, India, Argentina and elsewhere.

National Westminster Bank, commonly known as NatWest, is a major retail and commercial bank in the United Kingdom based in London, England. It was established in 1968 by the merger of National Provincial Bank and Westminster Bank. In 2000, it became part of The Royal Bank of Scotland Group, which was re-named NatWest Group in 2020. Following ringfencing of the group's core domestic business, the bank became a direct subsidiary of NatWest Holdings; NatWest Markets comprises the non-ringfenced investment banking arm. The British government currently owns 39%, previously 54.7% of NatWest Group after spending £45 billion bailing out the lender in 2008. NatWest International is a trading name of RBS International, which also sits outside the ringfence.

HBOS plc was a banking and insurance company in the United Kingdom, a wholly owned subsidiary of the Lloyds Banking Group, having been taken over in January 2009. It was the holding company for Bank of Scotland plc, which operated the Bank of Scotland and Halifax brands in the UK, as well as HBOS Australia and HBOS Insurance & Investment Group Limited, the group's insurance division.

Lloyds Banking Group is a British financial institution formed through the acquisition of HBOS by Lloyds TSB in 2009. It is one of the UK's largest financial services organisations, with 30 million customers and 65,000 employees. Lloyds Bank was founded in 1765 but the wider Group's heritage extends over 320 years, dating back to the founding of the Bank of Scotland by the Parliament of Scotland in 1695.

International Westminster Bank was a wholly-owned subsidiary of National Westminster Bank and its predecessors from 1913 to 1989, with branches in London, France, Spain and West Germany.

Cheltenham & Gloucester plc (C&G) was a mortgage and savings provider in the United Kingdom, a subsidiary of Lloyds Banking Group. C&G specialised in mortgages and savings products. Previously, C&G was a building society, the Cheltenham and Gloucester Building Society. Its headquarters were in Barnwood, Gloucester, Gloucestershire, England. C&G was closed to new mortgage and savings business on 9 September 2013.

TSB Bank plc is a retail and commercial bank in the United Kingdom and a subsidiary of Sabadell Group.

Lloyds Bank International is a wholly owned subsidiary of Lloyds Bank Corporate Markets in the United Kingdom, which is in turn part of Lloyds Banking Group, one of the largest banking groups in Europe.

Lloyds Bank California was a wholly owned subsidiary of Lloyds Bank Plc in the United Kingdom from 1974 to 1986. Throughout its existence, the U.S. retail banking operation functioned as an autonomous unit of the Lloyds Bank Group, alongside Lloyds Bank International and the National Bank of New Zealand.

National Westminster Bank of Canada, commonly known as NatWest Canada, was a wholly owned subsidiary of National Westminster Bank, a global integrated financial service group based in the United Kingdom, which operated from 1982 to 1998.

References

- ↑ McLister, Robert Lloyds Bank International, Mortgages for Canadians Canadian Mortgage Trends, 27 February 2009

- ↑ Report and Accounts (p. 8), Lloyds Bank Plc, 1986

- ↑ Report and Accounts (p. 35), Lloyds Bank Plc, 1989