Crédit Agricole Group, sometimes called La banque verte, is a French international banking group and the world's largest cooperative financial institution. It is the second largest bank in France, after BNP Paribas, as well as the third largest in Europe and tenth largest in the world. It consists of a network of Crédit Agricole local banks, 39 Agricole regional banks and a central institute, the Crédit Agricole S.A.. It is listed through Crédit Agricole S.A., as an intermediate holding company, on Euronext Paris' first market and is part of the CAC 40 stock market index. Local banks of the group owned the regional banks, in turn the regional banks majority owned the S.A. via a holding company, in turn the S.A. owned part of the subsidiaries of the group, such as LCL, the Italian network and the CIB unit. It is considered to be a systemically important bank by the Financial Stability Board.

The National Bank of Canada is the sixth largest commercial bank in Canada. It is headquartered in Montreal, and has branches in most Canadian provinces and 2.4 million personal clients. National Bank is the largest bank in Quebec, and the second largest financial institution in the province, after Desjardins credit union. National Bank's Institution Number is 006 and its SWIFT code is BNDCCAMMINT.

The Bank of France is the French member of the Eurosystem. The bank doesn't translate its name to English and uses its French name Banque de France in all English communications. The bank was established by Napoleon Bonaparte in 1800 as a private-sector corporation with unique public status. Charles de Gaulle's government nationalized the bank in 1945 after several governance changes in the meantime. The Bank of France was granted note-issuance monopoly in Paris in 1803 and in the entire country in 1848, issuing the French franc. It remained France's sole monetary authority until end-1998, when France adopted the euro as its currency.

ICICI Bank Limited is an Indian multinational bank and financial services company headquartered in Mumbai with a registered office in Vadodara. It offers a wide range of banking and financial services for corporate and retail customers through various delivery channels and specialized subsidiaries in the areas of investment banking, life, non-life insurance, venture capital and asset management.

Barclays Bank has operated as a retail and commercial bank in Canada from 1929 to 1956, from 1979 to 1996, and most recently from 2010.

The Bank Al-Maghrib is the central bank of the Kingdom of Morocco. It was founded in 1959 as the successor to the State Bank of Morocco. In 2008 Bank Al-Maghrib held reserves of foreign currency with an estimated worth of US$36 billion. In addition to currency management, the Bank Al-Maghrib also supervises a number of private banks supplying commercial banking services. The bank is headquartered on Avenue Mohammed V in Rabat; it has a branch in Casablanca and agencies in 18 other cities in Morocco.

CS Alterna Bank, operating as Alterna Bank, is a Canadian direct bank and a wholly owned subsidiary of the Ontario-based credit union Alterna Savings. The bank offers chequing and high-interest savings accounts and mortgages.

HSBC Continental Europe, known until December 2020 as HSBC France SA, is a subsidiary of HSBC, headquartered in Paris.

The Bank of Canada is a Crown corporation and Canada's central bank. Chartered in 1934 under the Bank of Canada Act, it is responsible for formulating Canada's monetary policy, and for the promotion of a safe and sound financial system within Canada. The Bank of Canada is the sole issuing authority of Canadian banknotes, provides banking services and money management for the government, and loans money to Canadian financial institutions. The contract to produce the banknotes has been held by the Canadian Bank Note Company since 1935.

Banque du Liban is the central bank of Lebanon. It was established on August 1, 1963, and became fully operational on April 1, 1964. In 2023, Wassim Mansouri stepped up as interim governor of the Banque du Liban after Lebanon failed to name a successor to Riad Salameh, whose term finished in July 2023.

The Bank Act is an act of the Parliament of Canada respecting banks and banking.

The Office of the Superintendent of Financial Institutions is an independent agency of the Government of Canada reporting to the Minister of Finance created "to contribute to public confidence in the Canadian financial system". It is the sole regulator of banks, and the primary regulator of insurance companies, trust companies, loan companies and pension plans in Canada.

Banque Cantonale de Genève (BCGE) is a limited company established under Swiss public law, resulting from the merger of the Caisse d'Épargne de la République et Canton de Genève and the Banque Hypothécaire du Canton de Genève. It is one of the 24 cantonal banks.

The Central Bank of Djibouti is the monetary authority of Djibouti. It is responsible for managing the country's currency, the Djiboutian franc, as well as the national foreign exchange position and accounting.

The history of banking in China includes the business of dealing with money and credit transactions in China.

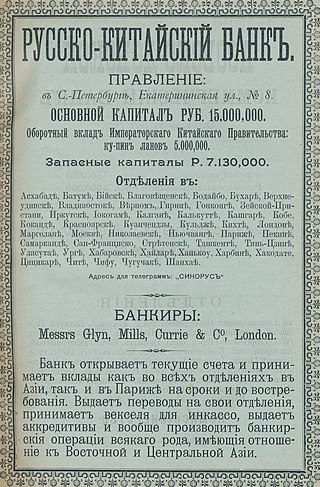

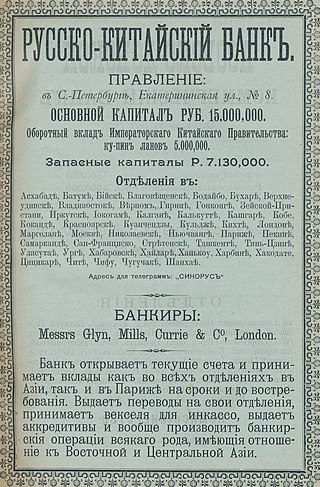

The Russo-Chinese Bank was a foreign bank, founded in 1895, that represented joint French and Russian interests in China during the late Qing dynasty. It merged in 1910 with the French-sponsored Banque du Nord, a large domestic bank in Russia, to form the Russo-Asiatic Bank.

RCI Banque SA, trading as Mobilize Financial Services, is a France-based international company that is a wholly owned subsidiary of Renault and part of Renault's Mobilize unit. RCI Banque specialises in automotive financing, insurance, and related activities for the Renault group brands globally for the Nissan group brands in Europe, Russia, Asia and South America; and for Mitsubishi Motors in the Netherlands.

Currency Exchange International (CXI) is a foreign currency exchange company in the United States.

Equity Banque Commerciale du Congo (EquityBCDC) is a commercial bank in the Democratic Republic of the Congo. It is a merger between Equity Bank Congo (EBC), formerly ProCredit Bank DRCongo, and Banque Commerciale du Congo. This followed the acquisition of majority shareholding in both banks by the Equity Group Holdings Limited, a Kenya-based financial services conglomerate with total assets in excess of US$10 billion.